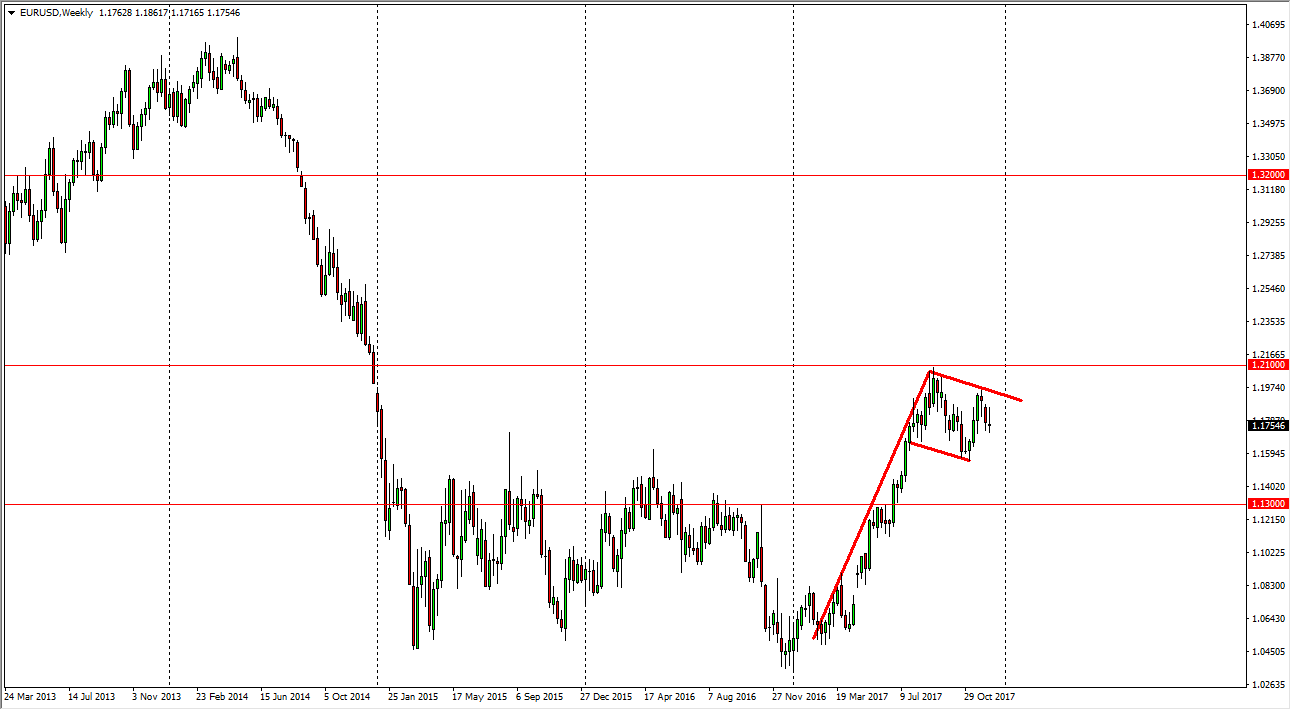

EUR/USD

The EUR couldn’t keep the bullish pressure up during the week, and as a result we ended up forming a shooting star. I think the next week or so is going to be negative, as there is no wherewithal or conviction in the market. When I look at the charts though, I cannot help but see a bullish flag but until we break above the 1.20 level, none of that matters. Expect choppiness, and a general attitude to get nowhere.

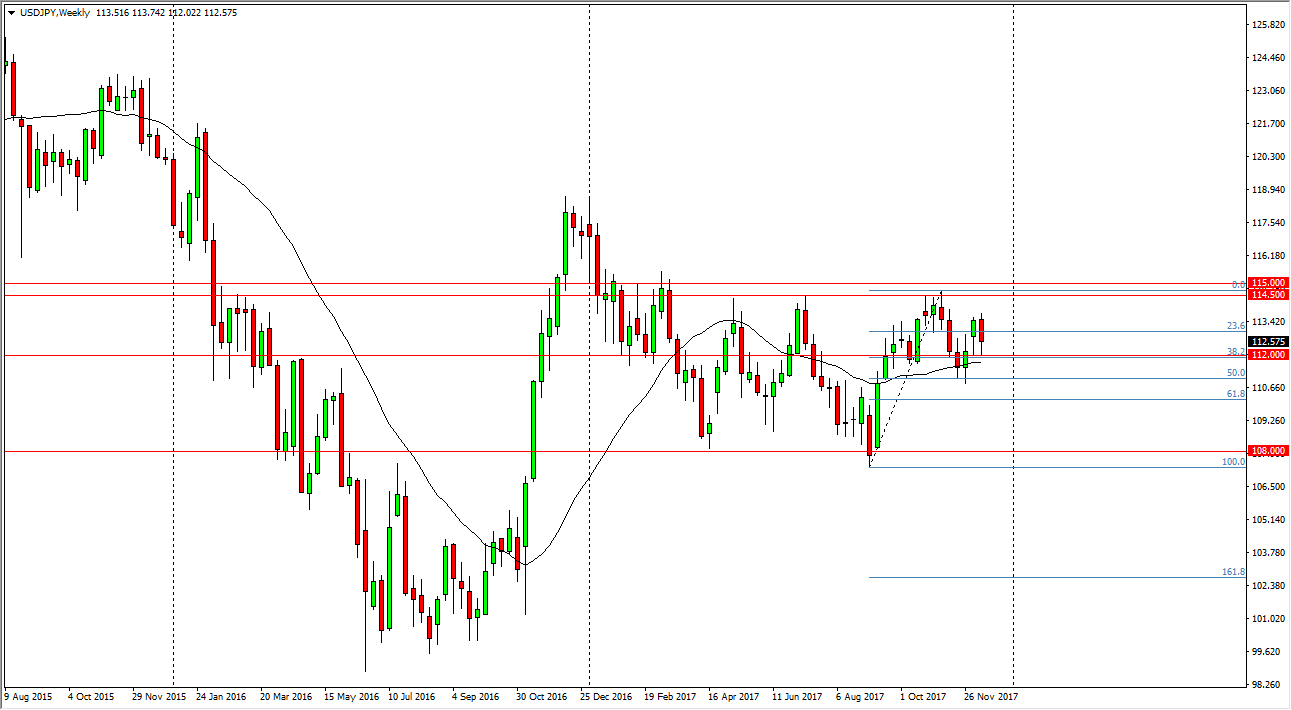

USD/JPY

The US dollar was negative against the Japanese yen during most of the week, but did rally a bit during the day on Friday as it looks like tax reform is coming after all. The 112 level underneath is massively supportive, so I think that we will probably see buyers jumping back into take advantage of weakness when we see it. A break above the 114.50 level sends this market looking towards the 115 level. A clearance of that is a very bullish sign.

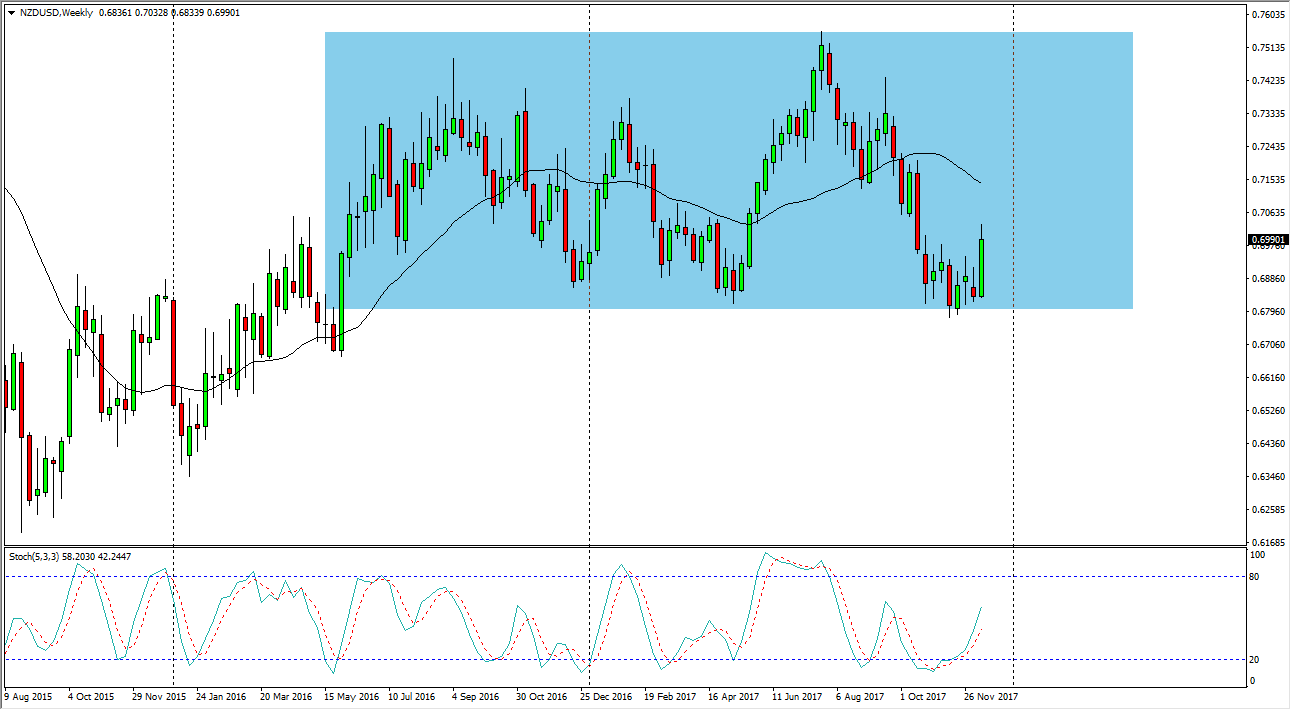

NZD/USD

The New Zealand dollar rallied significantly during the week, breaking out above a significant amount of resistance. Beyond that, we are at the bottom of a significant consolidation area, so it’s likely that we will continue to see buyers push this market towards the 0.75 level above. Because of this, I am bullish of the market but recognize we are going to see a lot of noise.

Gold

Gold markets pulled back during a large portion of the week, but turned around to form a bit of a hammer. The hammers suggesting that we are going to go higher, and therefore I think that we will go looking towards the $1300 level over the next several weeks. I believe in buying dips in the gold market, unless of course we break down below the weekly uptrend line. In general, I think $1300 is a reasonable target going forward.