Gold ended the week down $25.52 at $1248.07 an ounce, recoding a third consecutive weekly loss, as investors continued to favor risky assets. The general strength in world equity markets is pulling away demand for gold. Figures from the Labor Department showed a monthly net gain of 228000 jobs, surpassing consensus estimates of 195000, and an unemployment rate holding at 4.1%. All eyes will be on the Federal Reserve policy meeting on Wednesday. Investors see a Fed rate hike next week as a certainty so they will probably focus more on the economic projections of FOMC members.

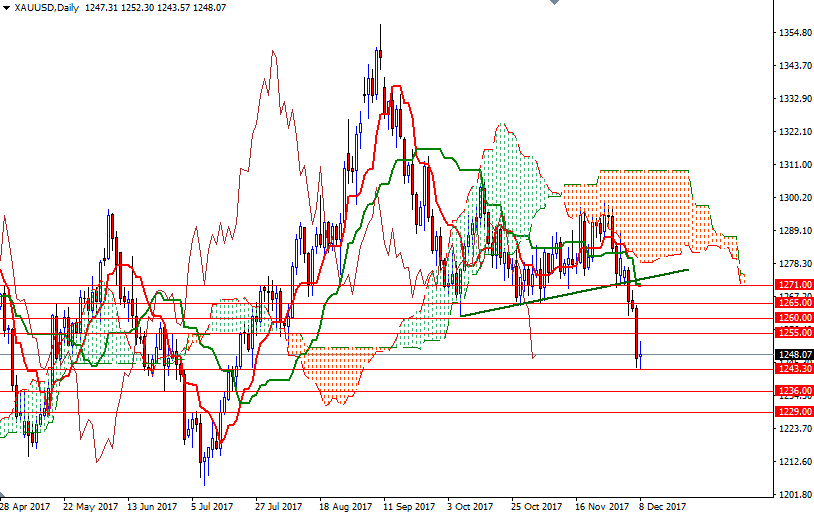

A breach of some key technical levels also dragged gold lower. Technical selling pressure developed after the metal broke below the support at 1271. XAU/USD is trading below the Ichimoku clouds on the daily and the 4-hourly charts. Plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) also indicates that the bears have momentum on their side.

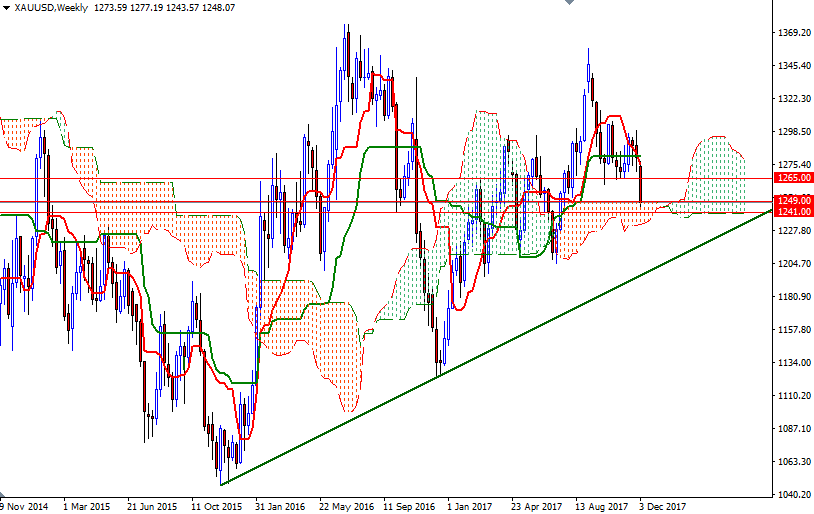

Despite this negative outlook, note that the weekly cloud stands right below. Technically, Ichimoku clouds not only identify the trend but also represent support and resistance zones. The thickness of the cloud is also relevant as it is more difficult for prices to break through a thick cloud than a thin cloud. If XAU/USD dives below 1243.30-1241, a move towards the bottom of the weekly cloud is possible. The bears will need to produce a daily close below 1229/6 to challenge the next support in 1218/5. If the market can climb and hold above 1251/49, it is likely that prices will visit the 1256.50-1255 area. The next upside barrier comes in around 1260. The bulls have to push through 1260.80-1260 in order to tackle the critical resistance at 1265.