Gold prices closed at their lowest level in a week on Wednesday, under pressure from a stronger dollar rising stock markets. In economic news, the Commerce Department reported that the U.S. economy grew at a 3.3% pace in their third quarter. Federal Reserve Chair Janet Yellen said “We continue to expect that gradual increases in the federal funds rate will be appropriate to sustain a healthy labour market and stabilize inflation around (our) 2 per cent objective.”

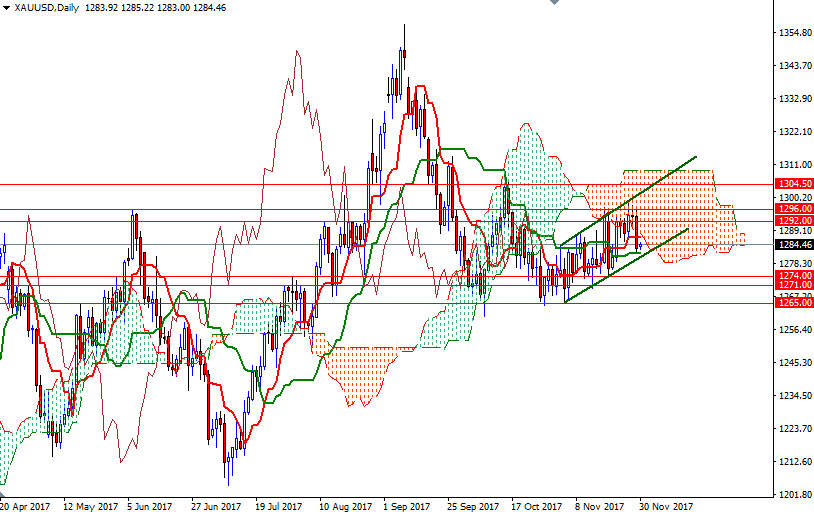

The market’s inability to pass through the resistance in the $1296.80-$1296 area was also behind yesterday's %0.8 decline. Not surprisingly, breaking below the support in the 1292/1 zone accelerated the downward movement and dragged XAU/USD to the 4-hourly Ichimoku cloud. The bulls are able to defend their camp in the 1283-1281.60 area so far, but they will need to lift prices back above the 1288 level if they don't intend to give up. In that case, XAU/USD might revisit 1292/1.

To the downside, keep an eye on the daily Kijun-sen (twenty six-period moving average, green line) sitting at 1281.60. If this support is broken, the market will test 1279.80-1278.60 next. A decline below 1278.60 could trigger further weakness and pave the way towards the 1274 level.