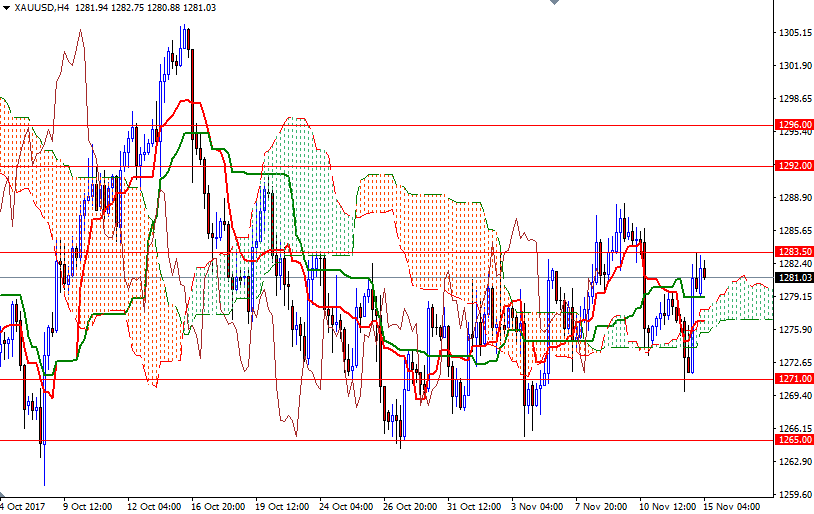

Gold prices ended Tuesday’s session up $2.02 as weakness in the U.S. dollar and pullbacks in major stock markets helped boost investor appetite for the precious metal. XAU/USD initially fell yesterday but bounced up nicely from the anticipated support level at $1271 and reached the $1283.50 level. Prices are stalling just below this area as market players await retail sales and consumer inflation data from the United States.

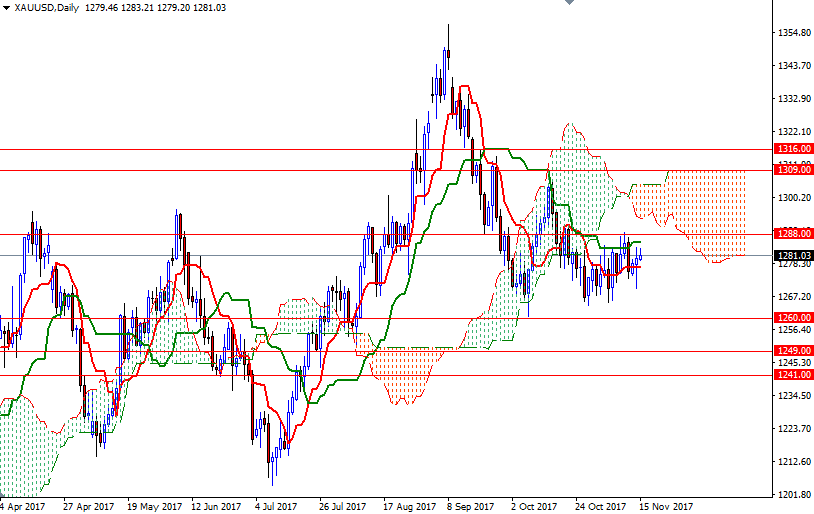

The market is trading above the Ichimoku clouds on the H4 and the H1 charts, but the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are flat, indicating absence of a strong momentum. If XAU/USD can successfully get above 1283.50, it has the potential to rise to 1288/7. A break up above 1288 would make me think that the 1292 level could be the next target.

To the downside, the bears will need to pull prices below the intra-day support in 1279/8 to test 1275/4, the bottom of the 4-hourly cloud. A break below 1274 would lead to a fall to 1271. If this support gives way and we take out yesterday’s low, look for further downside with 1265 as the next target.