Gold prices fell $15.53 an ounce on Monday, weighed down by a rally in the U.S. dollar index. The greenback was boosted by a fall in the euro after German coalition government talks collapsed. World stock markets that edged higher at the start of a busy week also put downside price pressure on gold. This week, investors will be focusing on Fed Chair Janet Yellen’s speech and the release of minutes of the Federal Open Market Committee’s latest policy meeting. A bullish element that could rescue the precious would be a flare-up in U.S.-North Korea tensions.

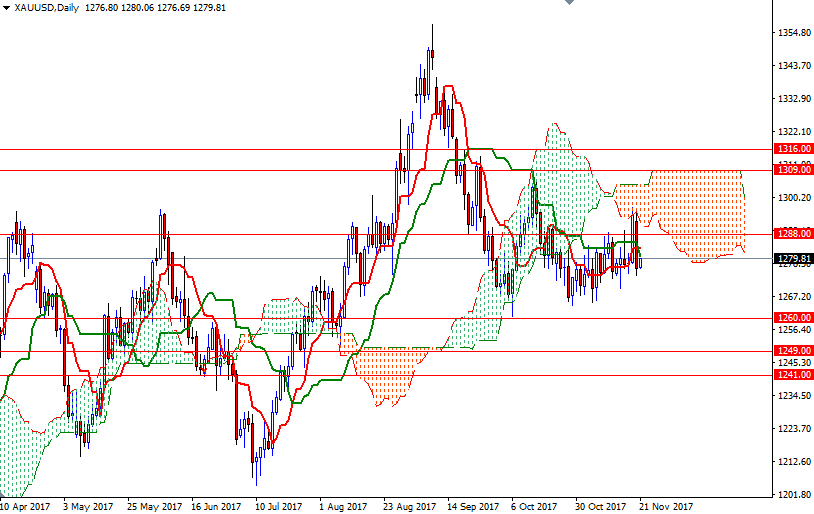

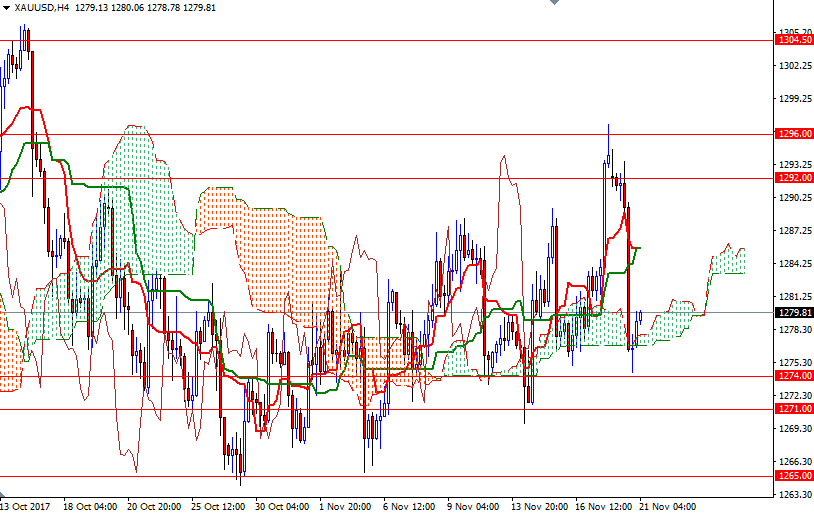

XAU/USD gave up a big portion of last week’s gains after prices broke below the 1281 level. The market moved towards 1274/1 but this area has been supportive so far. Prices climbed back above the Ichimoku cloud on the H4 chart the bulls will have to push prices beyond 1283.50 for a stronger recovery.

In that case, the market will be targeting the 1285.60 level, the confluence of the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) on the H4 chart. Penetrating that barrier paves the way for a test of 1288. If the bears, on the other hand, successfully drag prices below the 1274 level, we will probably visit the support at 1271. The market has to get down below there in order to continue to the downside and test 1265 and 1260.