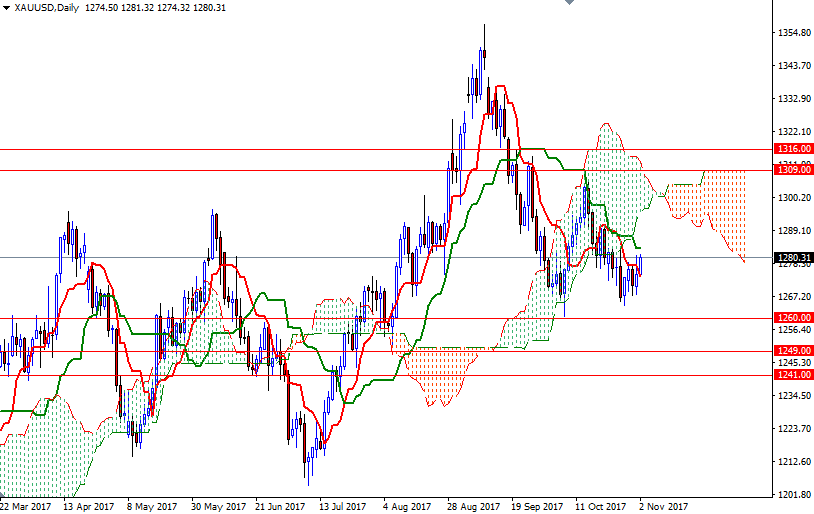

Gold prices ended Wednesday’s session with gains after the Federal Open Market Committee meeting ended with a statement that saw very little reaction from the markets. The Federal Reserve left short-term interest rates unchanged as expected, and signaled it would consider lifting them by the end of the year. The weakness in U.S. equities was also supportive for gold.

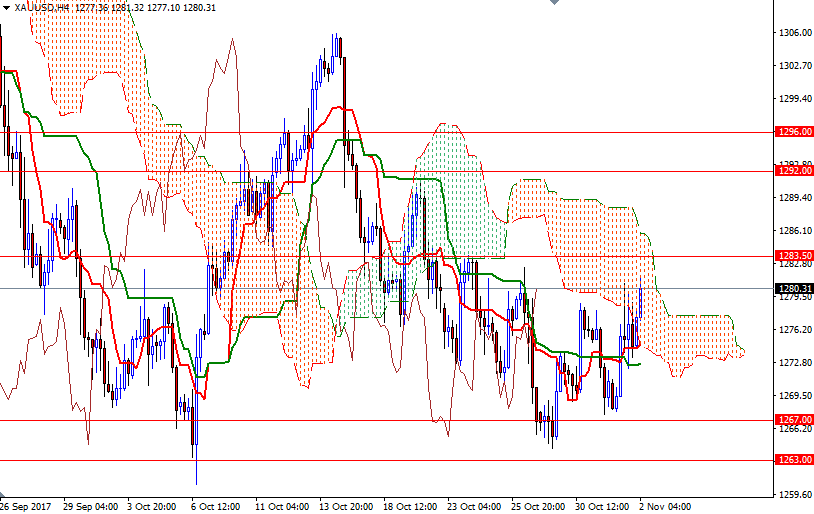

XAU/USD is currently in the process of testing the resistance in the 1280/78 zone. The market is trading above the Ichimoku clouds on the H1 and the M30 time frames. The Tenkan-sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on the H4 and the H1 charts. These suggest that the bulls have momentum on their side for the time being.

However, as I pointed out in my previous analysis, the bulls have to successfully break through 1283.50 and penetrate the 4-hourly cloud (the top of the cloud currently sits at 1286.50) to make an assault on 1292. Closing above 1292 on a daily basis would pave the way for 1297/6. To the downside, the initial support stands in 1273/2. A break down below 1272 opens up the risk of a test of 1269/7.