Gold prices settled at $1275.29 per ounce, rising nearly 1.6% over the course of the week, as renewed political unrest in Europe and weakness in the U.S. dollar boosted the precious metal’s safe-haven appeal. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 113795 contracts, from 107068 a week earlier. Weakness in U.S. equity markets also helped provide a lift to gold. Major U.S. indexes retreated after scoring record highs earlier this week.

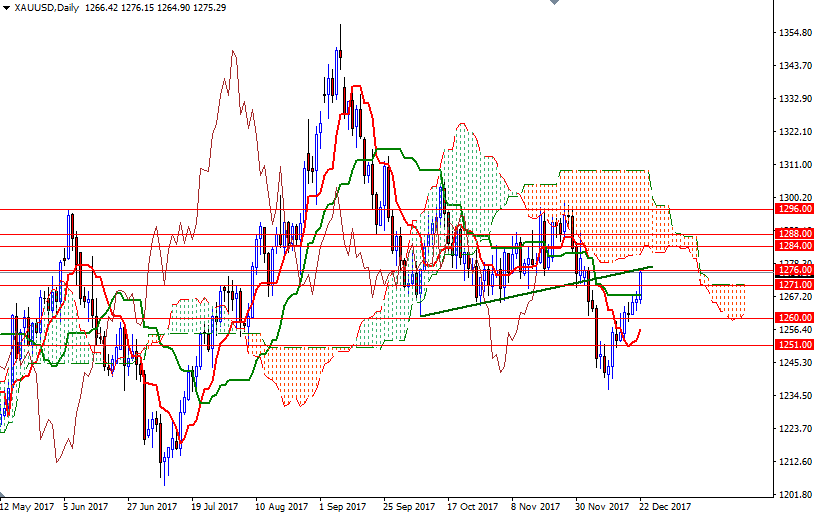

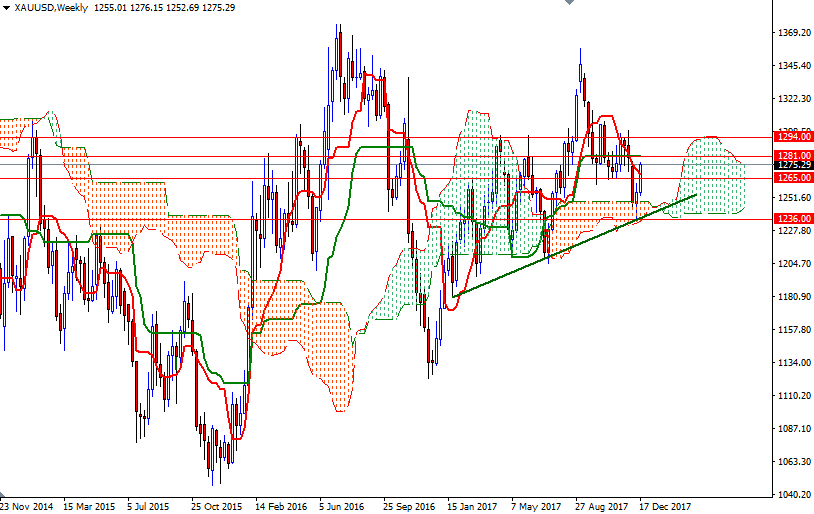

From a chart perspective, the bulls have the overall technical advantage. Prices are above the weekly and the 4-hourly Ichimoku clouds. The bulls have momentum on their side but the daily cloud occupies the area roughly between the 1284 and the 1296 levels. Technically, Ichimoku clouds define an area of support or resistance depending on their location and in our case the weekly cloud represents resistance. Another thing to pay attention is the negative Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross. With these in mind, I think the market will remain range bound until the next week.

If the bulls can push prices above 1276 and successfully take out last week’s high, the market may proceed to the daily cloud. In that case, the next targets could be 1281 and 1288/4. Closing above 1288 on a daily basis is essential for a continuation towards 1296/4. Beyond that, the bears will be waiting in the 1302/0 area. If XAU/USD fails to anchor somewhere above 1276, a test of 1271 or even 1265 is possible. The bears will have to capture 1260/59 to gather momentum for 1256.50 and 1251-1248.50.