Gold prices ended the week up $7.67 at $1255.35 an ounce, snapping a three-week losing streak, as a retreat in the dollar sparked some short-side profit taking. The Federal Reserve raised short-term interest rates at its last policy meeting of the year. The central bank’s forecast of three additional hikes in 2018 and 2019 was unchanged from its previous projections. However, the persistent shortfall of inflation from the 2% goal leads some investors to bets the Fed would raise rates only twice in 2018.

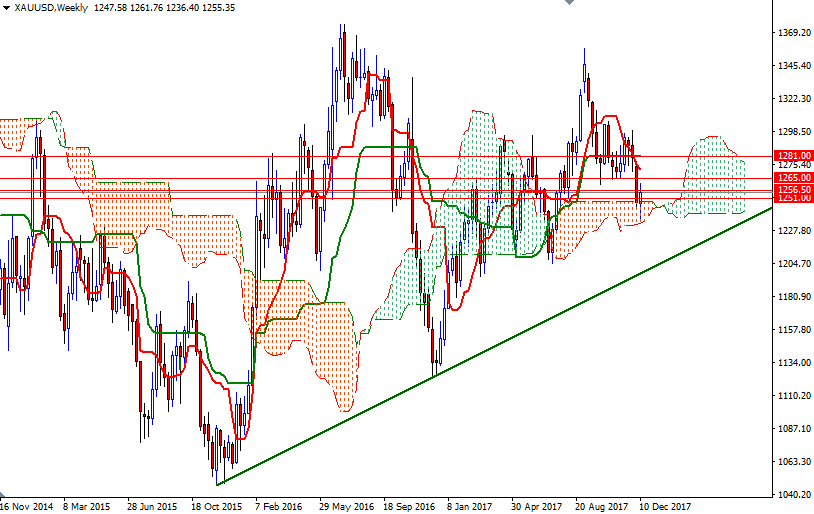

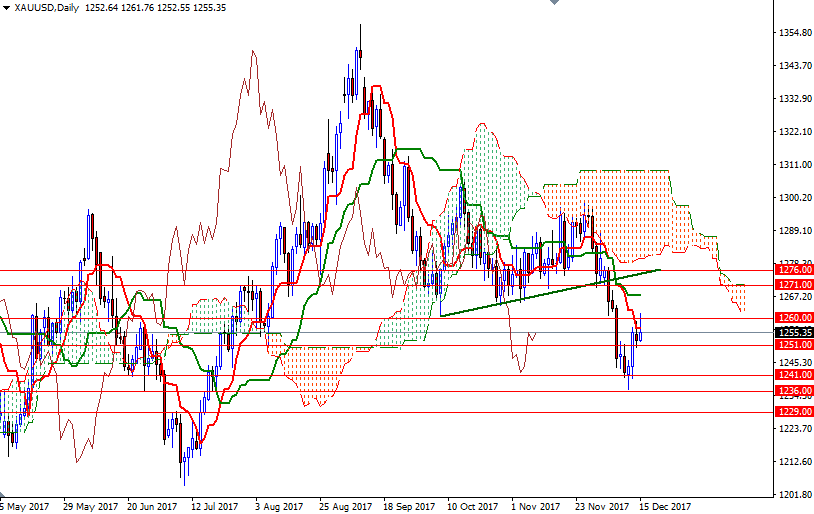

XAU/USD retreated to the bottom of the weekly Ichimoku cloud before reversing and challenging the initial barrier in the 1165/0 zone, a former support. Short term charts suggest that a test of 1676/1 is likely if this resistance is broken. A break through there brings in 1281, the weekly Kijun-sen (twenty six-period moving average, green line). The bulls have to capture this strategic camp to make an assault on 1291/88.

On the other hand, the market is still trading below the daily cloud and we have negative Tenkan-sen (nine-period moving average, red line) - Kijun-sen crosses on the weekly and the daily charts, In other words, downside risks will remain until the market penetrates the daily cloud. The bears will need to drag prices below the support in the 1251/49 zone to gather momentum for 1244/1. Below there the 1236 level stands out as a critic support. Closing below 1236 on a daily basis makes me think that the bears will be targeting 1229/6 next.