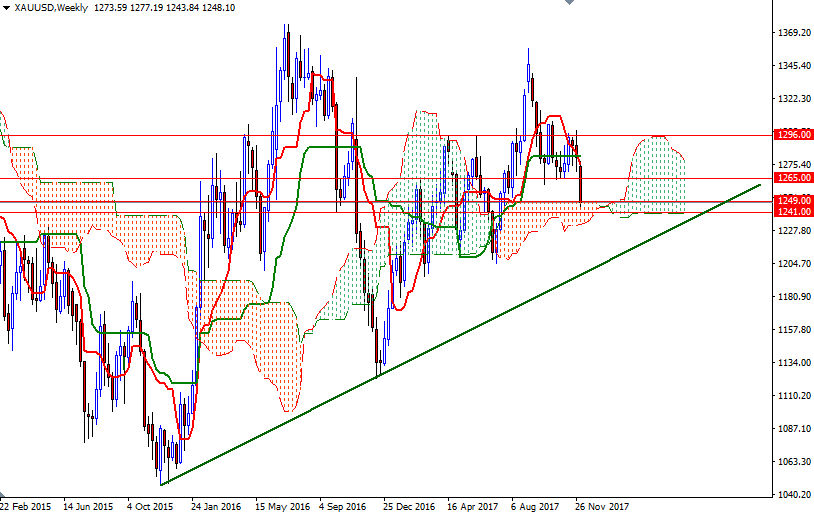

Gold prices dropped nearly 1.3% on Thursday to settle at their lowest level since July 21 as a broad selloff in commodities and a stronger dollar pulled the market down. XAU/USD fell sharply and retreated towards the 1241 level as expected after breaking below the key support at 1260 generated extra pressure on the market. The dollar’s recent strength has made gold less popular so the market will focus on the upcoming release of nonfarm payrolls data.

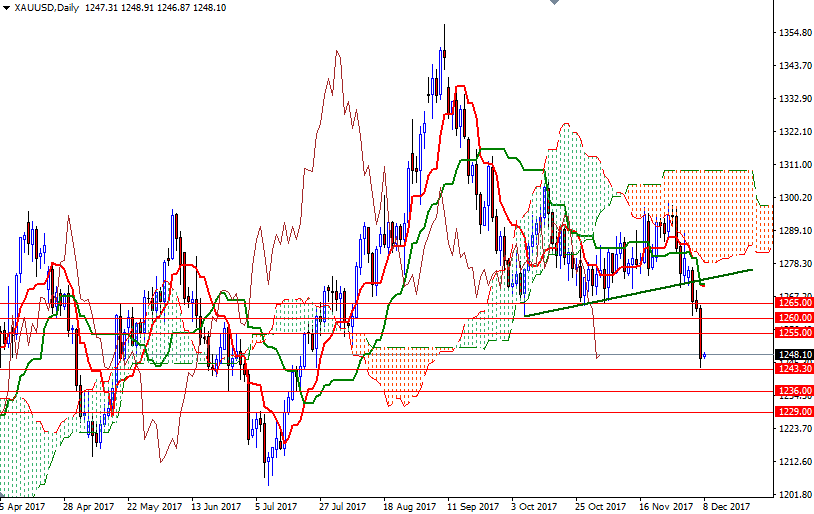

From a chart perspective, negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) and trading below the daily and the 4-hourly Ichimoku clouds, suggest that the bears have the overall short-term technical advantage. Down below, there is an anticipated support zone that stretches from 1243.30 to 1240. The bears will have to capture this strategic area so that they can make an assault on 1236. If this support is broken, the market will be aiming for 1233/2.

The top of the weekly cloud sits at 1249 so the bulls will need to push prices above there to revisit 1252.60 or perhaps 1253.80. Beyond that, the 1256.50-1255 area stands out as an intra-day resistance. If prices can get back above 1256.50, then the next target will be 1260.