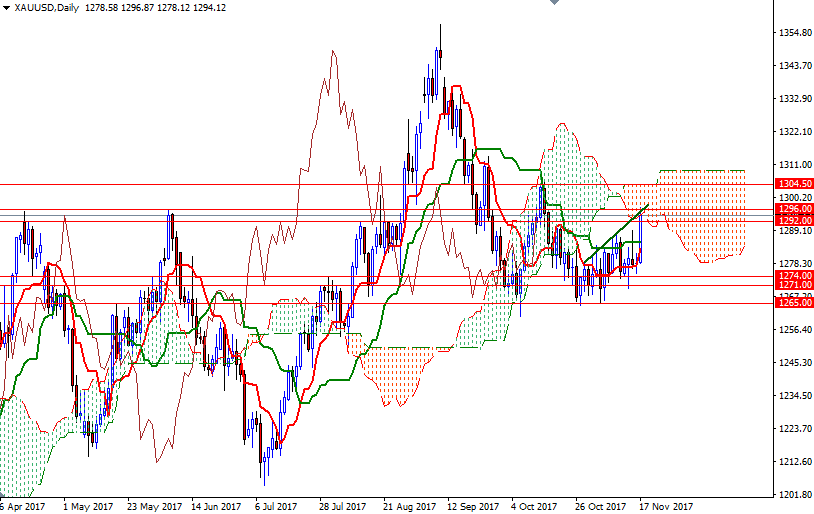

Gold prices settled at $1294.12 an ounce on Friday, rising 1.5% on the week, as a weaker U.S. dollar index and declines across global equity markets generated demand for the precious metal. XAU/USD began the week drifting lower but the bulls were able to protect their camp in the $1274-$1271 zone. Weaker stock markets favor the competing asset class, gold, but market players may be hesitant to make aggressive bets ahead of the release of minutes of the Federal Reserve’s latest policy meeting.

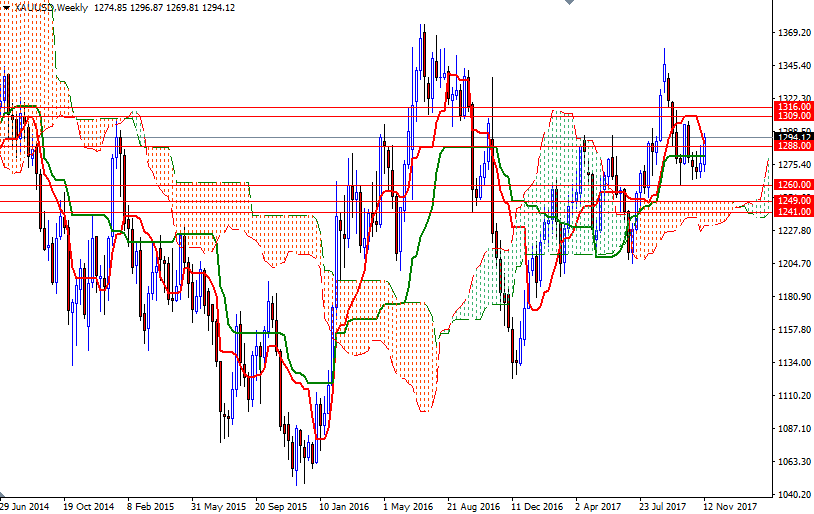

The market is above the Ichimoku clouds on the weekly and the 4-hourly charts. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. As I said a week ago, the bulls have the slight overall near-term technical advantage. Ultimately, the market saw an upside breakout from a sideways trading range on Friday and reached the 1296/2 area, where the bottom of the daily cloud resided.

Despite this positive outlook, note that the daily cloud sits right on top of us. If the market can anchor somewhere beyond the 1296 level, XAU/USD is likely to proceed to 1304.50 next. The bulls have to produce a daily close above this barrier to challenge the bears waiting at 1309. A break through there brings in 1316/3. On the other hand, if the daily cloud acts as resistance as anticipated, we could see a pull-back to 1288/7 or 1283/1. Closing below 1281 on a daily basis paves the way for 1274/1. Below there, the 1265/0 area stands out as an obvious key support.