The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 12th November 2017

Last week, I saw the best possible trades for the coming week as long USD/JPY, and long of the S&P 500 Index in U.S. Dollars. The overall result was negative, as the USD/JPY currency pair fell by 0.47%, and the S&P 500 Index fell by 0.20%, producing a small average loss of 0.34%.

The Forex market over the past week has turned mildly against the U.S. Dollar. There was remarkably little news last week, and there is very little going on with potential to significantly move prices.

The news agenda this week is almost certainly going to be dominated by some items of important U.S. economic data, as there is no real central bank input due from any of the major global economies. There is renewed political speculation about the survival of the current U.K. government, which might keep the British Pound in its current state of high volatility.

The American stock market made a new all-time high, but has pulled back and looks as if it may be readying for a deeper bearish retracement.

Following the current picture, I see the highest probability trades this week as long of the GBP/USD currency pair, and long of Crude Oil in U.S. Dollar terms. There are very few clear strong trends in the Forex market now.

Fundamental Analysis & Market Sentiment

There is very little clear sentiment in the market right now, or any outstanding fundamental factors which have emerged from last week’s exceptionally quiet schedule. There is some speculation today that the British Prime Minister might face a leadership challenge within her own party, but as it is not known whether a successful challenge would lead to a new government pursuing a stronger or weaker Brexit, it is hard to see in which direction this would be most likely to push the British Pound, which technically looked poised to rise further at the close of last week.

Technical Analysis

U.S. Dollar Index

This pair printed a bearish engulfing candlestick, and it looks as if there may be new resistance holding the price down from 12087, shown in the chart below. I wrote last week that this level might halt any further advance. It would not be a surprise if we begin a period of consolidation and uncertainty following the end of the recent bearish trend, so it is hard to be very confident in the Dollar’s short-term direction.

GBP/USD

This pair is a long-term upwards trend, and although the flow has a lot of deep retracements, it is clearly gradually rising. The weekly candle is a bullish engulfing candlestick. Friday saw the price make a move up, breaking up past resistance after a series of higher lows. The bullish case is strengthened by the fact that the price bottomed out close to the psychologically important level of 1.3000. For these reasons, I am cautiously bullish for the coming week.

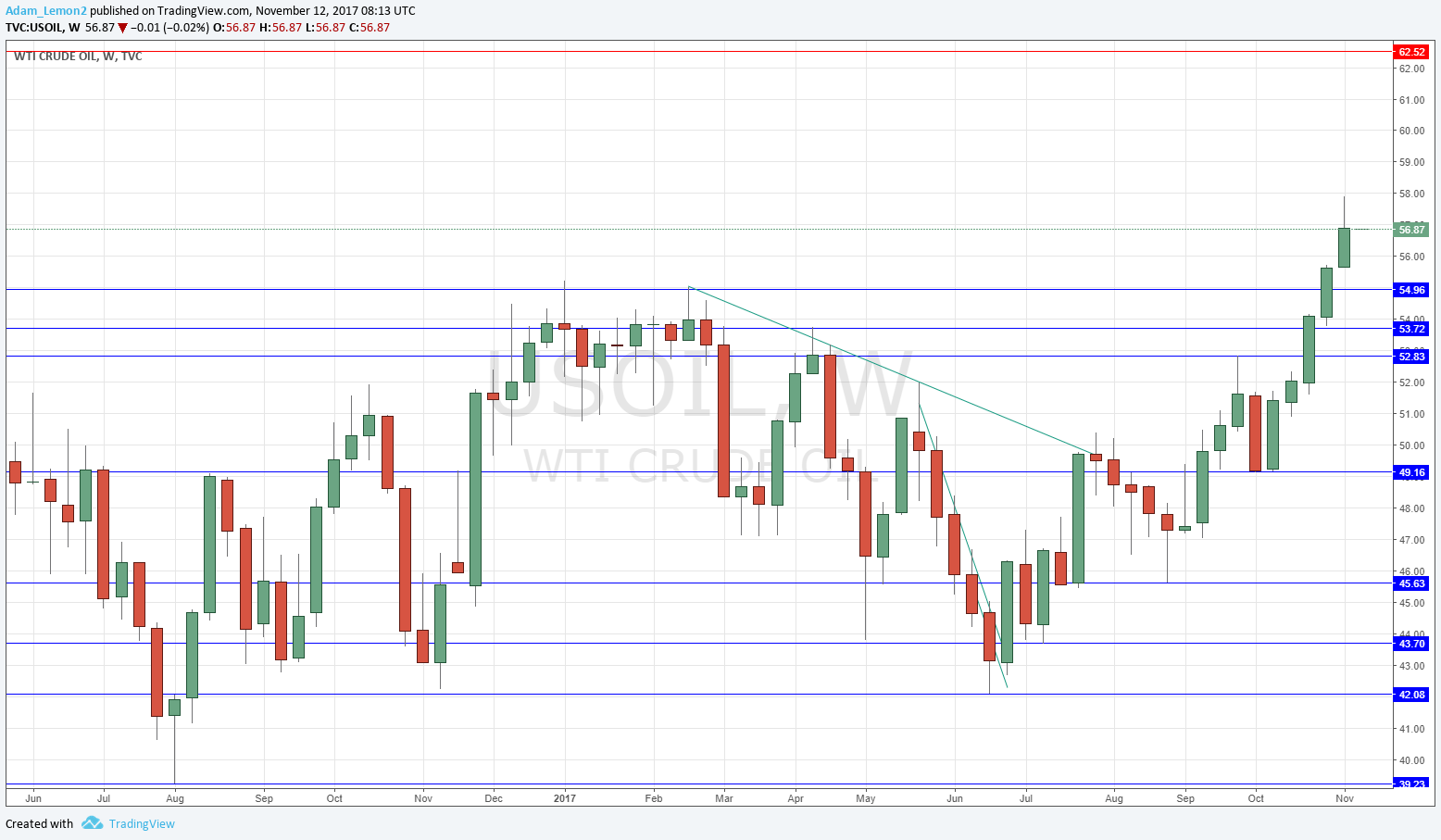

Crude Oil

This commodity has been making new 2-year highs after a strong bullish breakout. Last week printed a bullish candlestick in blue sky. There is a significant upper week on the weekly candle, which should make bulls at least a little cautious, but if the price begins to make new highs again, it looks likely to continue to rise. The advance will be helped along by any new threats being made in the middle east, if they emerge in the coming days, between the Saudi and Iranian axes.

Conclusion

Bullish on the British Pound and Crude Oil; bearish on the U.S. Dollar.