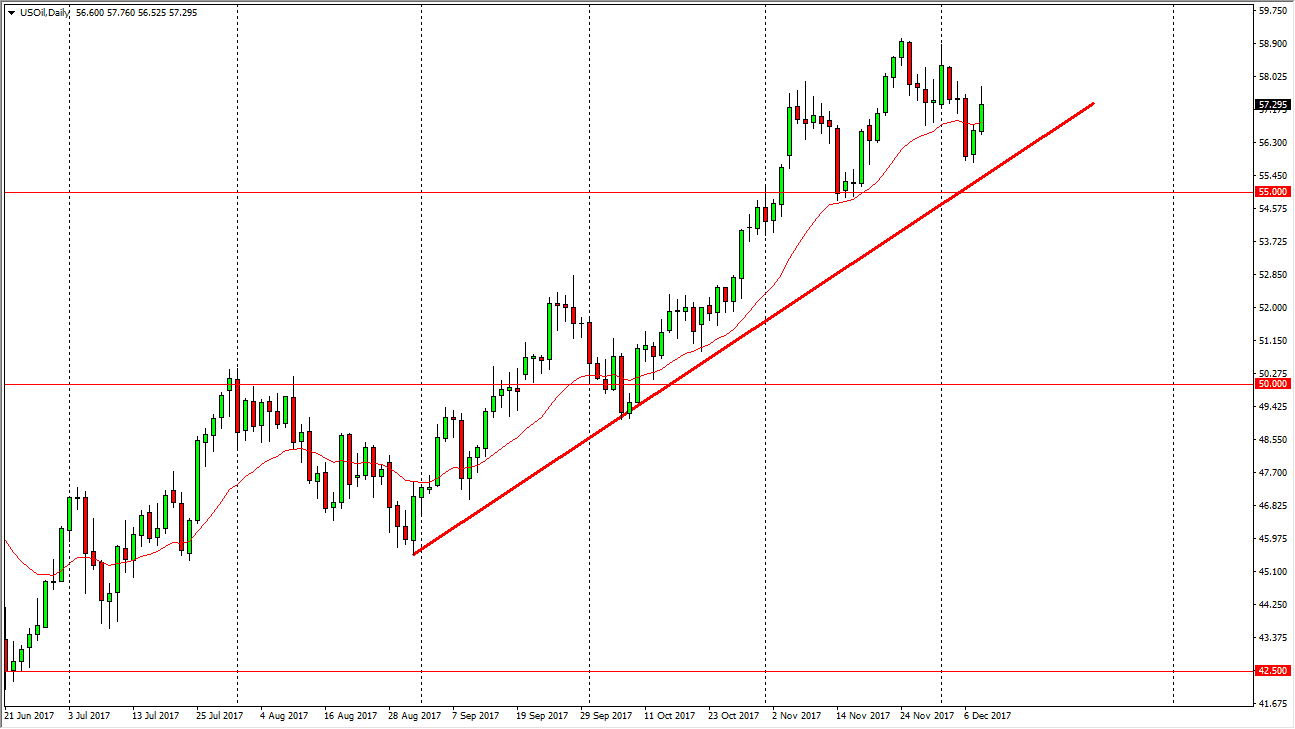

WTI Crude Oil

The WTI Crude Oil market rallied on Friday again, as the uptrend line continues to pick the market up on dips. The $59 level above is resistance, and certainly $60 is very resistive based upon the fact that it offers high valuation for oil, and that of course attracts more attention from the Americans and Canadians. I think that the market will turn around to the breakdown eventually, but in the short term it’s obvious that the buyers are involved. If we can break down below the $55 level, the market could break down significantly, perhaps reaching down towards the $50 level. In the meantime, I think there is a lot of noise just waiting to happen, so therefore I would keep my position size small as we could see a lot of volatility.

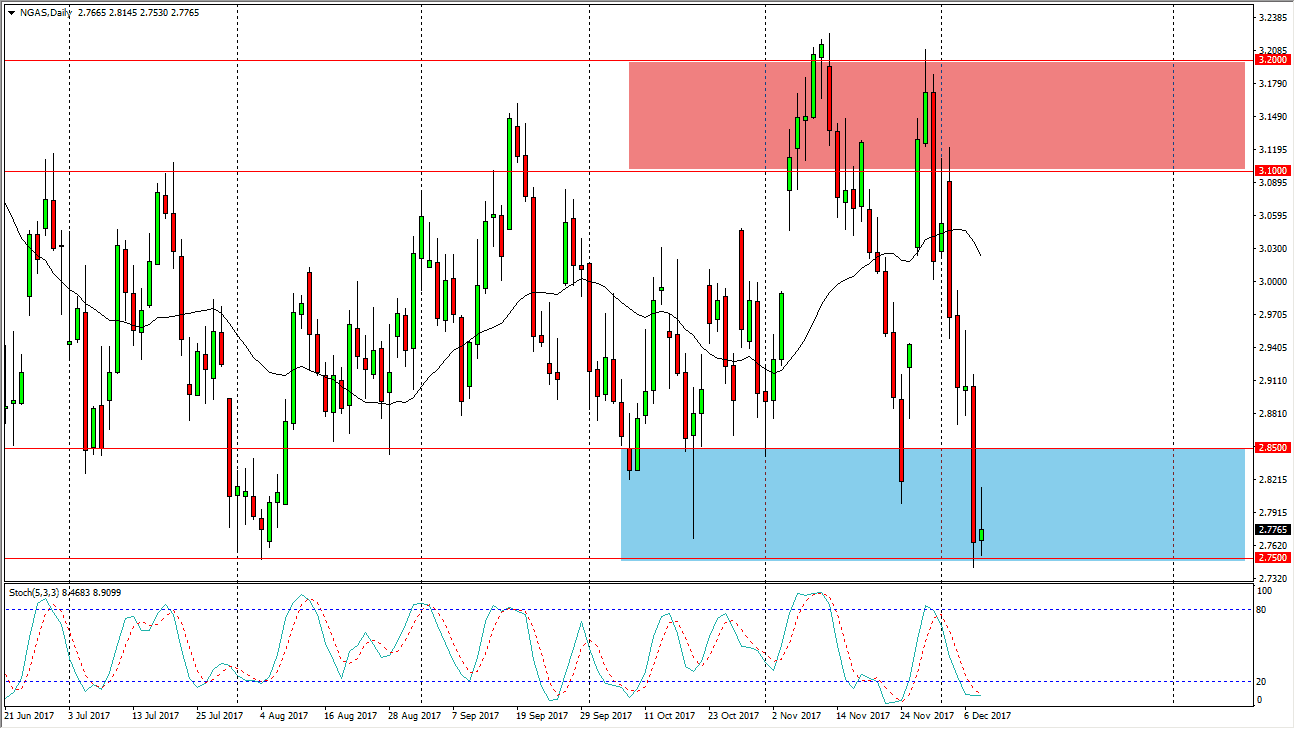

Natural Gas

Natural gas markets had a volatile session on Friday, testing the $2.75 level for support, and finding it. However, the market ended up forming a shooting star by the end of the day, so it shows that we see continued to see sellers jump into this market. If we break down below the $2.73 level, that would be very negative, and perhaps send down to the $2.50 level. Alternately, if we break above the top of the shooting star, we should then go looking towards the $2.85 level as it is a very bullish sign, and in general I think that the market will continue to bounce around, and I think that we are simply returning to the consolidation area that the market has been attracted to for the entire year. The $2.50 level below is the absolute “floor” longer term.