Gold prices ended Wednesday’s session up $4.34 an ounce, supported by a lower U.S. dollar index. XAU/USD continued to rally and hit four-week highs in Asia trade today. Pending home sales were better than expected but the Conference Board’s consumer confidence index came out below forecasts.

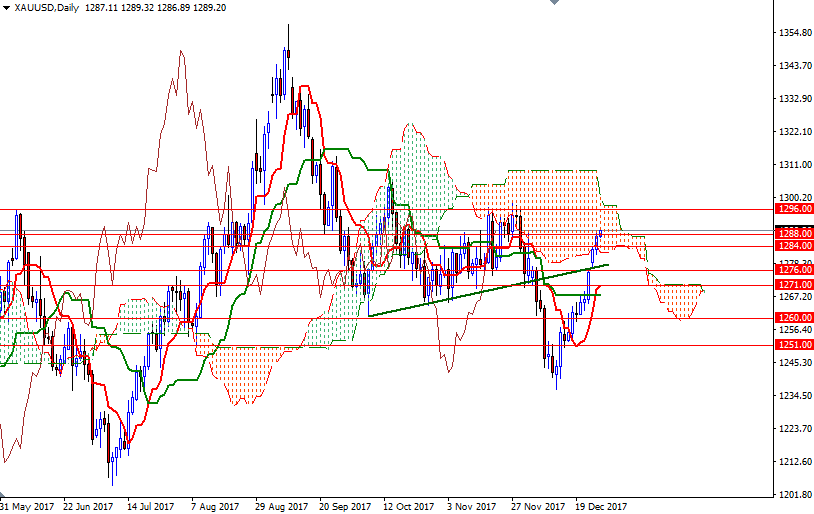

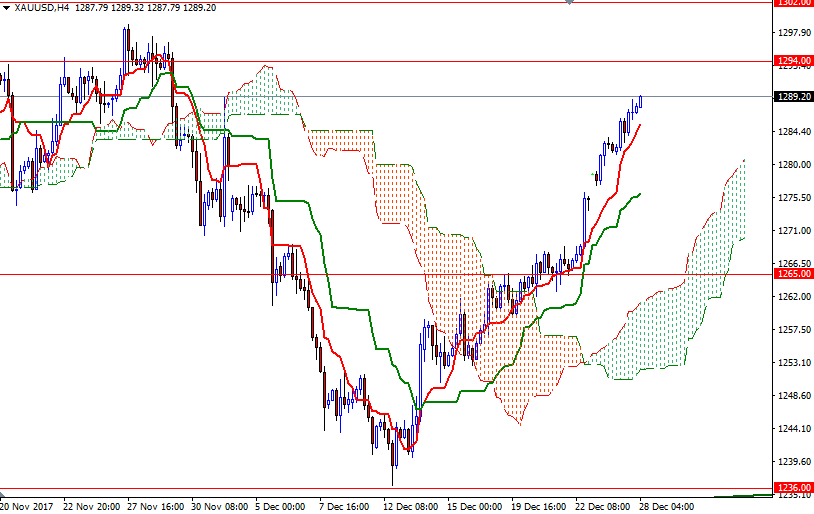

The bulls still have the near-term technical advantage, with the market trading above the the Ichimoku clouds on the 4-hourly and the hourly time frames. Positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both charts as well as Chikou Span (closing price plotted 26 periods behind, brown line)/Price crosses in the same direction are also inspiring the technically biased buyers. It seems that there will be more upside price action, but the resistance in the 1296/4 area may trigger some profit taking. The bulls will have to overcome this barrier in order to set sail for 1302/0.

To the downside, the initial support sits at 1286, followed by 1284/3 where the top of the hourly cloud stands. If the support in the 1284/3 zone is broken, look for further downside with 1281 and 1279.50-1278.50 as the next targets. Below there, the bulls will be waiting in the 1276/5 area.