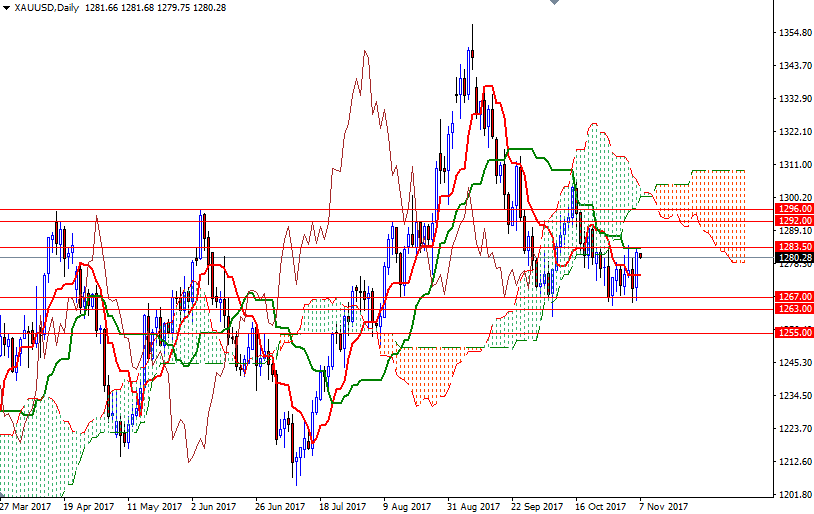

Gold prices ended Monday’s session up 1.21%, supported by short covering in response to geopolitical concerns. On the one hand gold is finding some support due to demand for protection against geopolitical risks, but on the other hand growing perception that the Federal Reserve has three hikes up its sleeve for 2018 is weighing on the market. So far gold prices have been continuously held in check by the key 1283.50 barrier while buying interest near the 1167/5 area put a floor in trading range.

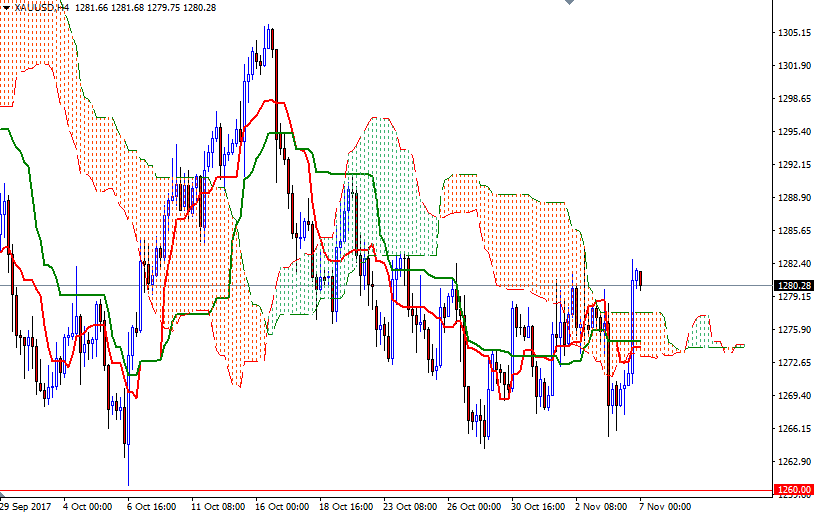

Yesterday’s price action pushed XAU/USD back above the Ichimoku cloud on both the H4 and the H1 charts. The market is trying to stay above the 4-hourly cloud for the time being and the short-term charts suggest that a test of 1288 is likely if the 1283.50 level is broken successfully. A break through there brings in 1292.

However, if the bears successfully defend 1283.50, which also happens to be the daily Kijun-Sen (twenty six-period moving average, green line), and drag prices back into the 4-hourly cloud, then the market may head down to 1274/3. Breaking down below the 1273 level could put some pressure on the market and increase the possibility of an attempt to revisit the support round 1276.