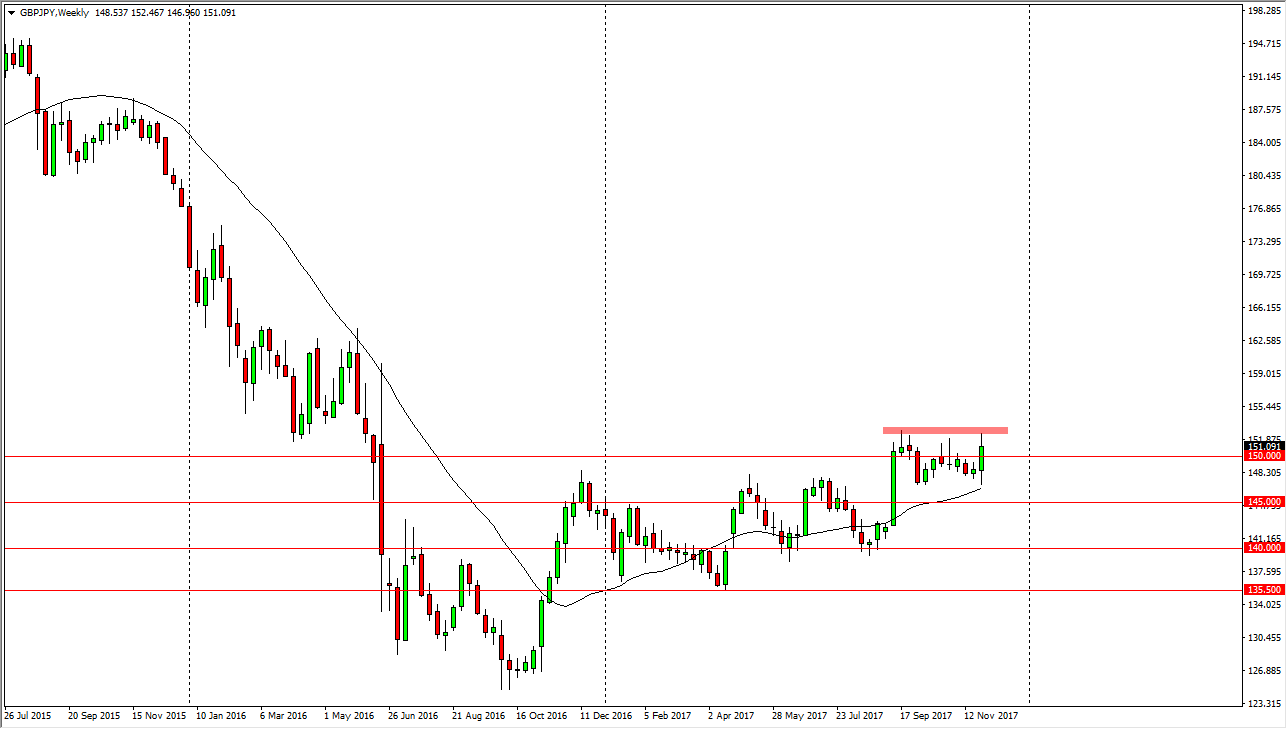

GBP/JPY

The British pound initially fell during the course of the previous week, but then rallied towards the 152.50 level. If we can break above that handle, then I think that the market will continue to go much higher, perhaps another thousand pips. We need to break the top of the range for the week, and then at that point it’s very likely that we will continue to see a “buy on the dips” attitude. Until then, it’s going to continue to be very choppy and difficult.

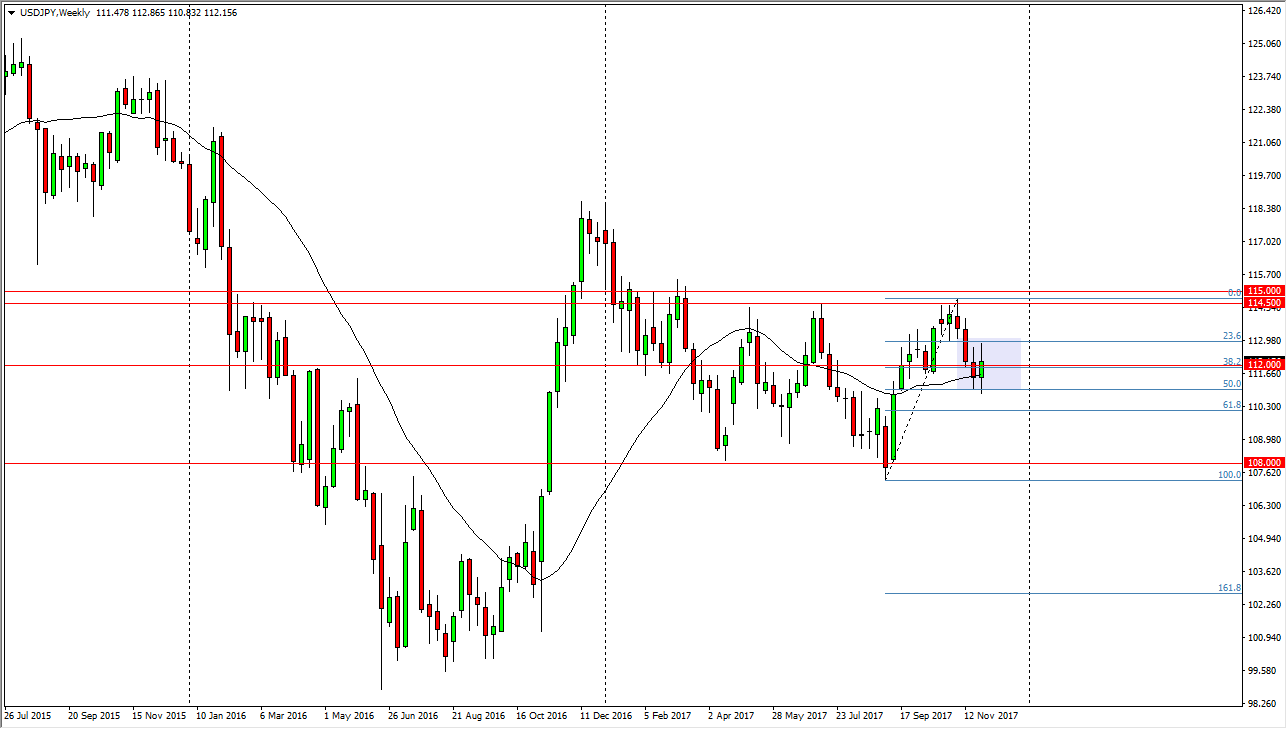

USD/JPY

The US dollar went back and forth during the week, bouncing around between the 111 level on the bottom, and the 113 level on the top. The market should continue to go back and forth, and therefore it’s going to be difficult to trade. However, if we can break out above the 113 handle, I think that the market could go much higher at that point.

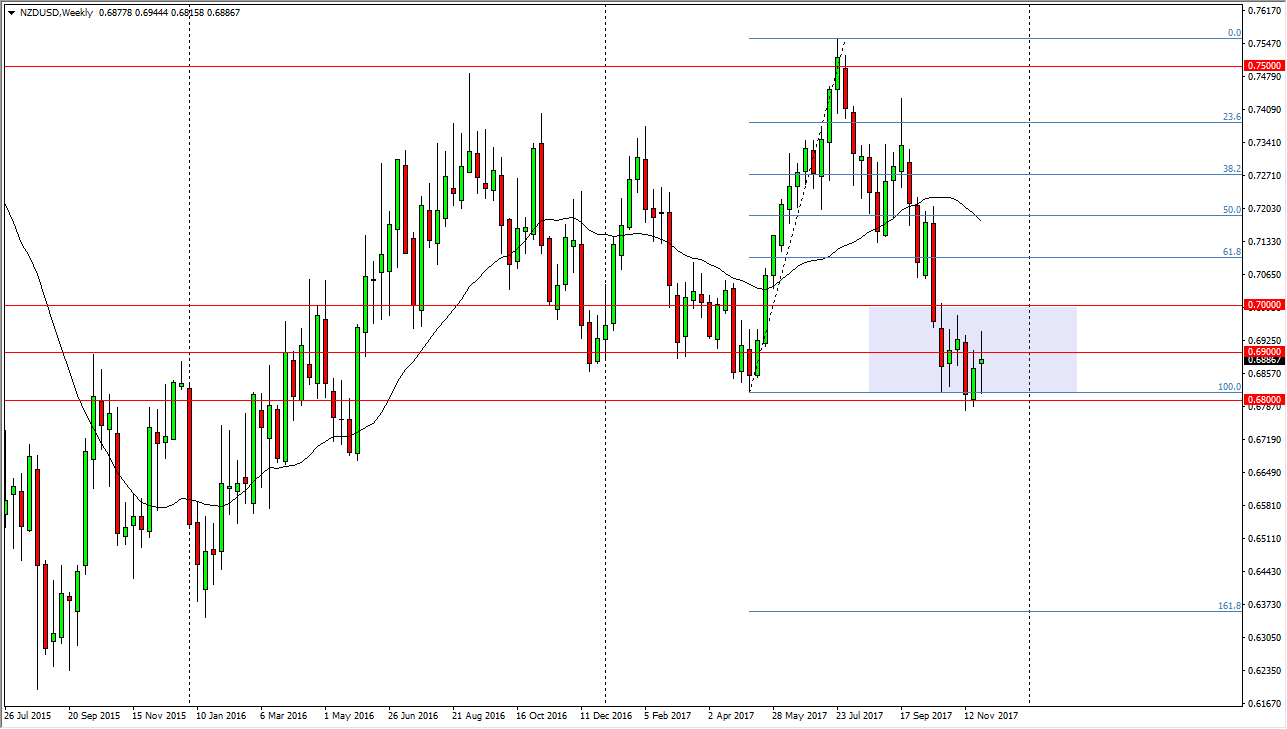

NZD/USD

The New Zealand dollar went back and forth during the week, as we continue to hang just below the 0.69 level. This market is very difficult to deal with, and I think that the market is more than likely going to find plenty of reasons to fall, as there is a general malaise when it comes to the New Zealand economy. There are a lot of concerns about Labour Party officials spending money. If we break down below the 0.68 handle, this market breaks down significantly. Rallies continue to be selling opportunities on short-term charts at the first signs of exhaustion.

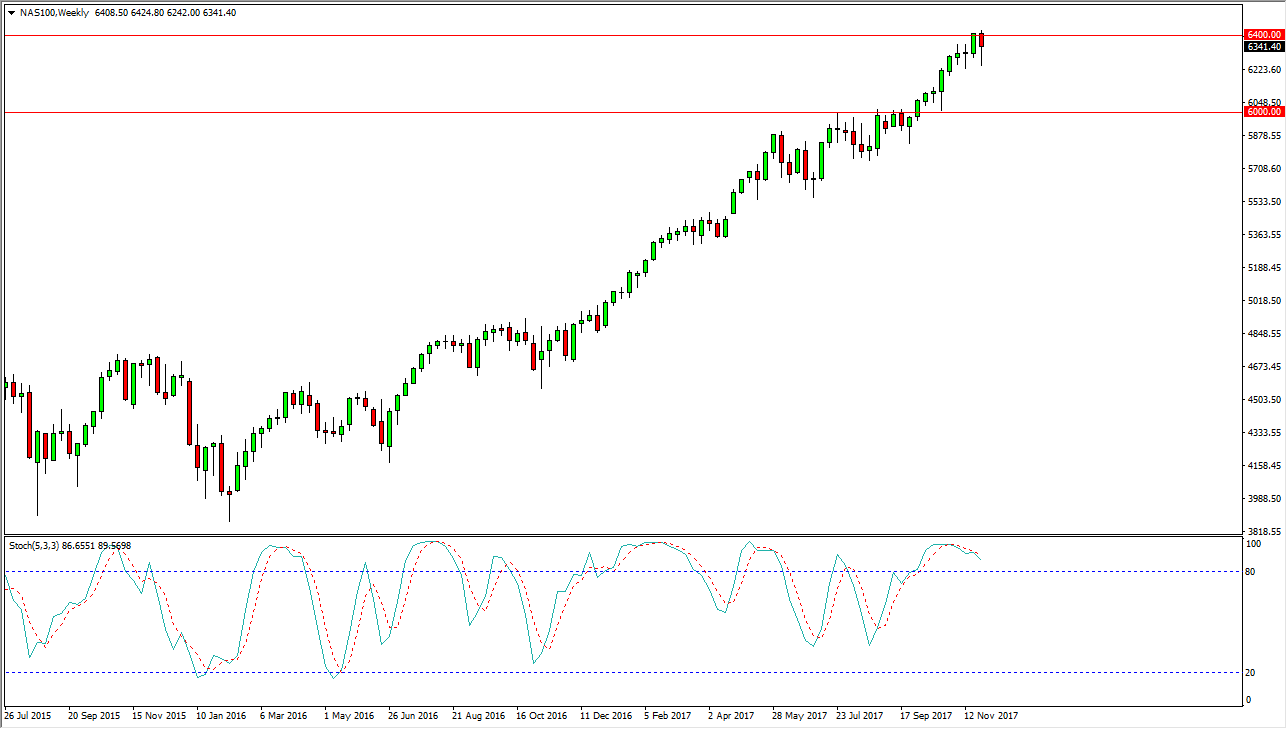

NASDAQ 100

The NASDAQ 100 fell during the week initially, but then rallied significantly, and then fell again on Friday. It looks as if there are a lot of resilient buyers underneath, and a break above the top of the 6400 level is a very bullish sign and should send this market looking to go much higher. Until then, it remains a “buy on the dips” algorithm driven marketplace that remains bullish.