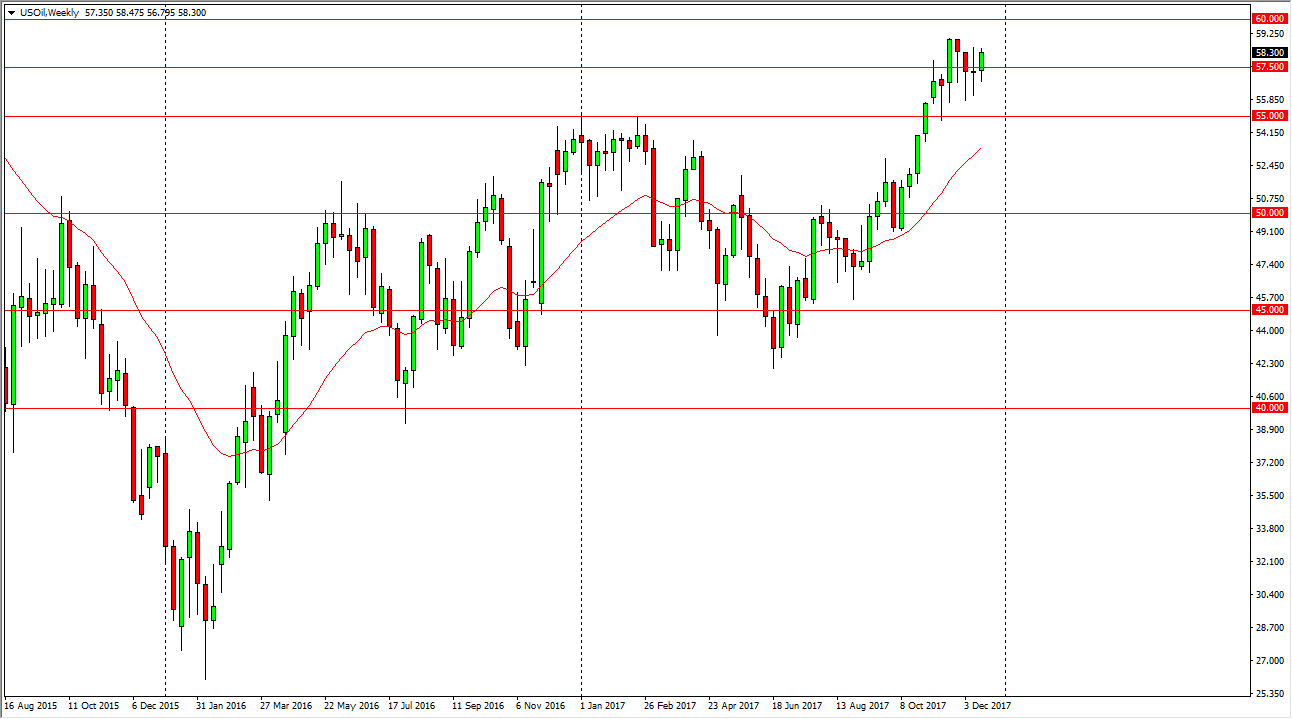

WTI Crude Oil

The WTI Crude Oil market initially fell during the week, but turned around to break above the $57.50 level. Now that we have done this, it’s likely that we will continue to see buyers jump into this market. I think the market is going to try to reach towards the $60 level above, which of course has a certain amount of psychological importance to it. Ultimately, I think that the lack of volume could push this market higher slowly, but short-term scalping is probably about as good as it gets.

USD/ZAR

The US dollar went lower during the previous week, testing the 12.50 level. With the South African government acting very much like Zimbabwe, looking to take land away from rightful owners, this scares investors, and as you can see we have seen investors leaving the South African Rand. If we break down below the 12.50 level, I think that the South African Rand continues to go much lower. On a rally, I would be looking for signs of exhaustion to start selling as well.

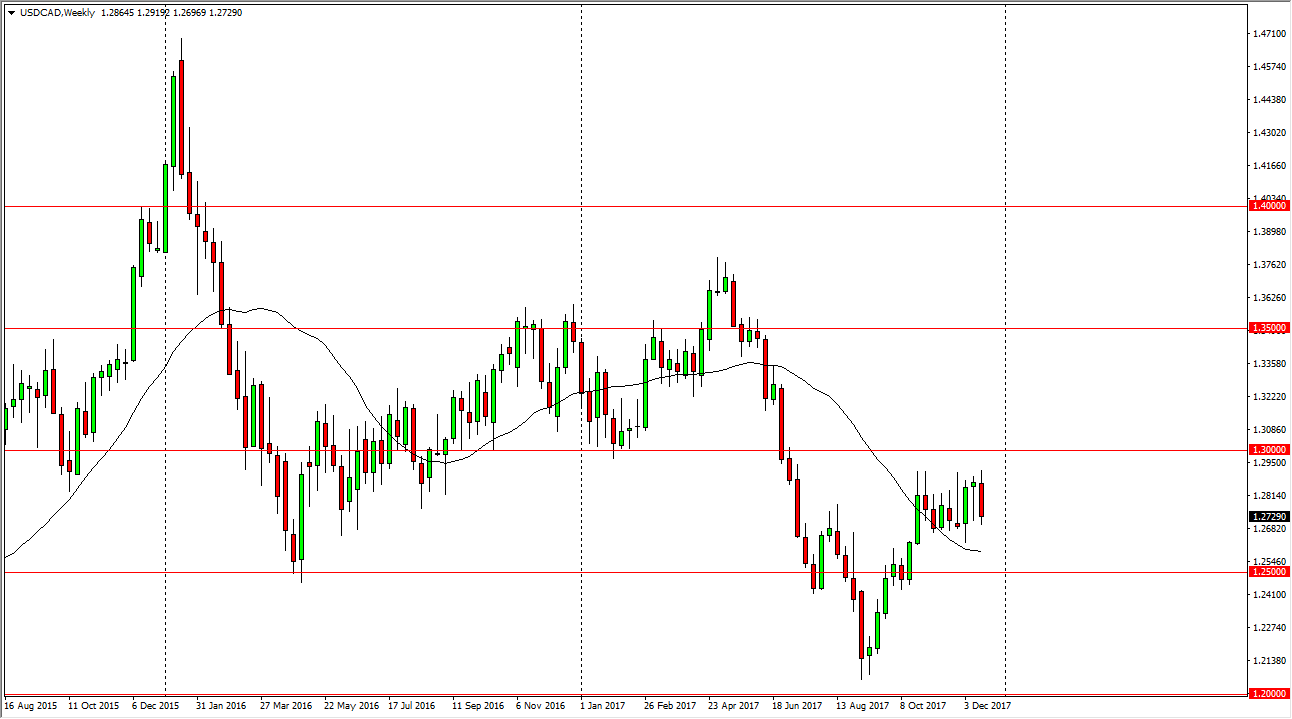

USD/CAD

The US dollar went back and forth against the Canadian dollar during the previous week, but ultimately remained within consolidation. I think that the market will probably rally from here after a significant mess by the Canadians with the GDP announcement. I think the market will probably drift its way towards the 1.29 level above, and then test the 1.30 level after that. Once we clear that level, the market could go much higher.

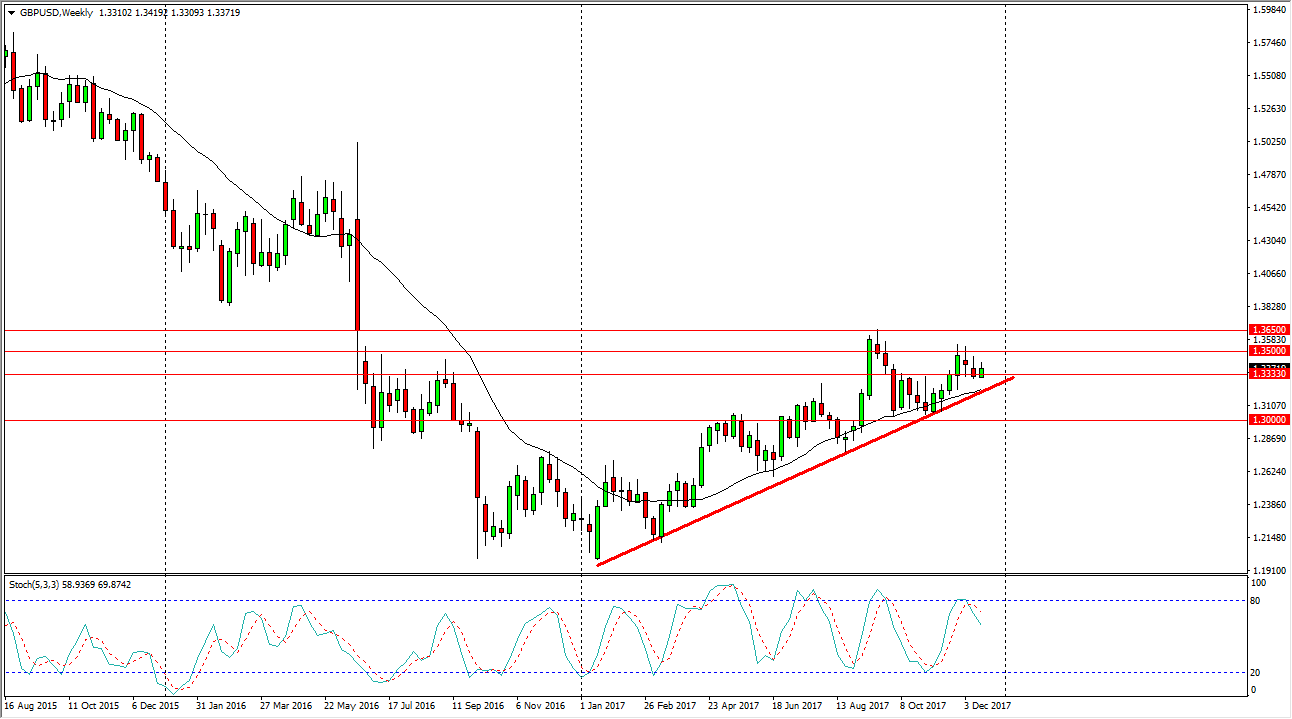

GBP/USD

The British pound rallied a bit during the course of the week, breaking above the 1.3333 handle. The market looks as if it is going to continue to honor the uptrend line underneath, so therefore I think we will go looking towards the 1.3650 level longer term. Short-term pullback should be buying opportunities, and I believe that the buyers will continue to favor sterling.