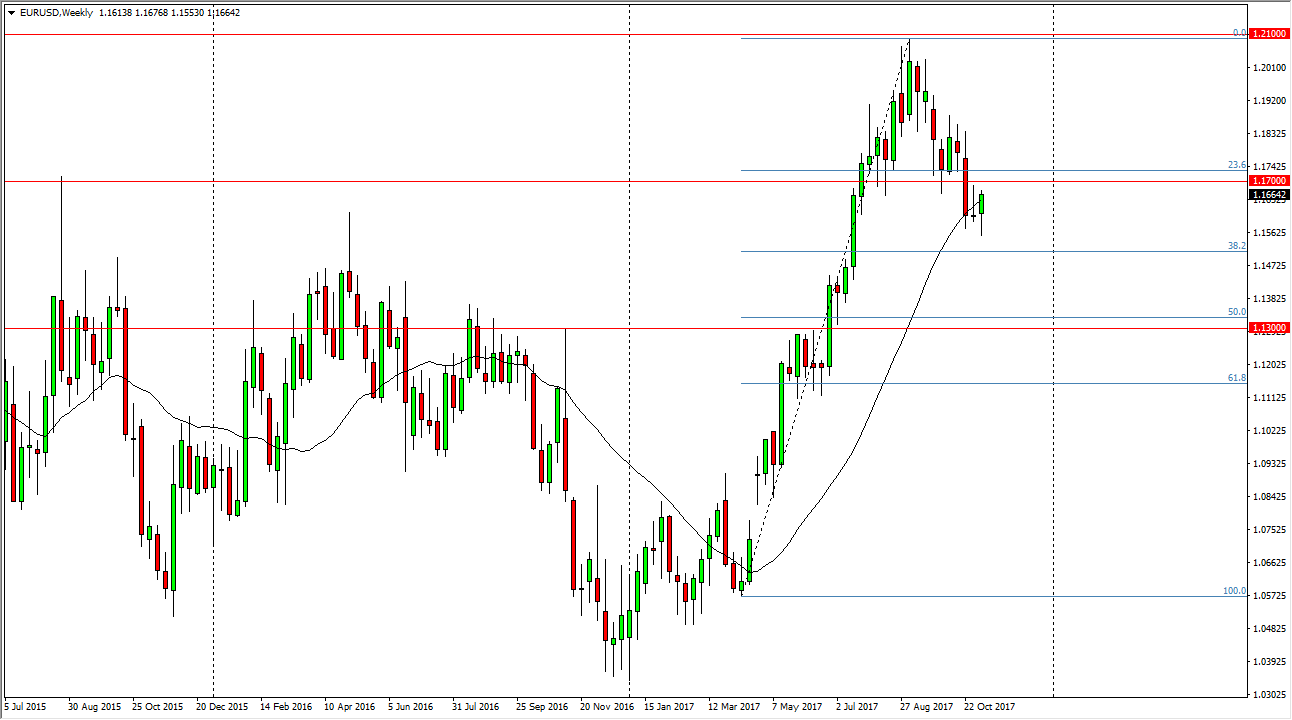

EUR/USD

For me, this could be one of the more interesting markets to pay attention to. On the weekly chart, we initially fell, looking likely to continue the downward pressure after breaking the neckline of the head and shoulders pattern on the daily chart, but since then we have rolled back to the upside. This is mainly due to the lack of fortitude in the U.S. Congress, and the inability the past tax reform. It now looks as if we are testing the neckline at the 1.17 handle. This is a simple trade for me, we either break above the 1.17 level, and go long, or we roll over again and continue to go lower. I am a seller until we break above the 1.17 level, and then I think we will reverse completely and go towards the 1.21 handle.

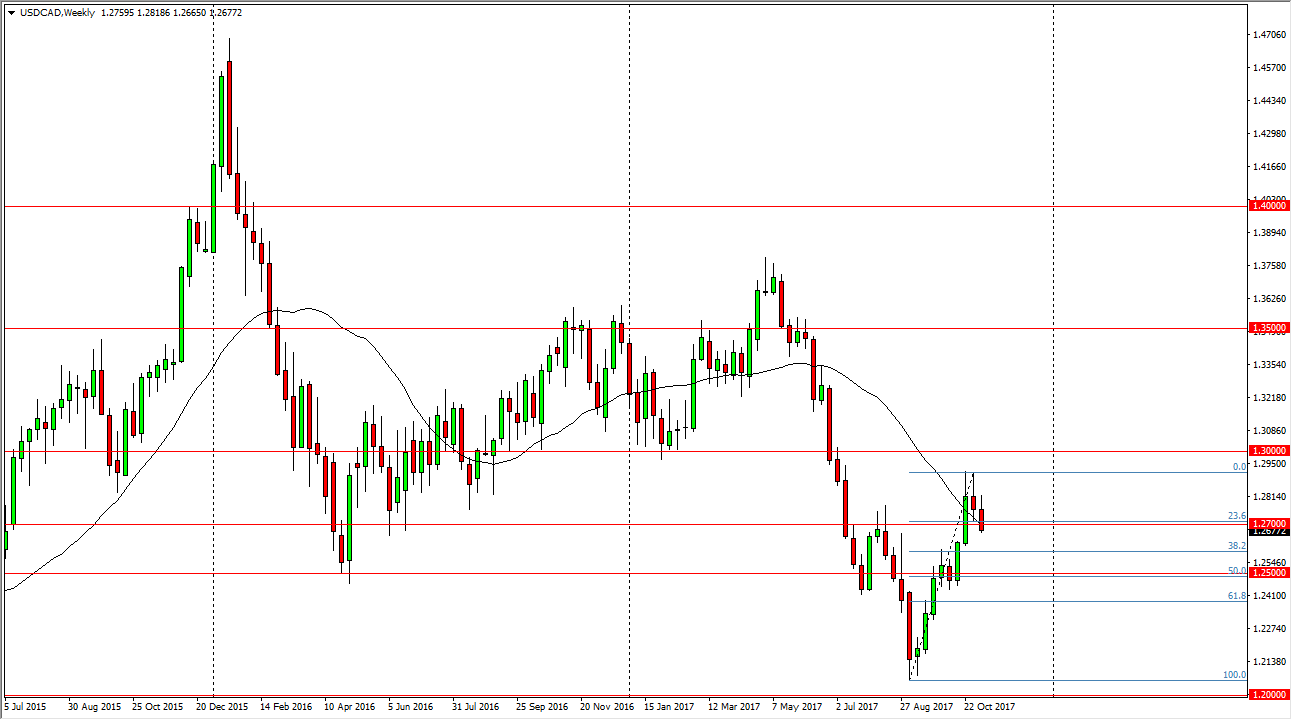

USD/CAD

Looking at the USD/CAD pair, we initially tried to rally during the week, but then rolled over and broke through the 1.27 handle. Ultimately, I think that we have made a “higher high”, and that suggests to me that although we are getting ready to roll over, it’s likely that we will continue to see the market look for value at lower levels. I think we are getting ready to drop down a little bit over the next week or so, but given enough time, I suspect that the buyers will come back. I look for weakness in the beginning part of the week, but then eventually the buyers to come back.

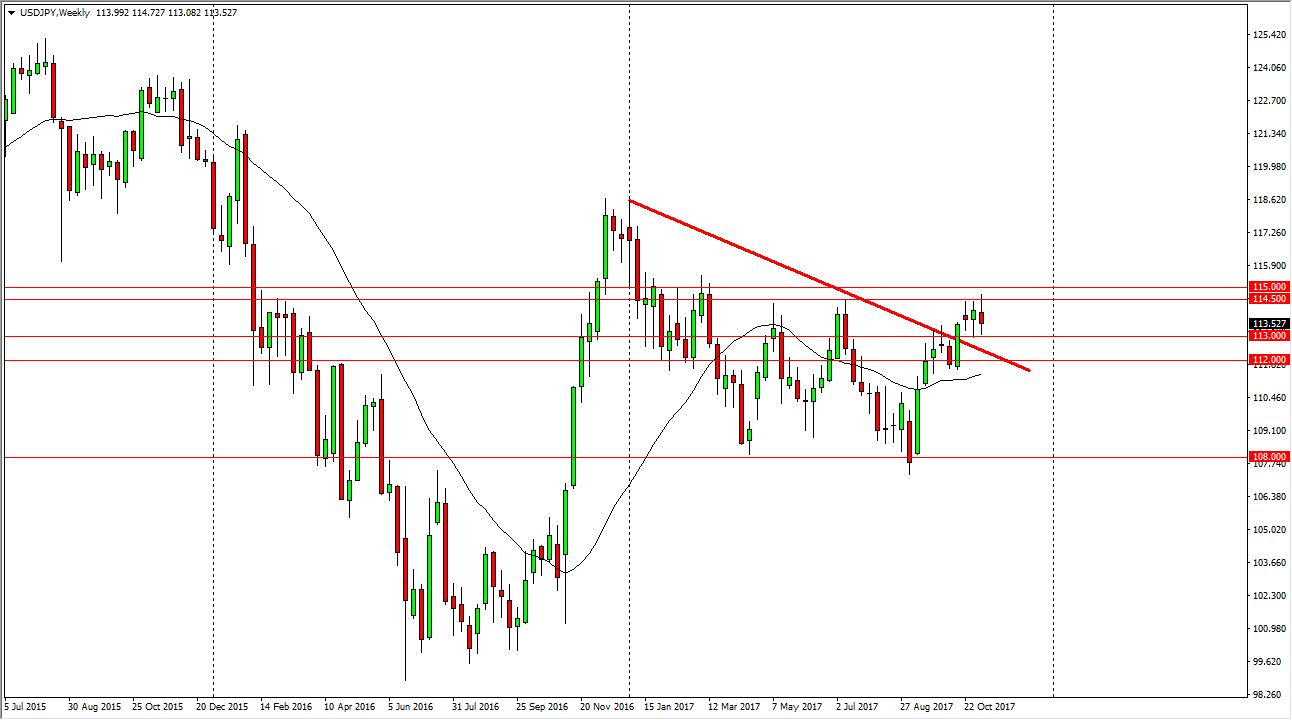

USD/JPY

The US dollar had a tough week against the Japanese yen, initially trying to break above the 114.50 level, which extends to the 115 level as far as resistance is concerned. However, we have turned around to show signs of exhaustion. I think that the 113 level will offer support, but more importantly there is a previous downtrend line that should offer support as well. The 112-level underneath is a “floor” in the market. I think we may see a little bit of weakness, but ultimately this market turns to the upside.

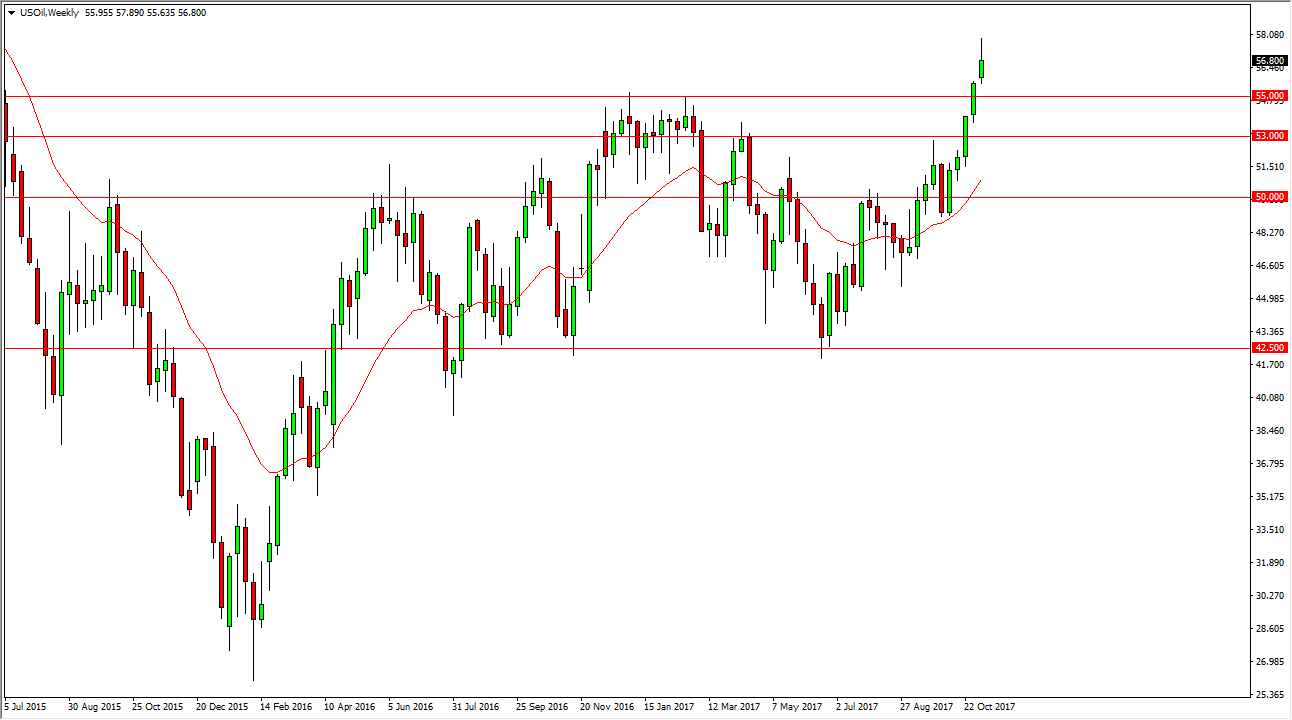

WTI Crude Oil

The WTI Crude Oil market rose significantly during the week, but gave back a bit of the gains at the $50 level. The weekly candle tells me that we will probably continue to see a little bit of a pullback, but I also recognize that the $55 level very easily could be support. Ultimately, I think that we will eventually see the market roll over significantly, because these high prices of course attract a lot of drilling in North America. However, I believe this week will be more of the same, after we get a little bit of a pullback to offer value for buyers.