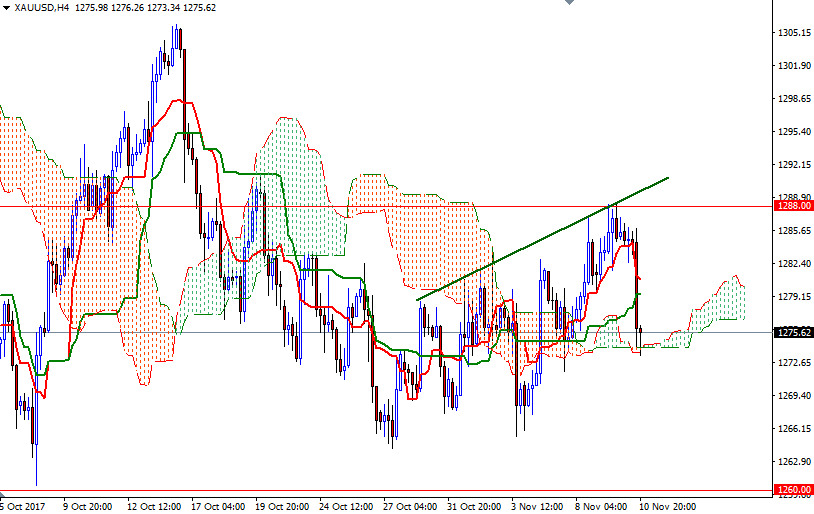

Gold snapped a three-week losing streak as a softer dollar and falling stocks prompted investors to seek safer assets. The precious metal benefitted from a drop in the U.S. dollar index, hitting a near three-week high on Thursday, but gave up a portion of its gain on Friday. The market’s failure to break through the 1288 level dragged prices to 1283.50 and breaking below 1281.60 sparked a further selloff towards the 4-hourly cloud as anticipated.

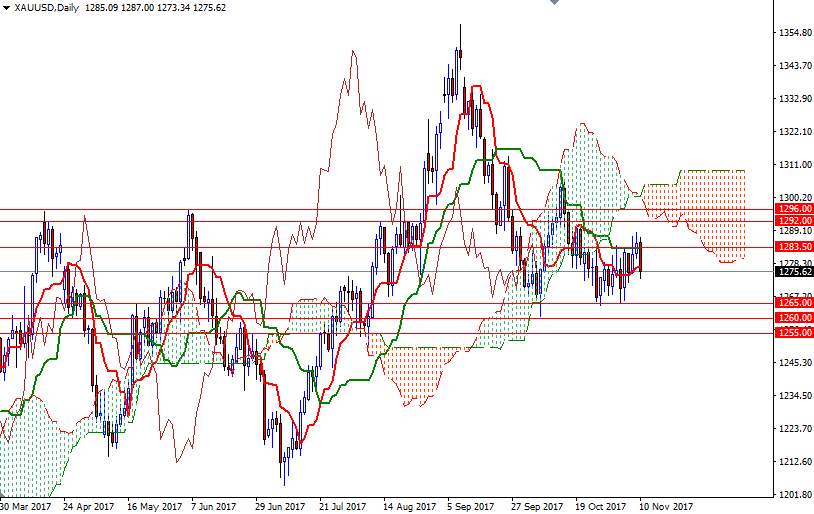

XAU/USD is trading above the weekly and the 4-hourly Ichimoku clouds but we are still below the daily clouds. The bulls have the slight overall technical advantage, though they have to lift prices above the 1285-1283.50 zone to make an attempt to penetrate the daily cloud. A daily close above the 1296/2 area, where the bottom of the daily cloud resides, could provide the bulls the extra fuel they need to approach 1309.

To the downside, the initial support sits in 1274/1, followed by 1267/5. Closing below the 1265 level on a daily basis would pull the Chikou-span (closing price plotted 26 periods behind, brown line) below the (daily) cloud and encourage sellers. In that case, 1260 and 1255 could be the next targets. A decline below 1255 could trigger further weakness and pave the way towards the 1249 level, the top of the weekly cloud.