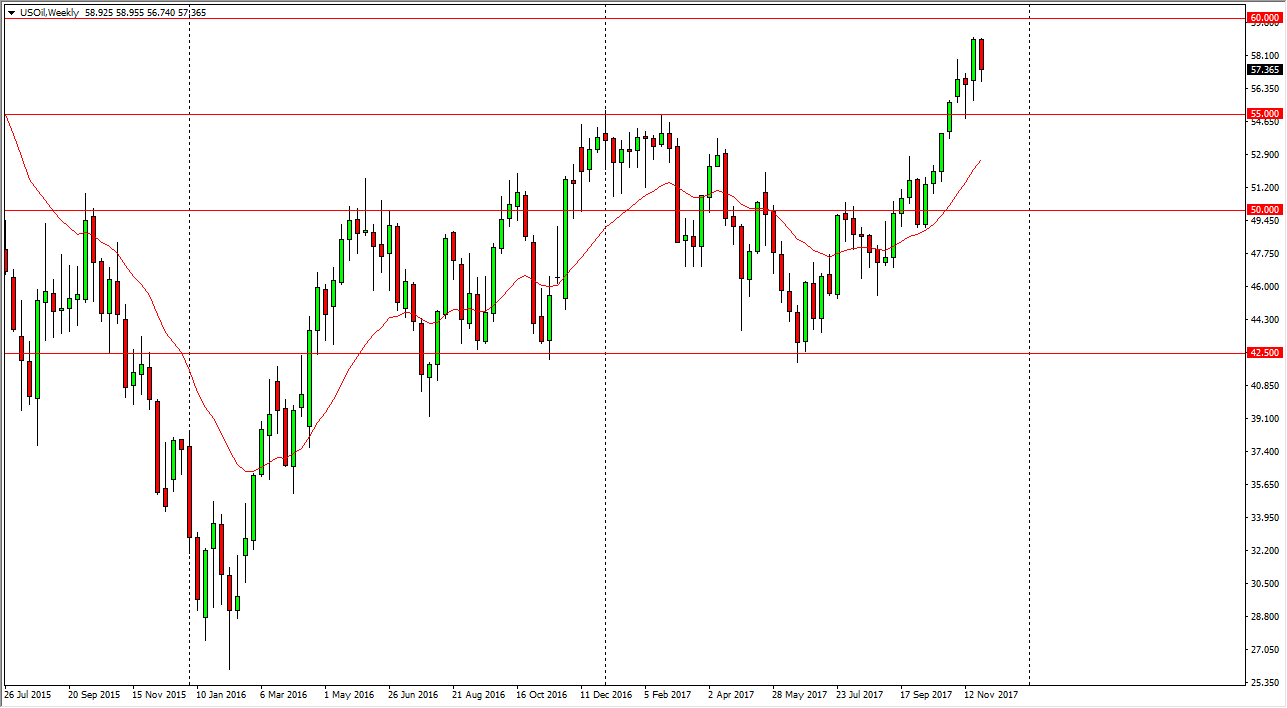

The WTI Crude Oil market will be very interesting during the month of December, because we have a lot of different things going on at the same time. For example, OPEC is discussing whether we can get some type of production cut out of the member countries, which currently it looks as if the market may be starting to believe that to be impossible. Also, we did get a decent inventory number coming out of the United States during the end of the month, but a lot of that would have been due to Thanksgiving driving more than anything else, and the distillate sector hasn’t exactly been bullish either. Also, at these high levels you can bet your bottom dollar that the Americans are more than willing to jump on with shale oil. I think $60 is going to be a very difficult nut to crack, and therefore expect a lot of noise.

If we can break down below the $55 level, I believe that the market will go looking towards the $50 level underneath. The $50 level course has a lot of psychological importance, and it would make sense that the market would go recent back towards there. However, if we did manage to break above the $60 handle, that would be a very bullish sign, and could have the market looking for $65 after that. I think we are going to continue to see a lot of choppy behavior, but we have gotten a bit overextended so pull back early in the month makes quite a bit of sense. There are a few things however, that could get in the way. Not the least of which is tension between Saudi Arabia and Iran.