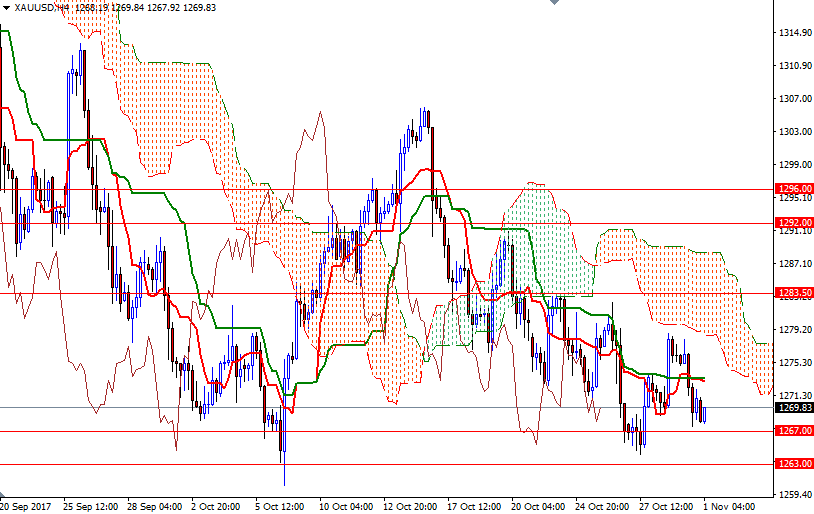

Gold prices ended Tuesday’s session down $5.16 but remained within the trading range of the past three days as investors awaited the outcome of the Federal Reserve’s two-day policy meeting. In economic news, the Conference Board said its index of consumer confidence increased to 125.9 from 120.6 the prior month. XAU/USD initially tried to pass through the $1278 level, the daily Tenkan-sen (nine-period moving average, red line), but the bulls run out of steam. Consequently, the market fell through $1273-$1272 and tested the support in the $1269-$1267 zone.

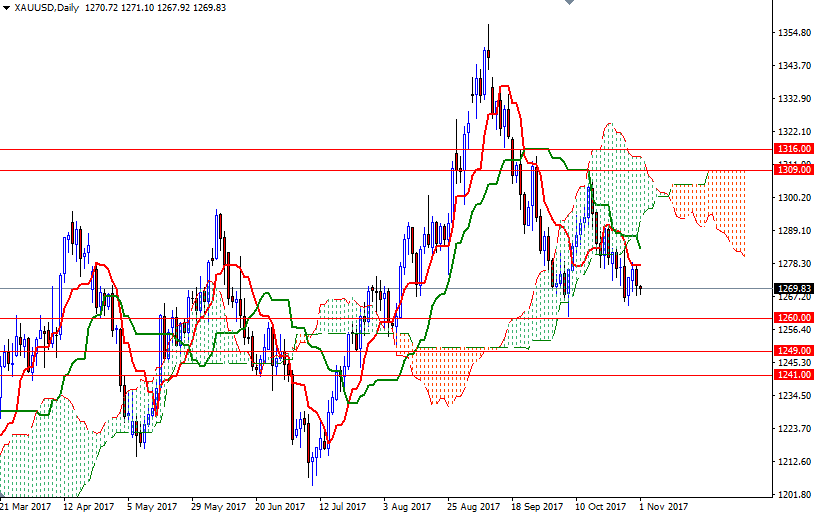

The market continues to feel bearish pressure from the Ichimoku clouds on the daily and the 4-hourly charts. In addition to that, the daily and the 4-hourly Chikou-span (closing price plotted 26 periods behind, brown line) lines are still below prices. The downside risks will remain until the market penetrates the cloud on the H4 chart and climbs back above the resistance at 1283.50. The bulls have clear this barrier to gather momentum for 1292.

To the downside, keep an eye on the aforementioned support in the 1269/7 area. If this support is broken, then the market will be aiming for 1263/0. The bears will have to produce a close below the 1260 level in order to put more pressure on the market and drag prices towards the weekly cloud.