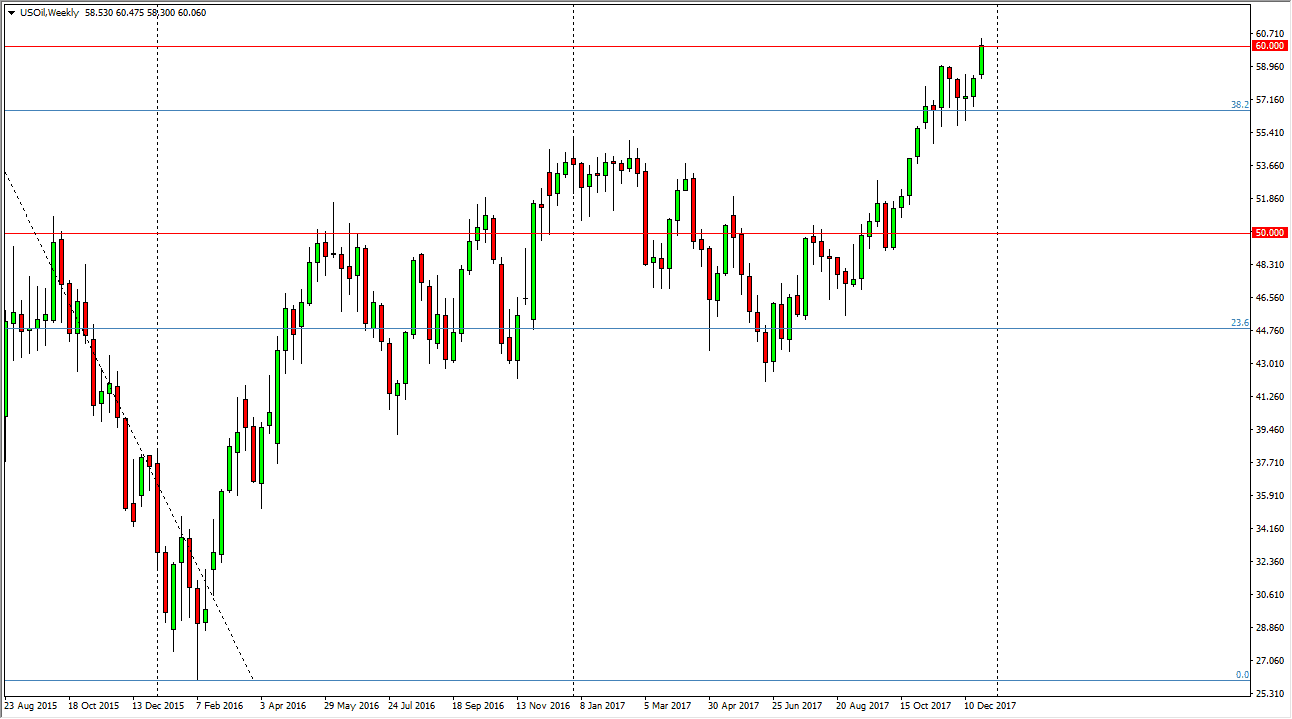

WTI Crude Oil

The WTI Crude Oil market rallied during the week, reaching above the $60 level towards the end of the day on Friday. Ultimately, I believe that the market should continue to go higher, but we probably need to break above the top of the weekly candle to see momentum build up for a move to the $62.50 handle. I think short-term pullbacks could offer buying opportunities though.

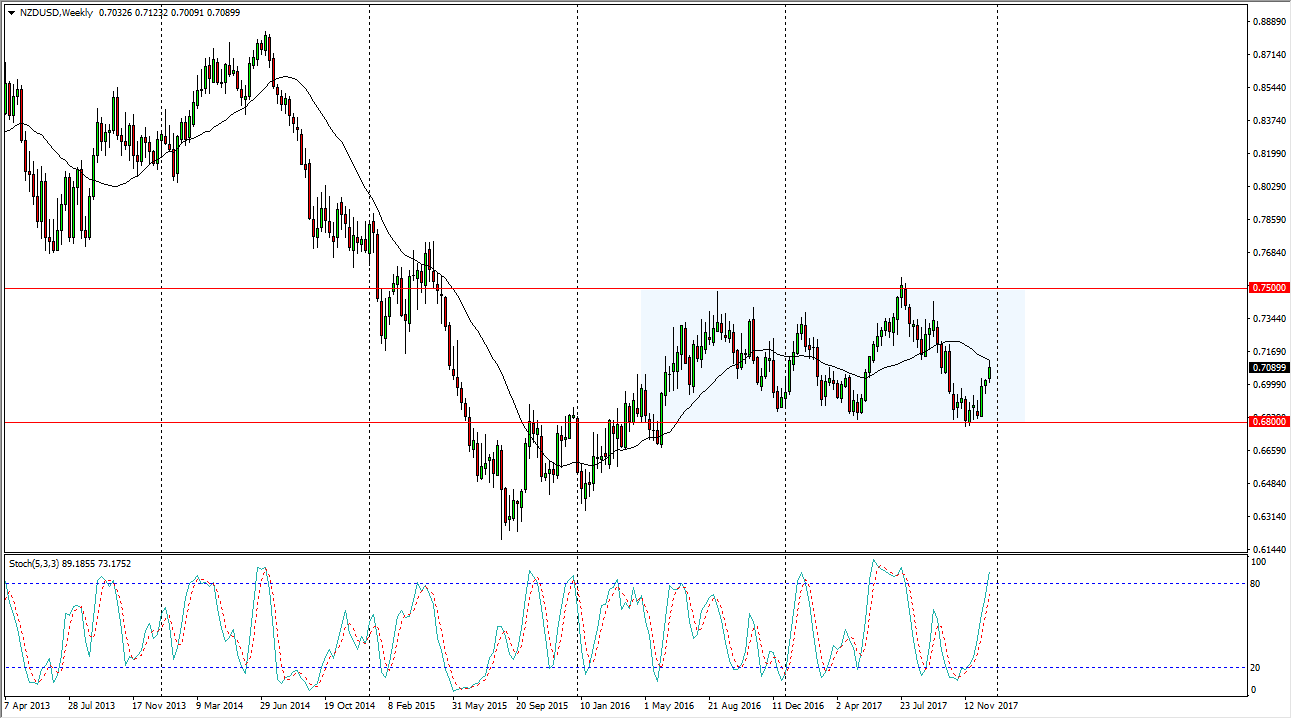

NZD/USD

The New Zealand dollar looks likely to continue the overall consolidation that we have seen for the last 18 months, but we are getting a little bit overextended. I think that initially this market could be slightly negative for the week but a suspect that the buyers will eventually take over and continue to drive towards the 0.75 handle above.

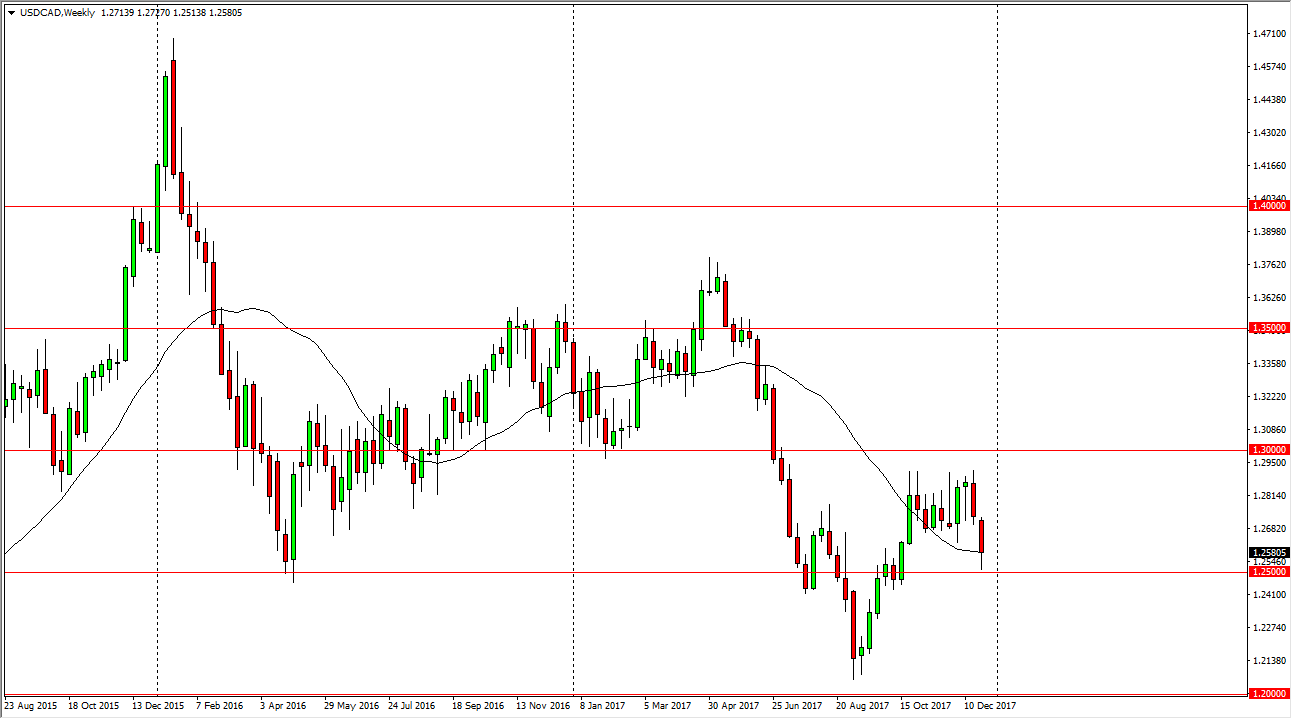

USD/CAD

The US dollar fell against the Canadian dollar, breaking below a short-term support level near the 1.27 handle rather handily. We tested the 1.25 level, but this was in thin environments as Friday was everything but a holiday. By bouncing from the 1.25 handle, it shows that the level is supportive, and I think that this market may be fairly quiet until we get the jobs number. Once we get that, it’s likely that we could breakdown from here and reach towards the 1.20 level, but on the other hand, if we bounce from here, we should return to the 1.29 level.

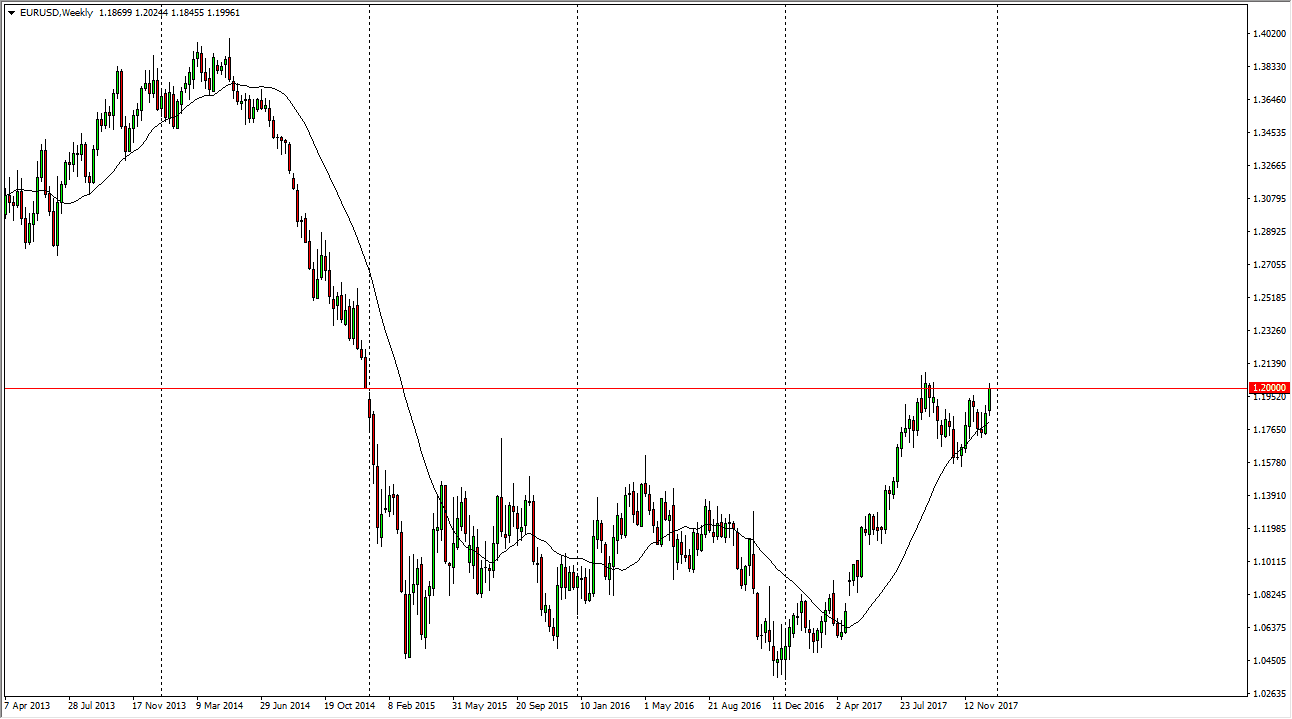

EUR/USD

The EUR/USD pair rally during the week, breaking the top of a bullish flag. We crashed into the 1.20 level where we found a bit of resistance, but I feel it’s only a matter of time before we break above that level and continue towards the 1.21 handle. Once we clear that level, I think this market is clear to go much higher. For what it’s worth, the flag on the weekly chart measures for a move to the 1.32 handle.