The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 28th January 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the S&P 500 Index, and long of the Forex currency pair GBP/USD. The individual results were excellent, with the S&P 500 Index rising this week by 2.20%, while GBP/USD rose by 1.96%, producing an average win of 2.08%.

The Forex market over the past several weeks has been bearish on the U.S. Dollar, despite last month’s interest rate hike. Technically the Dollar is below its prices of three and six months ago, which puts it in a long-term downwards trend. The only significant significant U.S. economic data released last week was the worse than expected advance GDP data, so there was nothing to change the bearish sentiment and the Dollar continued to fall strongly over the week. The Euro has the greatest long-term strength of any major currency.

The news agenda this week will probably be dominated by several key U.S. data and events throughout the week, and there is not other central bank input scheduled from another country.

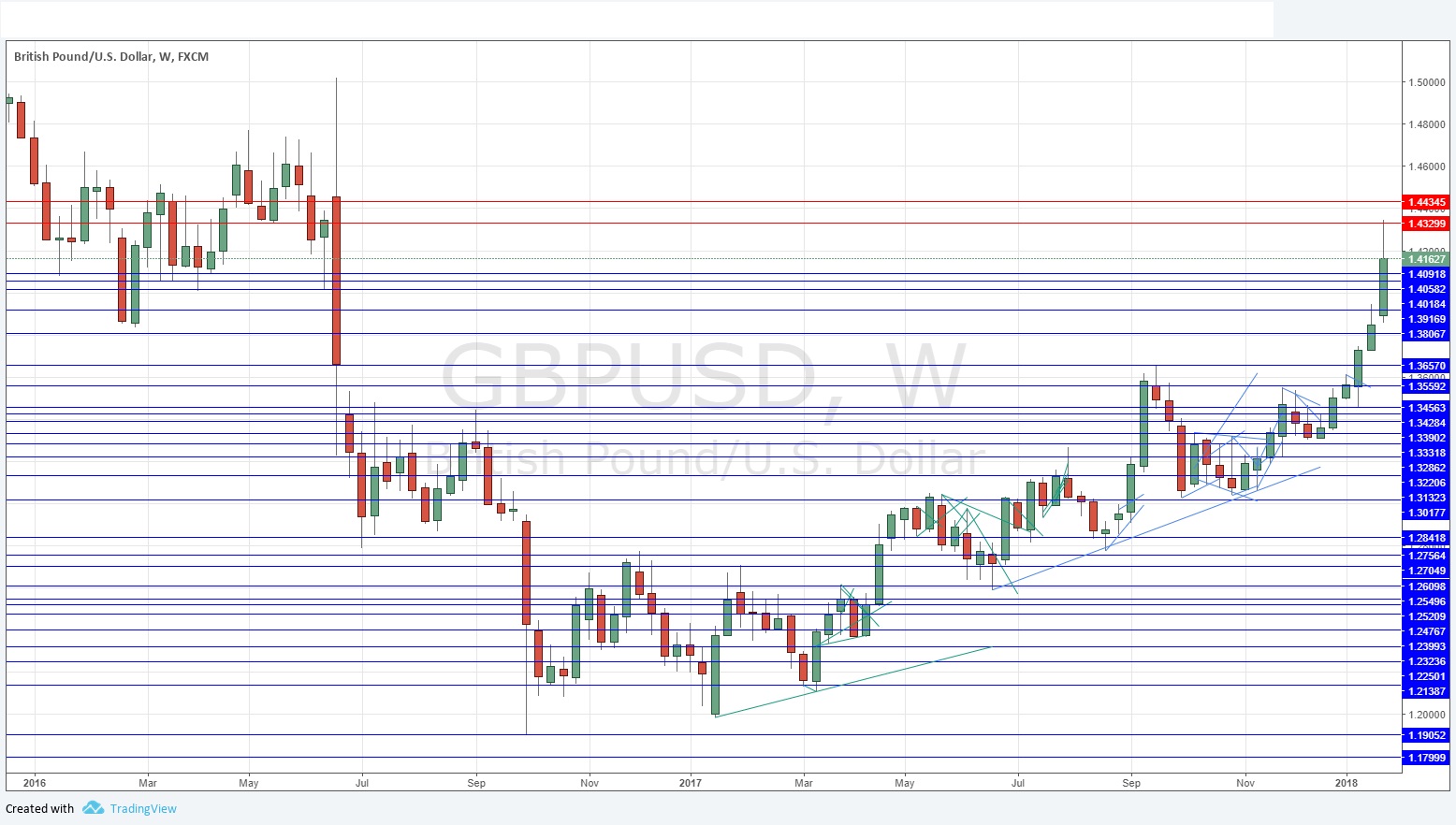

The American stock market remains in a strong and clear long-term bullish trend, and it made a new all-time high price on Friday. Of the three major Forex pairs, both the EUR/USD and to a lesser extent the GBP/USD are in convincing long-term bullish trends, while the USD/JPY currency pair in a long-term bearish trend. The GBP/USD currency pair just made a new 18-month high price, and the EUR/USD currency pair just made a new 3-year high price.

Following the current picture, I see the highest probability trades this week as long of the S&P 500 Index, and long of both the GBP/USD and EUR/USD currency pairs.

Fundamental Analysis & Market Sentiment

The market is largely bullish and “risk-on”, with the stock market looking particularly strong, while the U.S. Dollar looks bearish. Fundamental factors are mostly supporting the U.S. stock market and the Euro.

Technical Analysis

U.S. Dollar Index

This index printed a large, very bearish candlestick, which closed in its lower quarter with only a small lower wick. The price has made a new 3-year low, which is a bearish sign. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. The signs point to a continuing fall this week.

S&P 500 Index

This pair is in a strong long-term upwards trend, and just made a new all-time high price on Friday, which means it will probably continue to rise further. Buying stocks at all-time highs of the major index is usually a good strategy, even though the financial media is full of warnings as to how stocks are about to crash. These warnings have been coming for months; those who ignored them and bought have been rewarded. The market will probably crash or correct sharply eventually but meanwhile, there is money to be made on the long side. The fact that the week closed very close to its high is a bullish sign, further supported that January is traditionally a good time to buy stocks in a bull market, as evidenced by last week’s very strong bullish candlestick.

GBP/USD

This pair is in a long-term upwards trend, and just made a new 18-month high. Last week’s candlestick was large and closed up, but there was a large upper wick, suggesting bulls need to be cautious. The rejection of the psychologically key resistance at 1.4330, which marked a key inflection point in pre-Brexit trading, might also be another cap on the rise. This bullish trend was slow, but it has speeded up dramatically.

EUR/USD

This pair is in a long-term upwards trend, and just made a new 3-year high. Last week’s candlestick was large and closed up, but there was a large upper wick, suggesting bulls need to be cautious. The rejection of the psychologically key resistance at 1.2500, might act to cap on the rise. This bullish trend is nevertheless steady and powerful.

Conclusion

Bullish on the S&P 500 Index, and the GBP/USD and EUR/USD currency pairs.