Gold prices ended Wednesday’s session down $2.89 an ounce as strength in the U.S. dollar and a recovery in stock markets weighed on the market. XAU/USD initially tested the resistance at $1269.10 as expected but was unable to break through. Consequently, prices fell back below $1265. In economic news, Automatic Data Processing Inc. reported that the private sector added 190K jobs in November, broadly in line with expectations. ADP’s data is treated as a kind of preview for the monthly government report, though these figures aren’t always accurate in predicting the outcome.

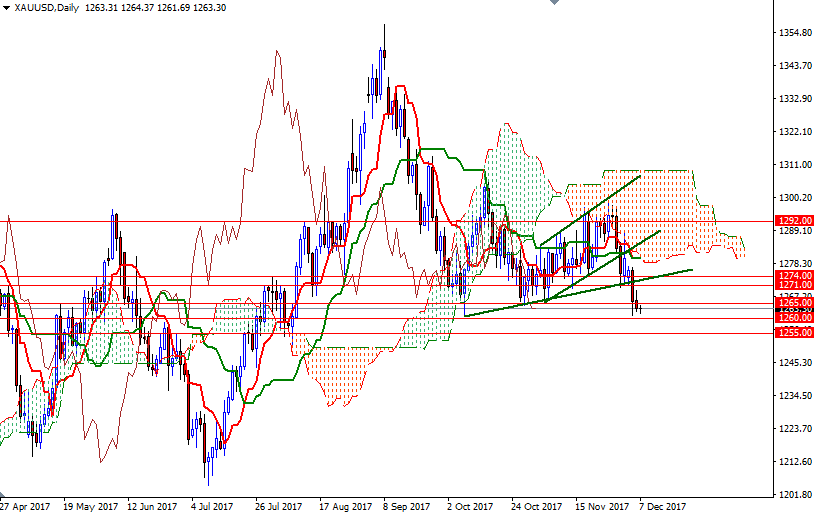

Prices remain stuck roughly between 1265 and 1260 in Asian session. Market players may be hesitant to make aggressive bets ahead of the Labor Department’s monthly non-farm payrolls report. The short-term charts are bearish, with the market residing below the Ichimoku clouds on the daily and the 4-hourly time frames. In addition to that, the Chikou span (closing price plotted 26 periods behind, brown line) is below prices.

The bears will have to overcome the strategic support at 1260 so that they can set sail for 1255. If the market dives below 1255, the 1250 level will be the next target. However, if the bulls can push and hold prices above 1265.65-1265, they may have a chance to test 1269.10-1267.50, the area occupied by the hourly cloud. A break above this barrier could trigger a push up to 1274/1.