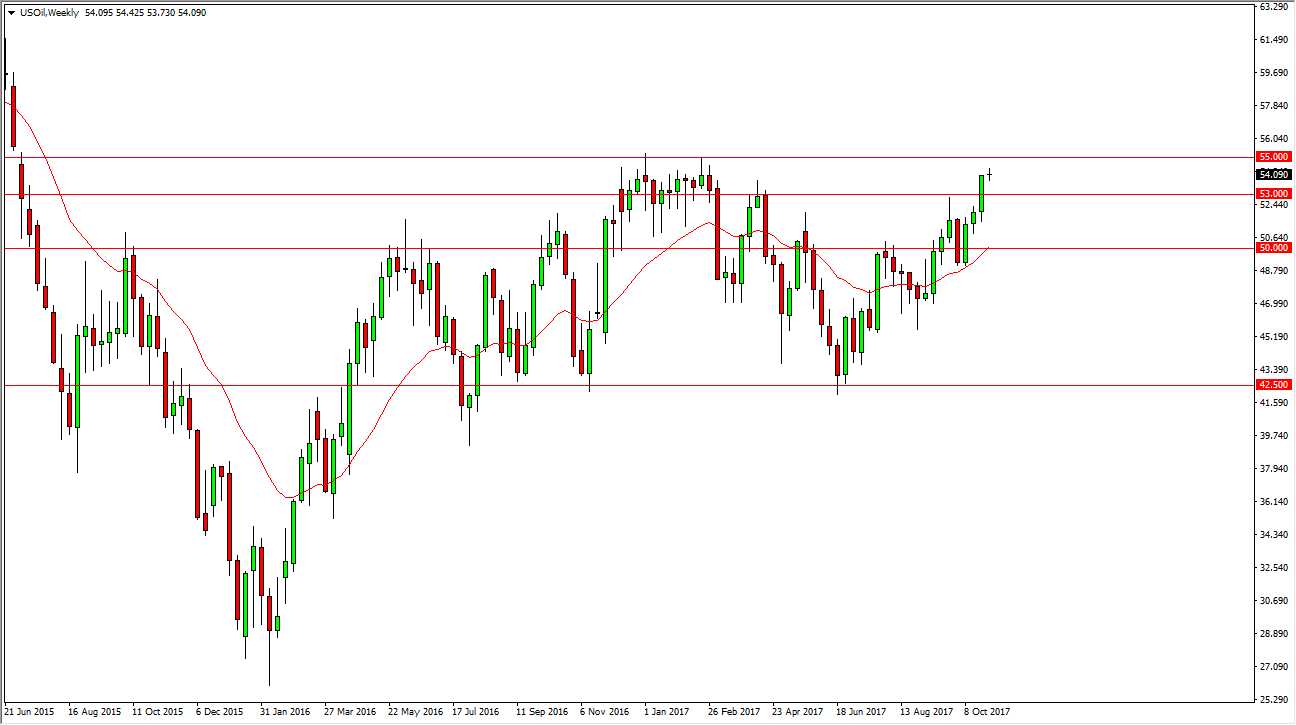

The WTI Crude Oil market has been very bullish of the last several weeks, as October ended up being one of the better months that I have seen recently. The $55 level above is the major resistance barrier that the market has been dealing with, as it is the top of the consolidation area that the market finds itself in. If we can break above the $55 level, I think this is an extraordinarily bullish sign, and the market could then go to the $60 level rather rapidly. Most of the hedge funds out there that I speak to our putting money into the oil markets now, and I think it’s likely that we will continue to see this. However, I suspect that at the beginning of the month we may need to pull back to build up the necessary momentum to finally break out. At the same time, we have the US dollar strengthening in general, so that does work against the value of oil overall.

I believe that this could be a crucial month, and that being the case it’s likely that we could see a larger move based upon what happens during November. Ultimately, if we break out to the upside, I think we will see an acceleration of buying, because it would be such an obvious signal to longer-term traders. However, pay attention to the weekly chart, because if we for some type of exhaustive weekly candle, I think that we will then drop to $50. There’s a lot going on in this market, as we are talking about potential production cuts, but at the same time if the oil markets rally, it’s likely that the Americans will be more than willing to fill the void. We are going to see a lot of noise, but $55 is crucial.