No signals have been given yet this year.

Today’s AUD/USD Signals

Risk 0.50%.

Trades must be entered from 8am New York time until 5pm Tokyo time, over the next 24-hour period only.

Long Trades

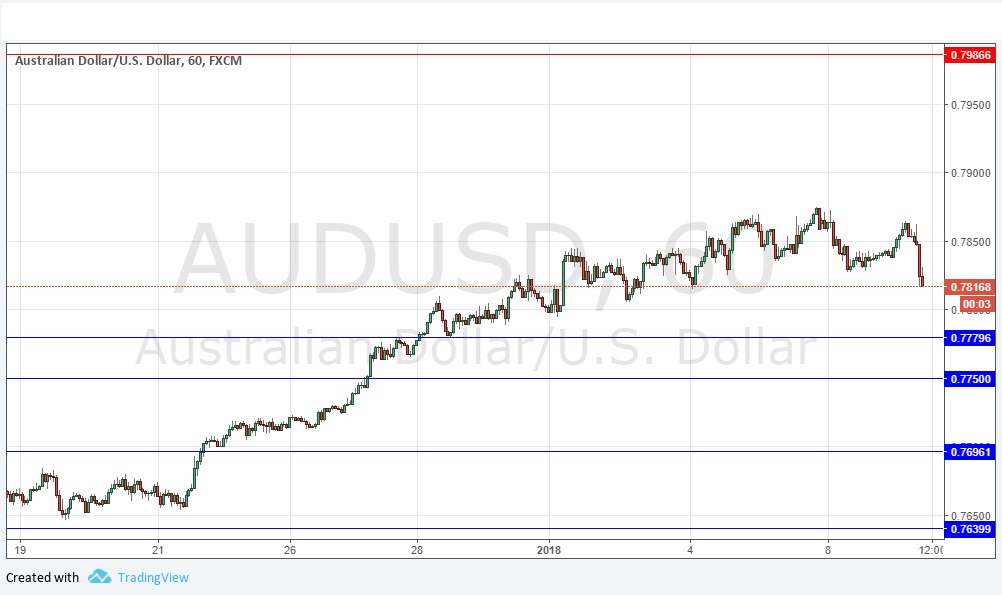

· Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7780 or 0.7750.

· Put the stop loss 1 pip below the local swing low.

· Move the stop loss to break even once the trade is 20 pips in profit.

· Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade

· Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7898.

· Put the stop loss 1 pip above the local swing high.

· Move the stop loss to break even once the trade is 20 pips in profit.

· Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

This pair rose with relatively strong momentum during December, but has begun to sell off over the past few days, and is starting to make new lows. The residual momentum suggests that there should be another upwards movement from a bounce at a lower price, making potential long trades at the support levels below look interesting. The level at 0.7750 truly stands out as likely to be strong, as it is an important psychological level as well as a pivotal point.

There is nothing important due today concerning either the AUD or the USD.