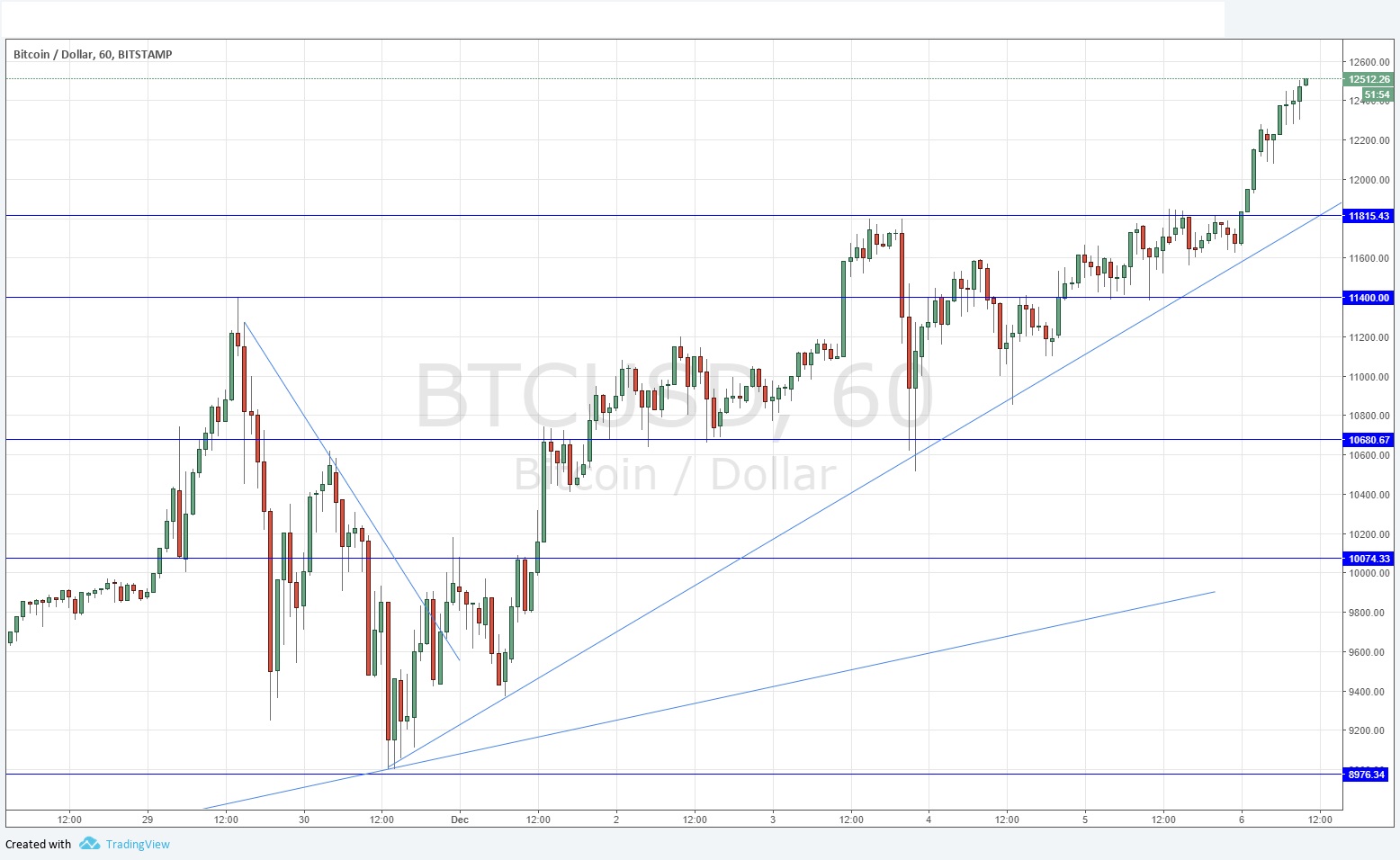

Yesterday’s signals produced a nicely profitable long trade from the bullish pin candle rejecting the support level identified at $11,400.00. The price is still advancing strongly, so it would make sense to let the trade run.

Today’s BTC/USD Signals

Risk 1.00% per trade.

Trades may only be entered before 5pm New York time today.

Long Trades

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $11,815.43, $11,400.00, or $10680.67.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that there was some chance of a downwards movement, but that the price could still take off, especially if there was a strong breakout above $11,800 which should probably then see the $12,500 level reached quickly. This latter scenario is what happened, with the price reaching $12,500 as I write. The level may provide some resistance as it is psychologically key, but there is no sign of that happening yet – everything is bullish, everything points to still higher prices.

I am bullish and it’s a bull market in Bitcoin.

Concerning the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed by Crude Oil Inventories at 3pm.