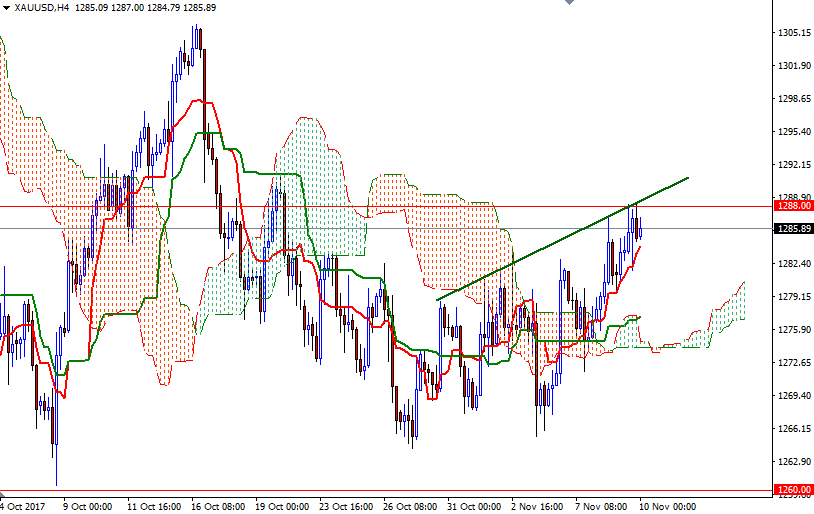

Gold prices rose for a second-straight session on Thursday as declines in global equities increased desire for safe haven diversification. XAU/USD moved higher as expected after prices got back above $1283.50, but the market was unable to penetrate the resistance at the $1288 level.

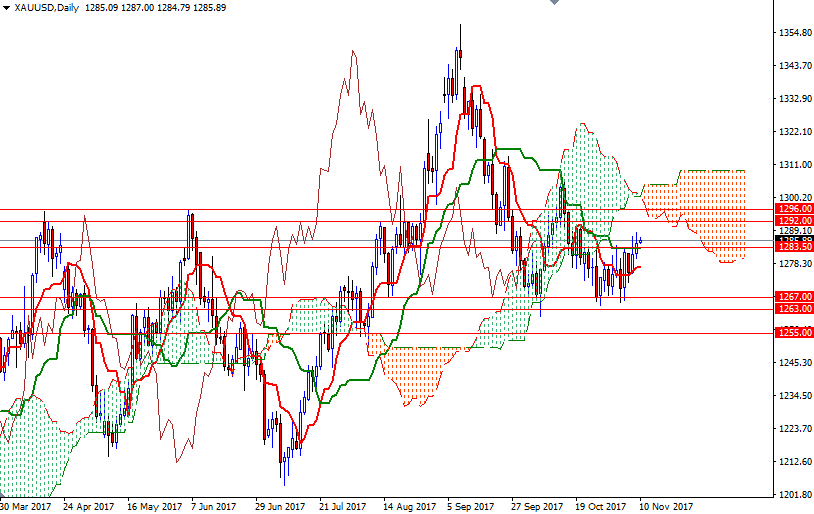

The short-term charts are bullish, with the market trading above the 4-hourly and the hourly Ichimoku clouds. We have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both time frames. Plus, the 4-hourly Chikou-span (closing price plotted 26 periods behind, brown line) is above the clouds. Despite this positive outlook, the market will continue to feel bearish pressure from the daily Ichimoku cloud.

To the upside, keep an eye on the aforementioned resistance at 1288. The bulls have to overcome this hurdle to gather momentum for 1292. If the bulls can push prices above 1292, then the 1297/6 area will be the next port of call. A failure to pass through 1288, on the other hand, could result in some profit taking. In that case, it is likely that XAU/USD will pull back to test 1283.50 and 1281.60. A break below 1279, the bottom of the hourly cloud, might lead to a drop to the 4-hourly cloud.