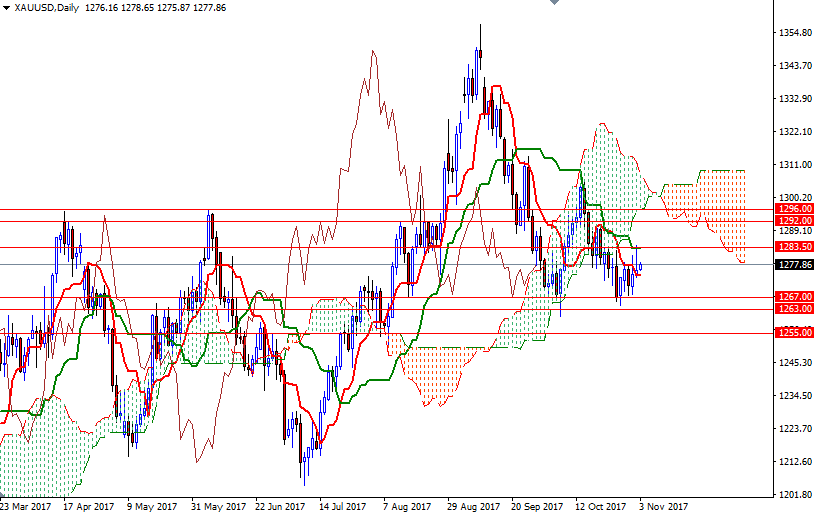

Gold prices rose slightly on Thursday and closed the session at $1275.88 an ounce. XAU/USD tested the $1283.50 level, but was unable to break through. The pattern on the charts suggests that prices will tend toward consolidation as markets await key U.S. data. Today sees the release of monthly non-farm payrolls report and not surprisingly market participants are reluctant to make aggressive bets.

The key levels, which I underlined earlier this week, are still valid as the support in the 1263/0 area remained intact and 1283.50 held as resistance. XAU/USD is being supported by the Ichimoku clouds on the H1 and the M30 charts. However, the market is residing within the borders of the 4-hourly cloud. If the bulls can convincingly push prices above 1283.50, the weekly and daily Kijun-Sen (twenty six-period moving average, green line) converge, look for further upside with 1288-1286.50 and 1292 as targets.

To the downside, the initial support stands in the 1273/2 area, followed by 1269/7. The bears will have to capture this strategic camp so that they can challenge the bulls on the 1263/0 battlefield. A daily close below 1260 implies that 1255 will be the next stop.