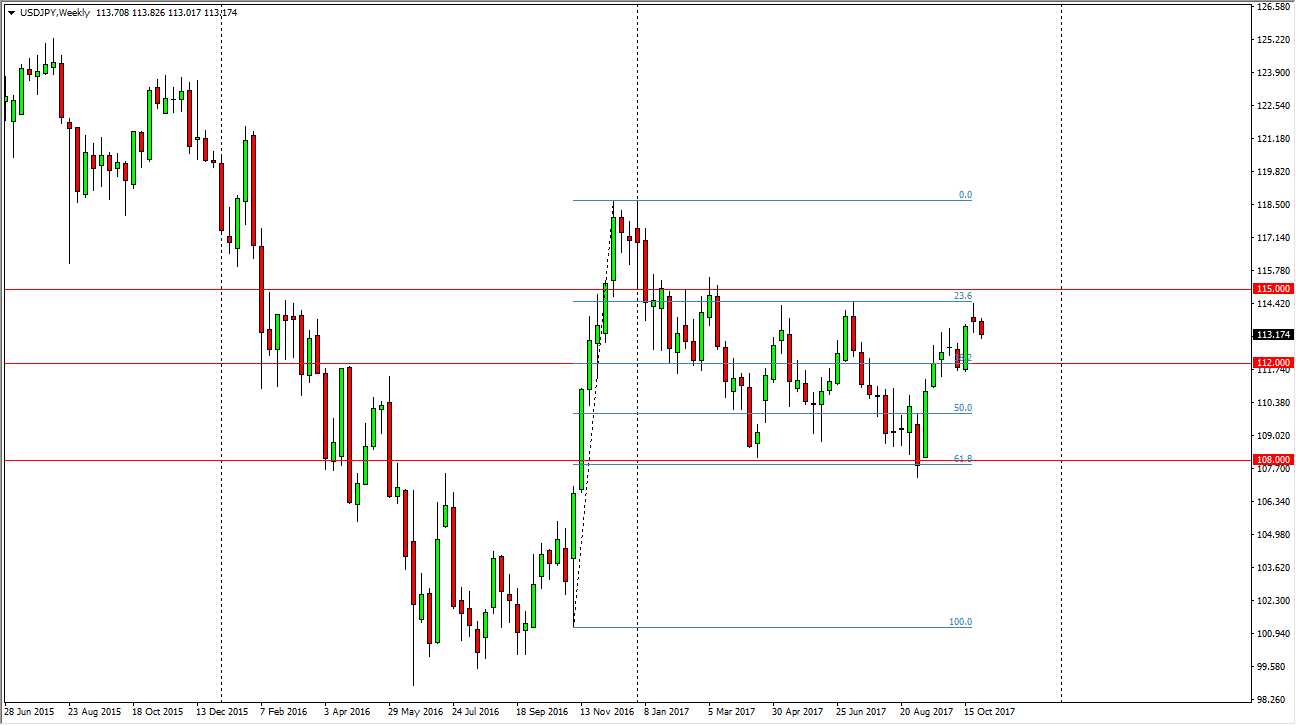

The US dollar had to rally during most of the month of October against the Japanese yen, but as you can see, we continue to find resistance at the 114.50 level above. That should extend towards the 115 handle, so it’s not until we break above there that I feel we are finally free of the massive resistance. A pullback from here seems likely, but I think that there are a couple of support regions that could come into play. Pay attention to the ZN futures market, as it could give us a “heads up” as to where the US dollars going next. If interest rates fall, it’s likely that this pair will turn around and rally, perhaps even breaking above the 115 handle. If we can break above there, the market should then go to the 118.50 level above. Ultimately, this is a market that should be choppy as per usual, but I think we are going to start out falling a bit.

I recognize the 112 level as significant support, but if we were to break down below there, the market probably will go looking for 110, and then the 108-level underneath. I think it is only a matter of time before the buyers return, but currently it looks as if we are still in the overall consolidation. However, I think things are changing in the US dollars favor, and that’s why I suspect that the 112 level will keep this market supported. If we do break down below there, it’s likely that we continue to bounce back and forth. I think we need some type of catalyst to go higher, so that’s why I’m paying attention to the interest rates coming out of the United States, as the correlation is massive.