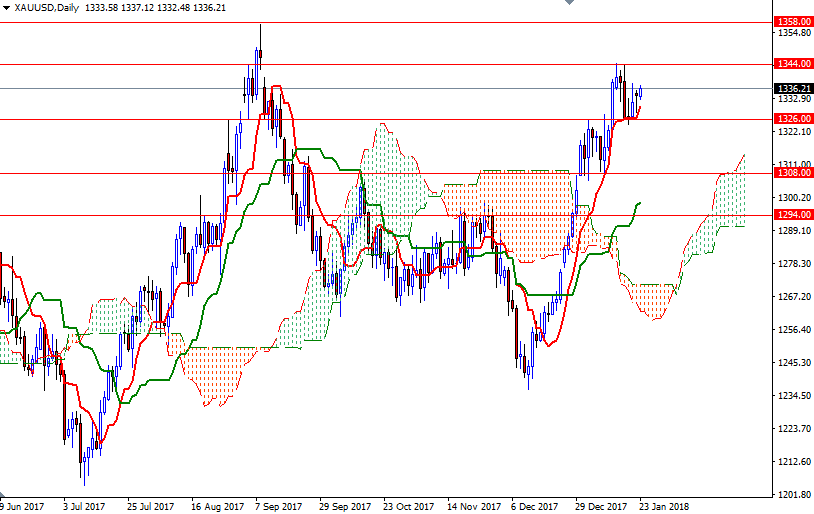

Gold prices settled lower on Monday but remained within the trading range of the previous session. A lower U.S. dollar provided support to the precious metal but failed to offset pressure from rallying world stock markets. XAU/USD is currently trading at $1336.21 an ounce, slightly higher than the opening price of $1333.58.

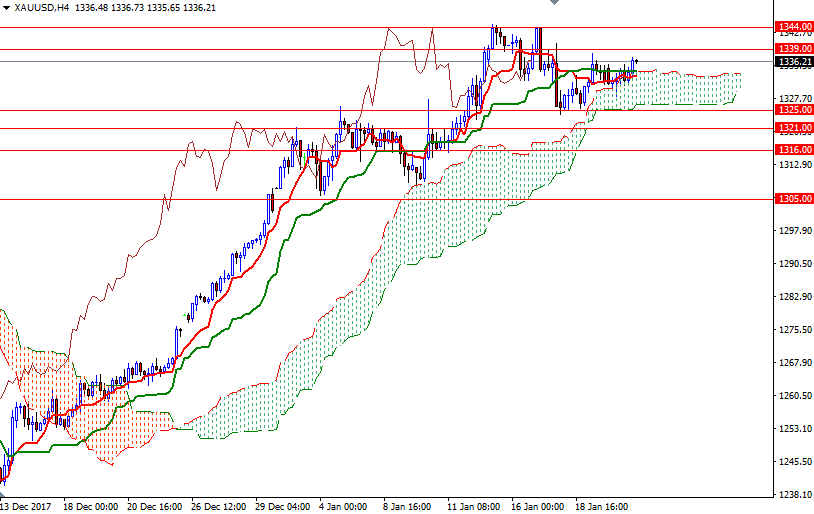

The Ichimoku cloud on the 4-hourly chart continues to be supportive while the market struggle to pass beyond the strategic resistance in the 1340/39 area. The bulls still have the overall technical advantage as the market trades above the weekly, the daily and the 4-hourly Ichimoku clouds. However, note that the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are flat on the H4 chart, indicating sideways trading in the near term.

The bulls have to lift prices above 1340 to challenge the critical barrier at 1344. If this resistance is broken, then the 1350.80-1350 area will be the next target. Closing above 1350.80 on a daily basis paves the way for a test of the solid resistance in 1358/5. To the downside, the initial support stands in 1331/0, followed by 1326/5. If prices successfully break below the 1325 level (the bottom of the cloud on the H4 chart), it is likely that the market will visit 1321 next. The bears have to produce a daily close below 1321 to set sail for 1316.