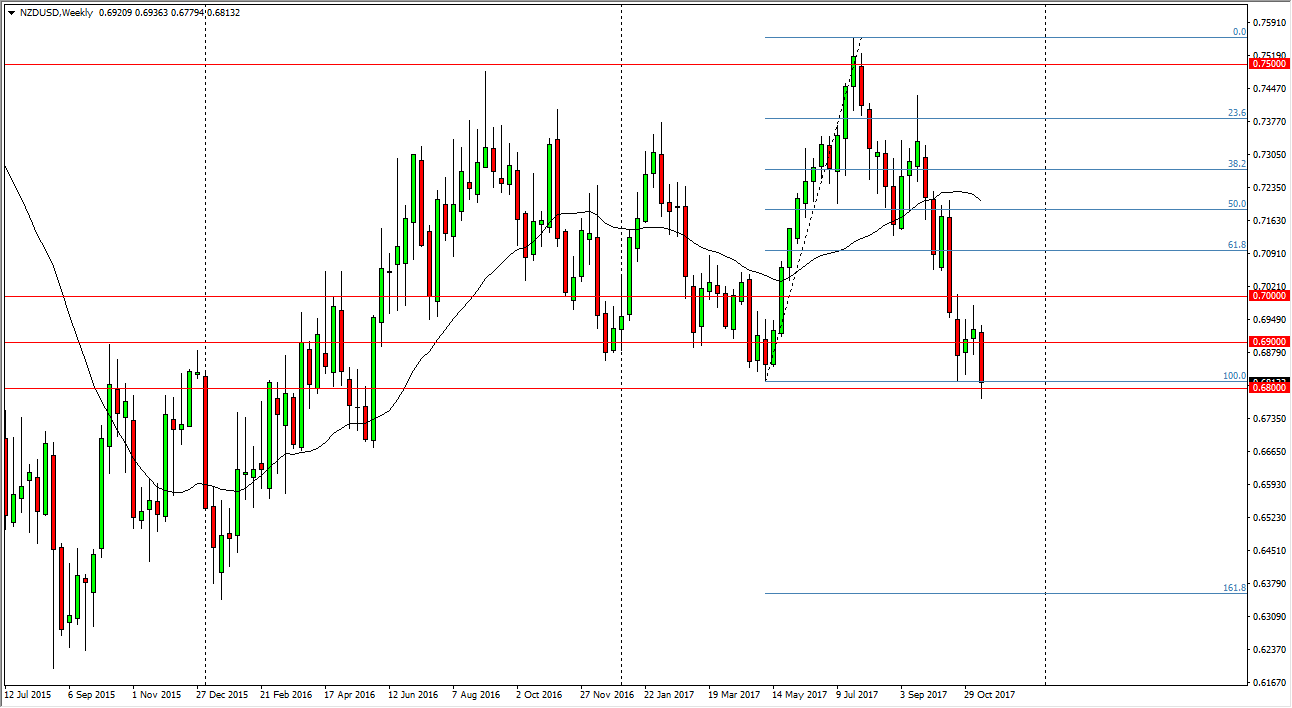

NZD/USD

The New Zealand dollar has had a rough week yet again, testing the 0.68 level. I believe that if we break down below the lows of the week, we will continue the downward pressure. Any rally at this point in time we will probably face a significant amount of resistance near the 0.70 level as well. This is a market that could get a boost to the downside if the US Congress can pass tax reform, as it would put bullish pressure and the greenback. At this point, I suspect there’s more downside risk than up.

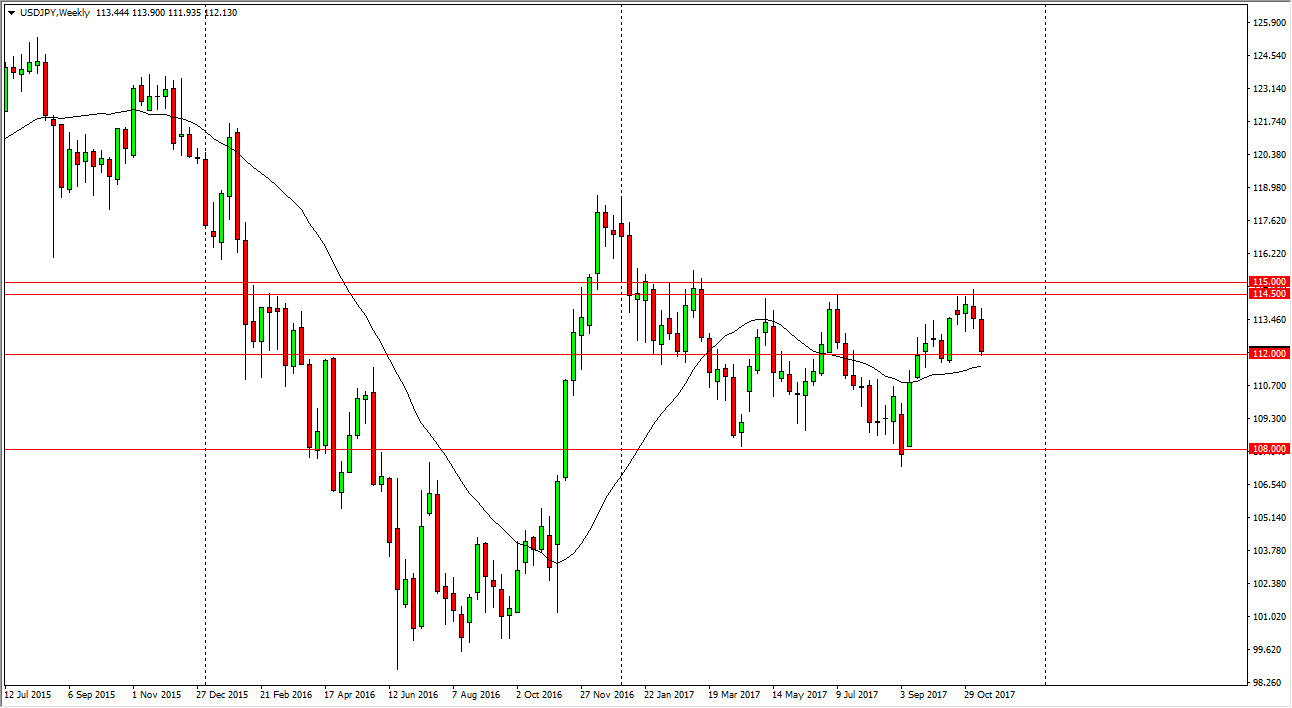

USD/JPY

The US dollar initially tried to rally, but then rolled over to reach towards the 112-level underneath. If we break down below the 112 level, the market should then go down to the 108 handle, which is the bottom of the larger consolidation area. If the US Congress cannot pass a tax bill, we should see this market break down towards the 108 handle without too much trouble as the US dollar has been struggling because of this. However, if things change in the U.S. Congress, then this market will rally and reach towards the 114.50 level. I suspect there’s probably more downward pressure than up at this point.

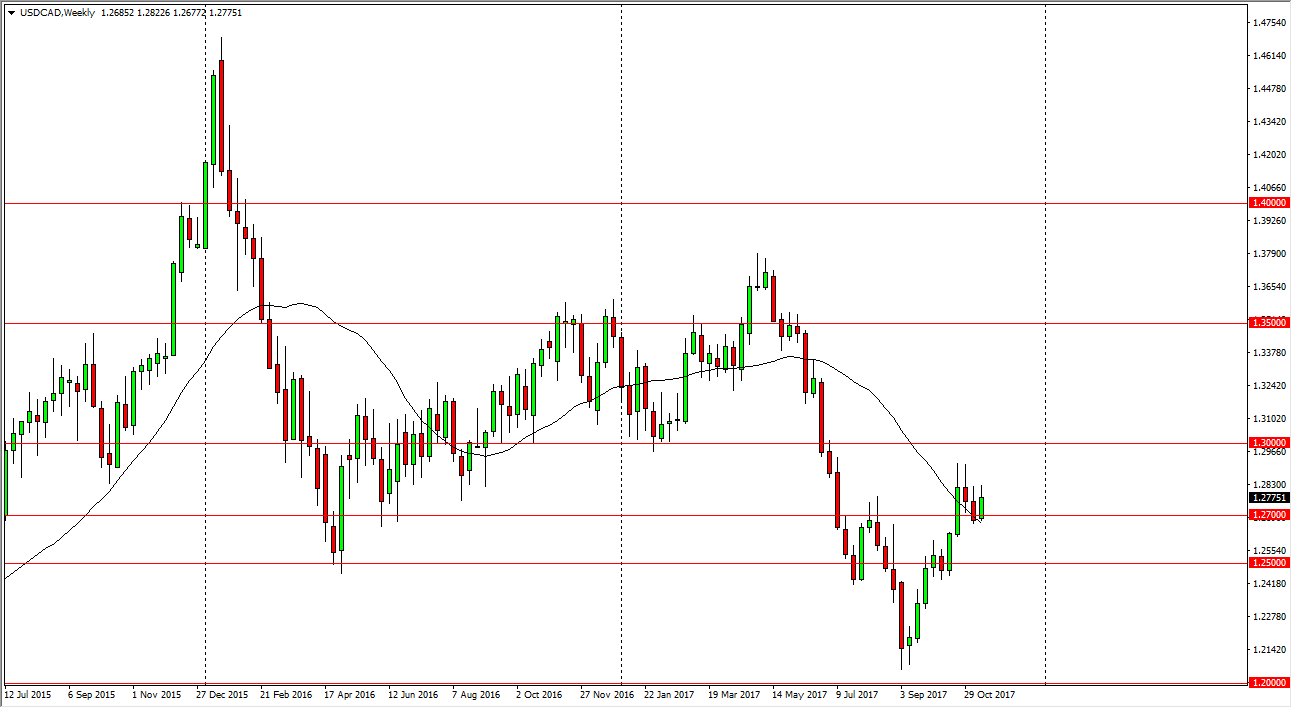

USD/CAD

The US dollar rallied against the Canadian dollar during the week, bouncing off of the 1.27 level, an area that was previous resistance, and is now support. It’s likely that the market could rally from there, perhaps reaching towards the 1.30 level. I suspect that if oil roles over, that might be reason enough, but if the tax bill passes, that will make this move absolutely explosive.

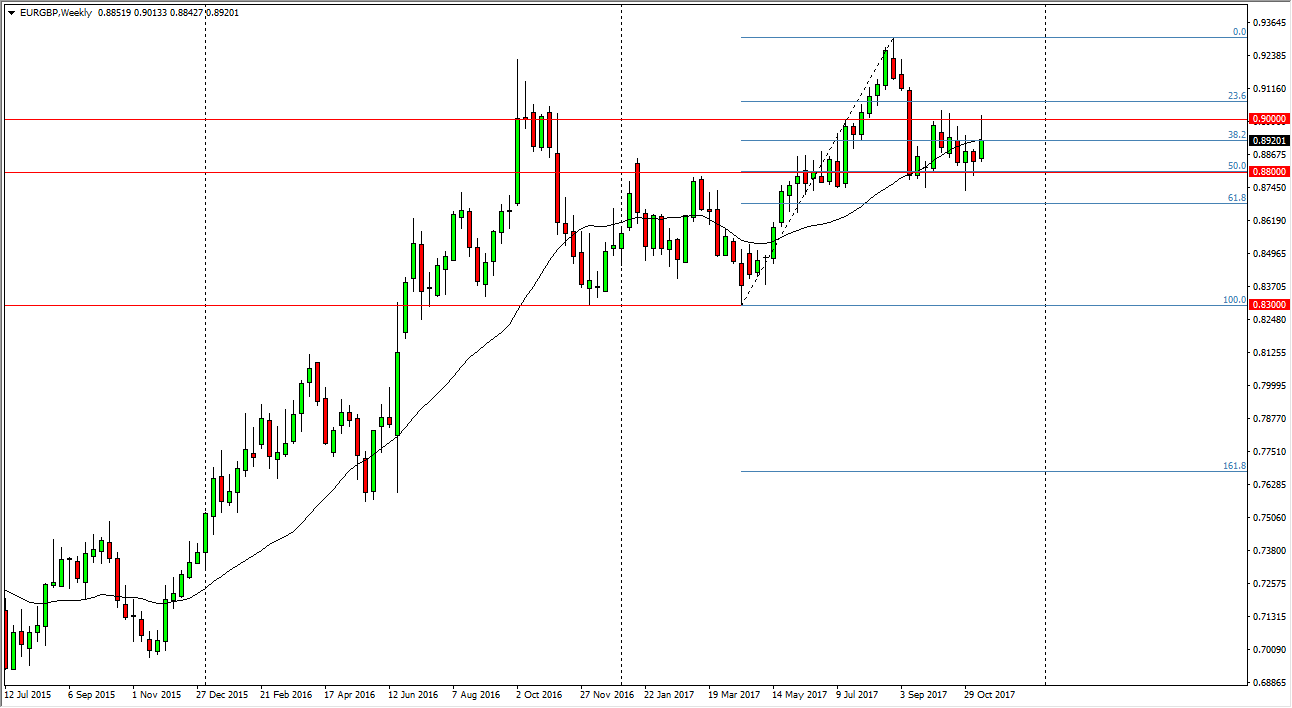

EUR/GBP

The EUR/GBP pair continues to bang around the 0.88 level on the bottom, and the 0.90 level on the top. I think we are going to continue to see more consolidation, but I do favor the upside as it’s more than likely going to continue to be a bit of uncertainty when it comes to the United Kingdom, and therefore traders will prefer the EU, least in the short term. A break above the 0.9050 level would be a much more explosive moved to the upside waiting to happen.