Gold prices ended Tuesday’s session down $0.63 as the dollar strengthened on the back of the better-than-expected U.S. data. The Conference Board’s consumer confidence index came in at 129.5, up from the previous month’s 126.1 and above expectations for a reading of 123.9. XAU/USD traded as low as $1290.58 an ounce, but the market ended the day above the $1292-$1291 zone.

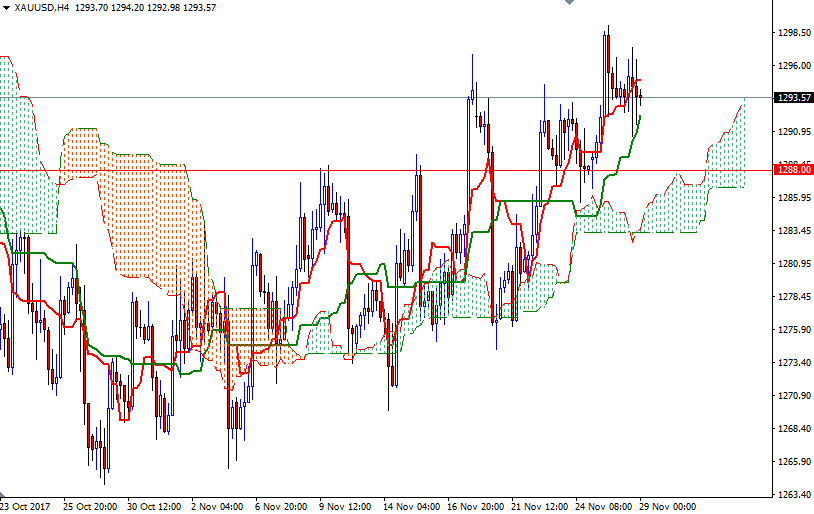

The market is trading above the Ichimoku cloud on the H4 and the H1 time frames, suggesting that the bulls still have the short-term technical advantage. However, as I pointed out yesterday, XAU/USD has to anchor somewhere above the 1296.80-1296 area to make a run for 1302/0. The bulls have capture this strategic camp so if they intend to make an assault on 1304.50.

To the downside, the 1292/1 zone stands out as the initial support. Since the bottom of the hourly cloud also convegre in this area, the bears have to successfully drag price below there to challenge 1288/7. A break below 1288/7 implies that the market will probably visit 1283/2.