Gold prices rose $11.51 on Wednesday, moving away from a four-and-a-half-month low reached earlier this week, as the U.S. dollar fell after core inflation data missed expectations and the Federal Reserve left the outlook on interest rates unchanged. Fed officials increased their projections for economic growth over the last couple of years but said inflation remains surprisingly tame, leading some to think that the U.S. central bank may not be able to hike rate rates as quickly as it would like.

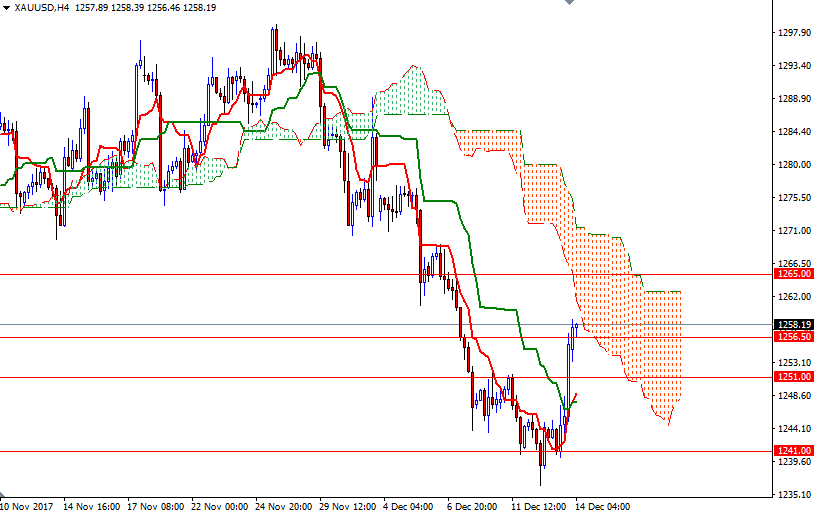

The near-term charts turned slightly bullish after yesterday’s 0.9% jump, which lifted the market above the Ichimoku clouds on the H1 and the M30 time frames. In addition, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames.

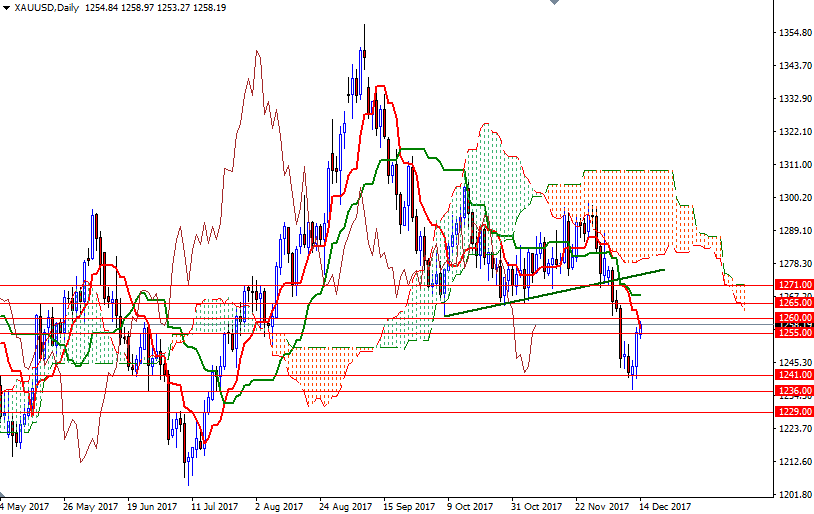

XAU/USD is trading above the 1256.50-1255 area, but the 4-hourly cloud sits right on top us. The bulls will need to push through 1260.80-1260 in order to challenge the next barrier standing at 1265. A break through there paves the way for 1271/69. To the downside, the initial support stands in 1256.50-1255, followed by 1253. If XAU/USD gets back below 1253, it is likely that the market will test the support at 1251/49. The bears have to produce a daily close below 1249 to gather momentum for 1246 and 1243/1.