Gold prices settled at $1270 an ounce on Friday, suffering a loss of 0.24% on the week, as expectations of tighter monetary policy in the U.S pushed the dollar higher. The Federal Reserve was more upbeat about recent economic developments. Recent data continued to suggest that the world's biggest economy was still is on a solid growth path, though concerns about low inflation persisted. The dollar index posted its third straight weekly increase and the major U.S. stock indexes closed the week with records.

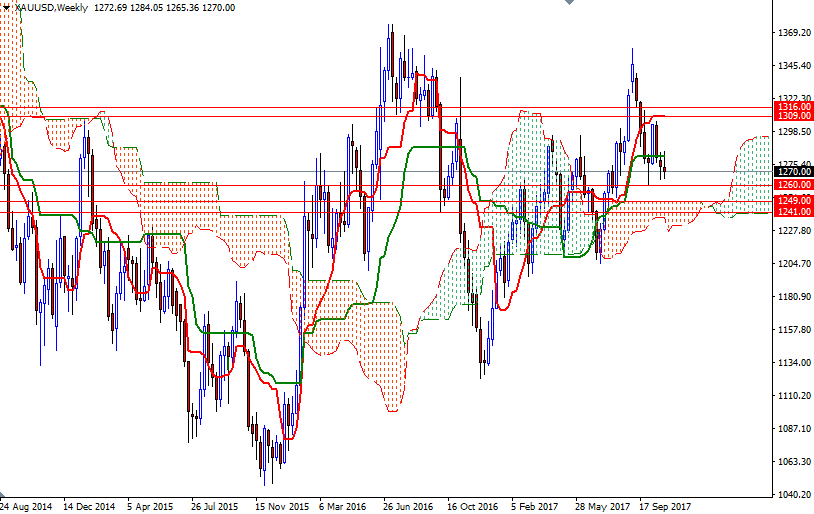

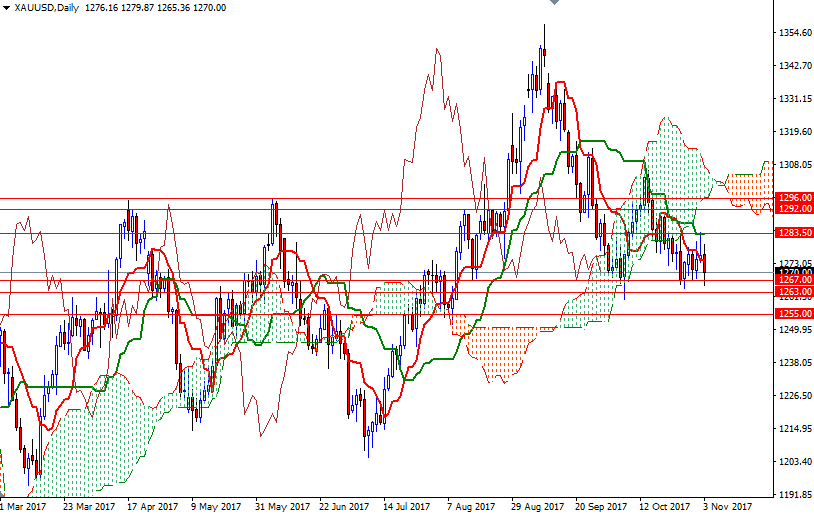

The bears have the short-term technical advantage, with the market trading below the Ichimoku clouds on the daily and the 4-hourly chars. The Chikou span (closing price plotted 26 periods behind, brown line) is also moving below the clouds. In other words, there is still the risk of a drop to the weekly cloud before the market decides on its next move.

If the bears increase pressure and drag prices below the 1263/0 area, then the market will probably visit 1255 and 1249/7. A break below 1247 could send prices down to the 1241/39 zone. The bottom of the weekly cloud sits at 1232. To the upside, the bulls will have to overcome nearby barriers such as 1275/4 and 1279 so they can make a move to challenge the critical 1283.50 level, a confluence of a horizontal resistance and the daily Kijun-Sen (twenty six-period moving average, green line). A daily close above this barrier could provide the bulls the extra fuel they need to tackle 1292. Beyond there, the bears will be waiting in the 1297/6 zone.