Gold prices ended Thursday’s session down $2.14, weighed down by the dollar’s bounce on better-than-expected U.S. economic data. XAU/USD tested the support at $1251 after the Commerce Department said retail sales rose 0.8% last month. A separate report from the Labor Department showed that the number of people filing new claims for unemployment benefits dropped by 11K to 225K.

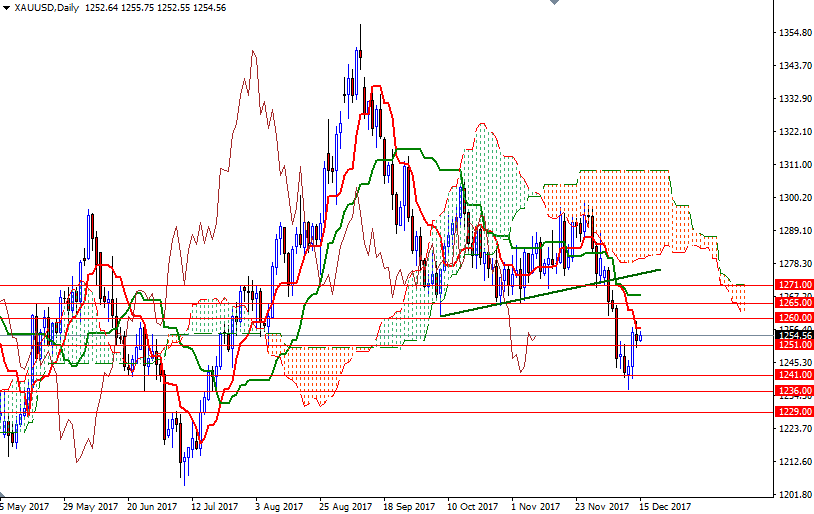

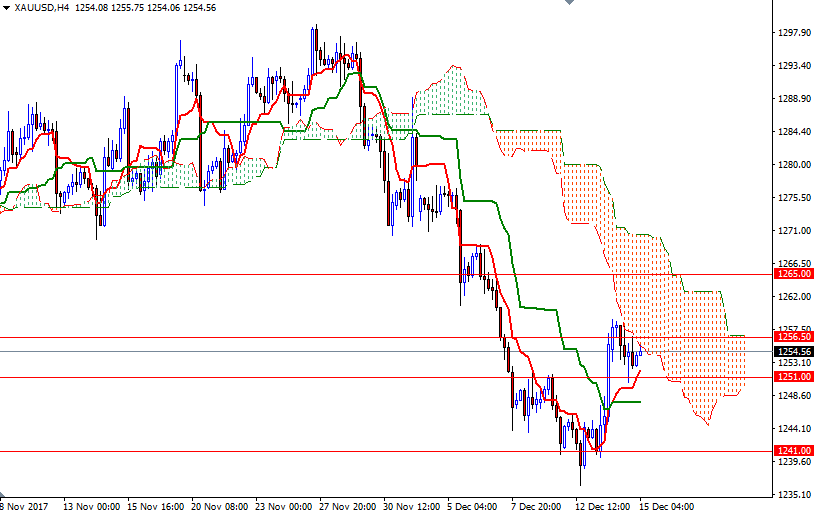

The market is trading above the Ichimoku clouds on the H1 chart and we have a positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) on the H4 time frame. However, prices are still below the clouds on the daily and the 4-hourly charts. If XAU/USD can get back above 1256.50, a move towards the 1260.80-1260 area seems possible. The bulls have to capture this strategic camp in order to tackle 1265.

If XAU/USD breaks below 1251 and take out yesterday’s low, then the market will visit 1249 next. The bears will need to drag prices below 1249 to gather momentum for 1247/6. Eliminating this support is essential for a continuation towards 1243/1.