Gold prices ended Monday’s session up $2.34 an ounce as turbulence in world stock markets whetted investors’ appetite for the relative safety of the precious metal. However, gold's gains were limited by a stronger dollar. XAU/USD is currently trading at $1275.80, not far from the opening price of $1276.05.

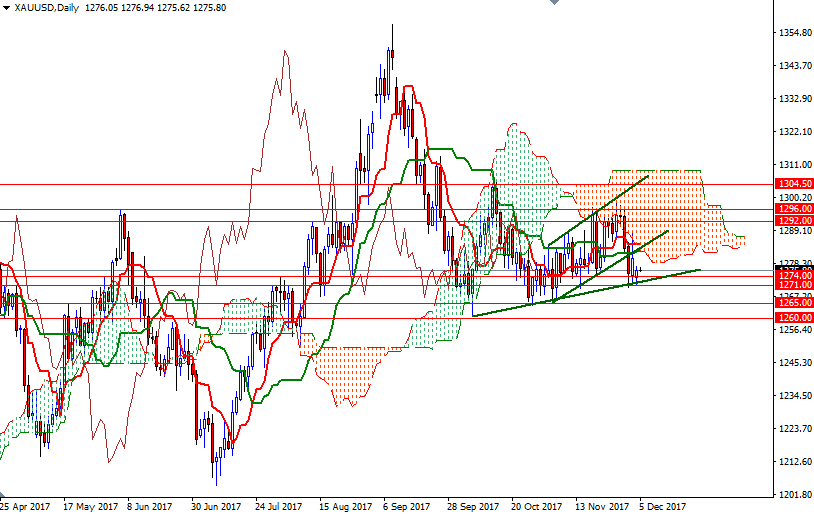

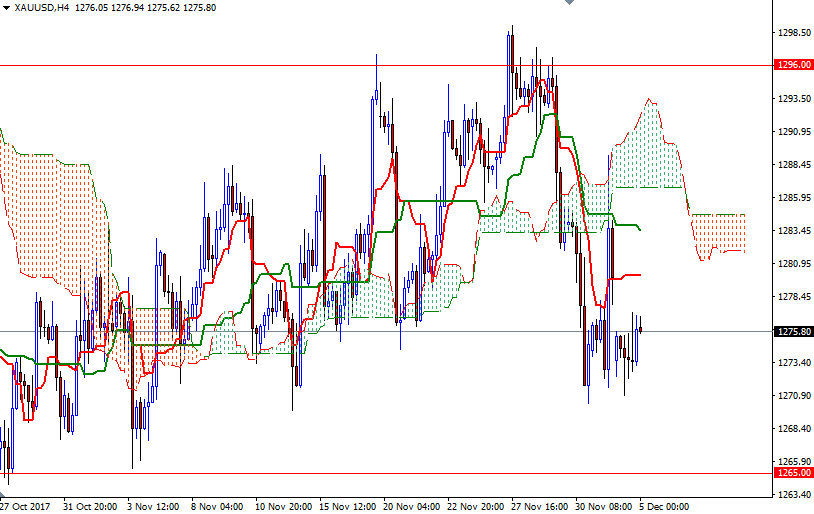

The market continues to feel pressure from the Ichimoku clouds on the daily and the 4-hourly charts. Negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on the H4 chart is another bearish element. Despite this outlook, the area between the 1274 and the 1271 levels has been supportive so far. In other words, the downside potential will be limited until the bears successfully drag the market below this area.

Breaking below 1271 could encourage sellers and pave the way for a test of 1265. The 1265 level is a strategic camp for the bears to capture if they intend to challenge the bulls on the 1260 battlefield. On the other hand, if the bulls can hold prices above the 1274/1 area and lift prices above 1277.20, it is likely that the market will target 1280.80-1279.50, where the top of the hourly cloud sits. Clearing this barrier suggests that 1282.31, the bottom of the daily cloud, will be the next stop.