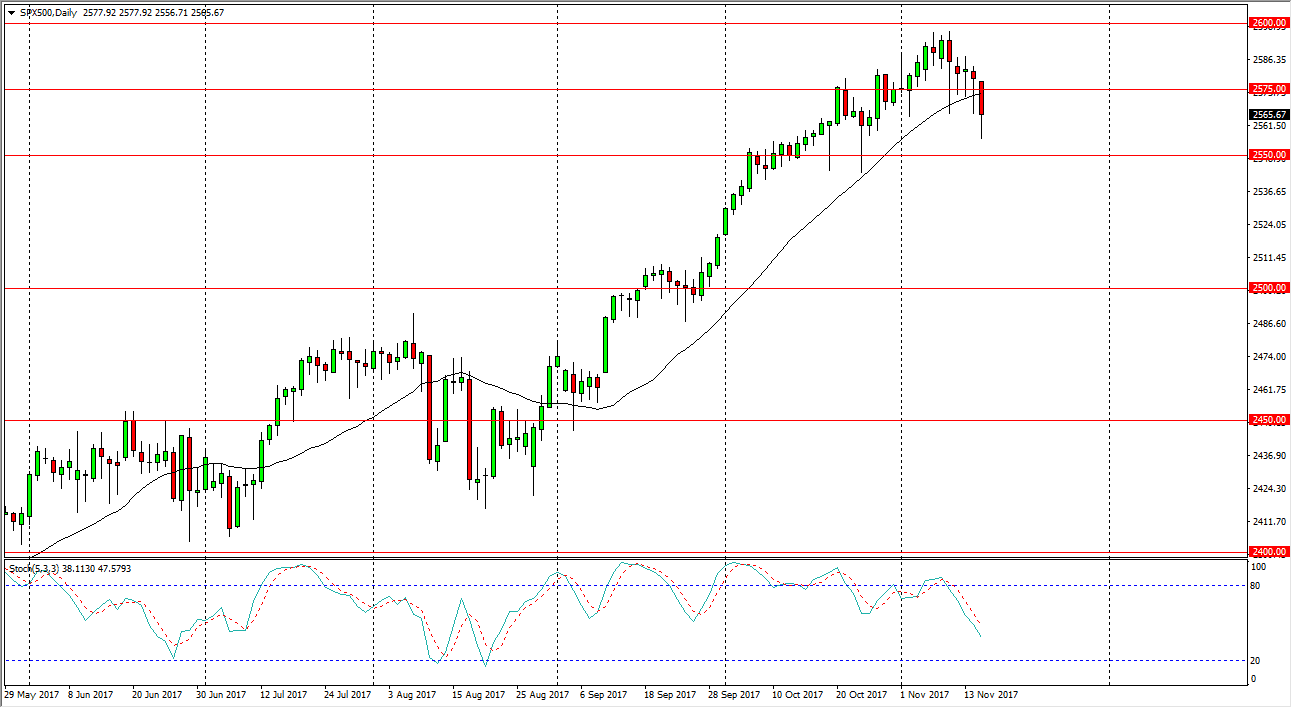

S&P 500

The S&P 500 has fallen a bit during the trading session on Wednesday, as we have broken through the bottom of several hammers. I believe at this point the S&P 500 will probably continue to drift a bit lower, perhaps looking for support near the 2550 handle. That would be a move that would be expected, because quite frankly we had been so overextended for so long. The market could even break down a bit lower than that, perhaps down to the 2500 level. Ultimately, I think that the markets should continue to be bullish, but finding a bit of value along the way is probably the best way to go forward. If we can break above the 2600 level, the market should continue to go much higher, perhaps to the 2700 level after that. However, I believe the stock traders are starting to become a bit concerned about the tax reform bill in the United States.

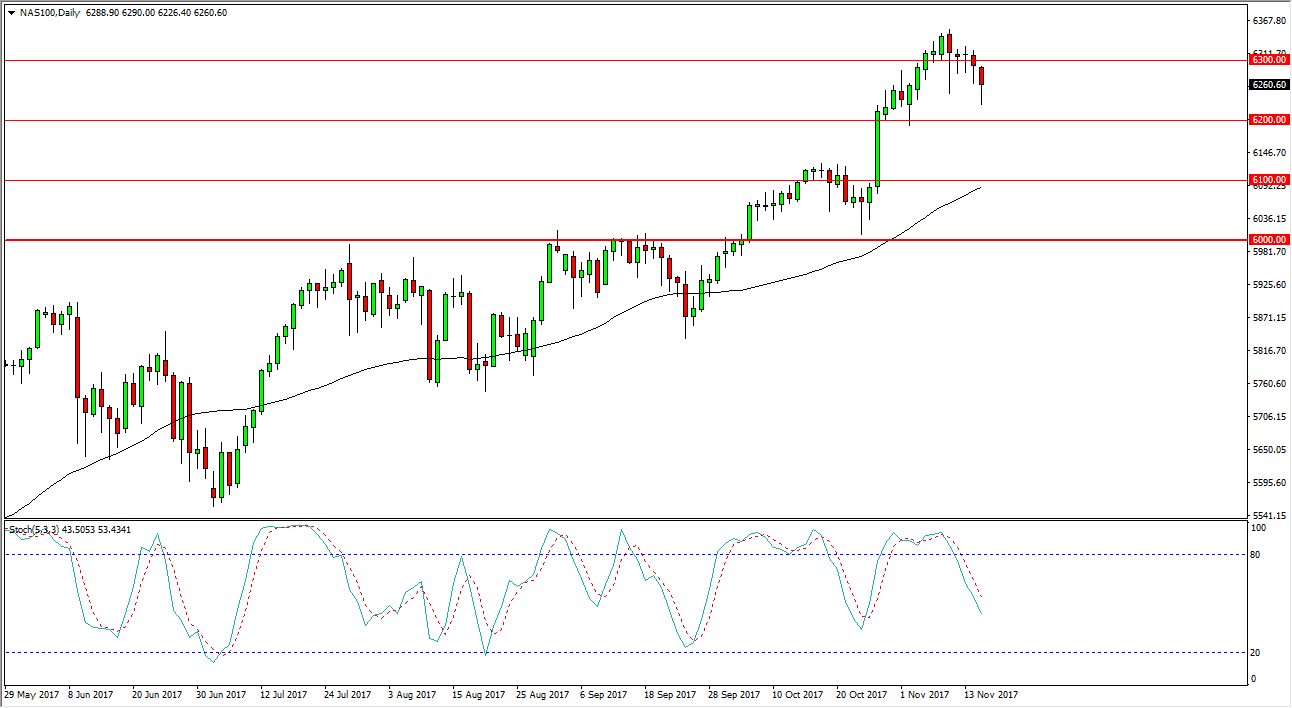

NASDAQ 100

The NASDAQ 100 fell significantly during the day on Wednesday, but bounced a bit towards the later part of the day. I think that there is even more support at 6200 level though, and I think that the markets in general are going to drift a little bit lower. However, I also recognize that the markets are bullish in general, so I think that looking for value underneath is probably the way to go forward. I think that breaking below the 6200 could send this market as low as 6100 underneath, and of course the “floor” of the overall uptrend is the 6000 level. I am a firm believer that the NASDAQ 100 will quite often lead the way for the rest of the US stock market, and I don’t think that’s going to be any different anytime soon.