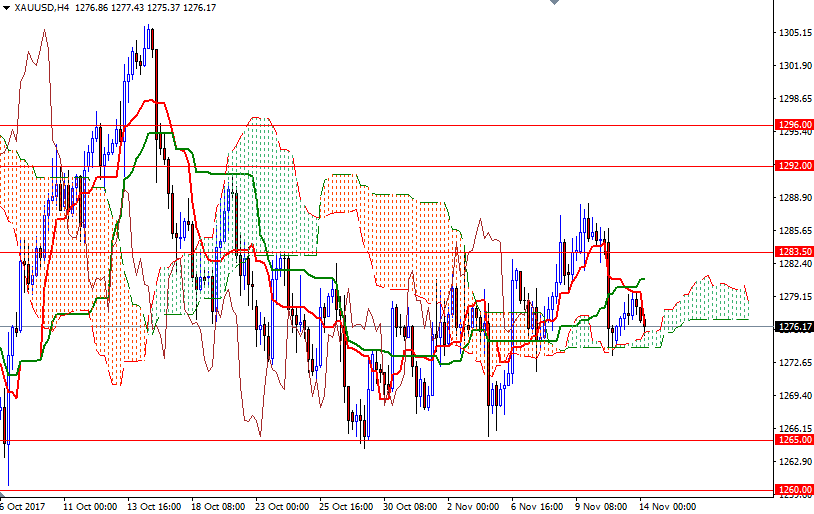

Gold prices ended Monday slightly higher after a quiet session. XAU/USD reached the $1280.30-$1279.60 area, the confluence of the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) on the 4-hourly chart, but was unable to break through. Consequently, prices retreated to Ichimoku cloud in Asian trade.

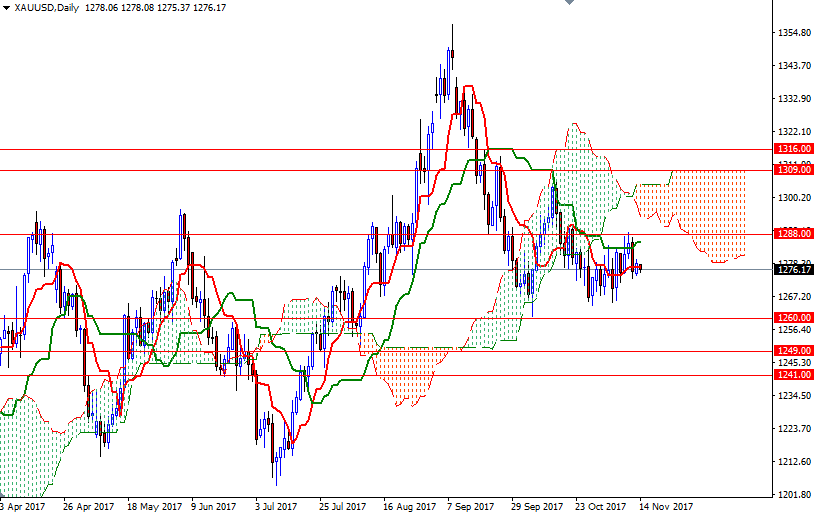

The short-term and the mid-term charts currently point opposite directions. Prices are moving above the weekly and 4-hourly clouds but we are still below the cloud on the daily chart. The 4-hourly cloud has been supportive so the bears will need to pull prices below there to test 1271. If this support gives way, it is likely that XAU/USD will visit the 1267/5 zone next.

The market has to push through 1280.86, the Kijun-sen on the H4 chart, in order to approach the next barrier sitting at 1283.50. Penetrating this barrier could foreshadow a move towards 1288/7. A daily close above 1288 implies that the bulls are getting ready to challenge 1292.