Gold prices settled at $1288.31 an ounce on Friday, suffering a loss of 0.29% on the week, as strength in global equities curbed appetite for the safe-haven metal. XAU/USD began the week heading lower but the anticipated support in the 1274/1 area kicked in and stopped the market from falling further, pushing it back to 1296/2. Markets are pricing in a nearly 100% chance the Fed will hike rates at its next meeting in December, but minutes from the Fed’s latest meeting showed that some officials believe inflation may stay weak for longer than expected - a case that makes me think that it is developments in inflation rather than the labor market that will determine the number of rate hikes in 2018.

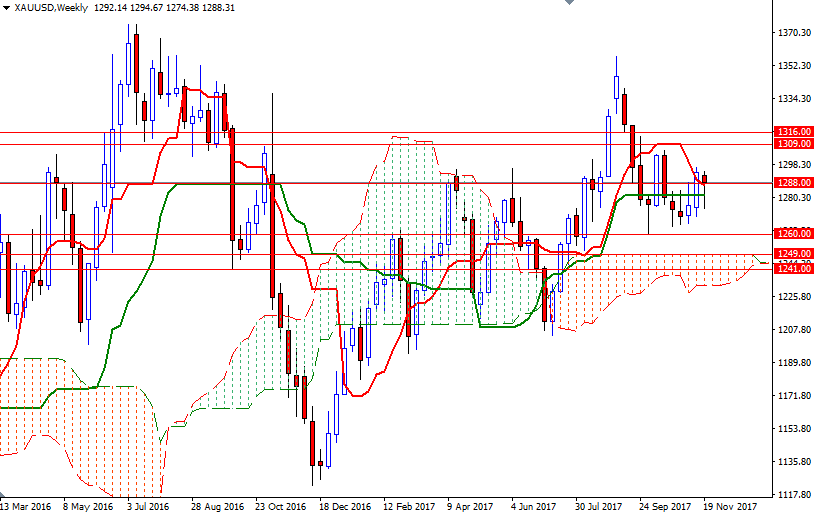

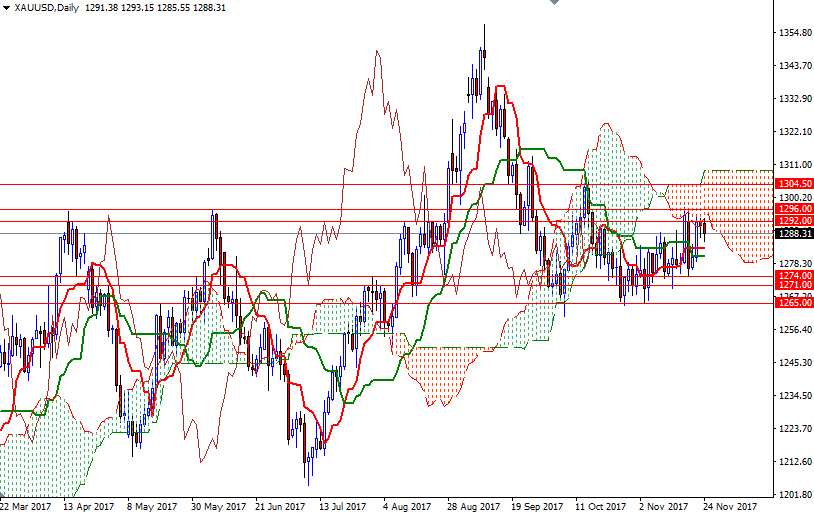

From a chart perspective, there are a couple of things to pay attention. XAU/USD is residing above the Ichimoku clouds on the weekly and 4-hourly time frames. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. The tall lower shadow of the weekly candle is also worth mentioning as it suggests that buying interest continues to emerge on dips. On the other hand, the daily cloud stands in the bulls’ way and the market hasn’t been able to break through the 1296/2 area.

In other words, the bulls have to convincingly lift prices above 1296 in order to make a run for 1304. If XAU/USD gets above 1304, the market will be aiming for 1309, the top of the daily cloud. To the downside, the initial support sits in 1283/2 followed by 1280-1278.60. A break below 1278.60 could open up the risk of a move towards 1274/1. The bears have to produce a daily close below there to gather momentum for 1265/0.