Gold prices ended slightly lower Tuesday, ending a four-day streak of gains, as the dollar clawed back some of its recent losses. The market challenged the resistance at $1344 in early Asia session, but it was unable to pass through. XAU/USD is currently trading at $1338.55, very close to the opening price of $1338.40.

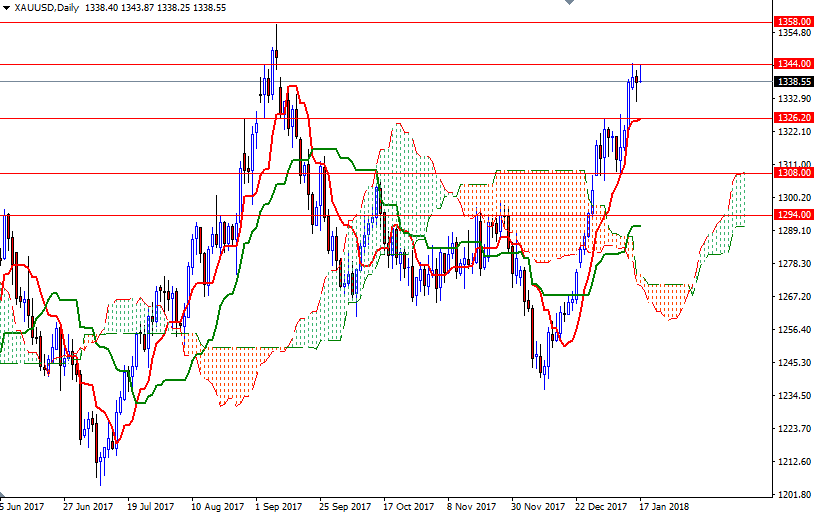

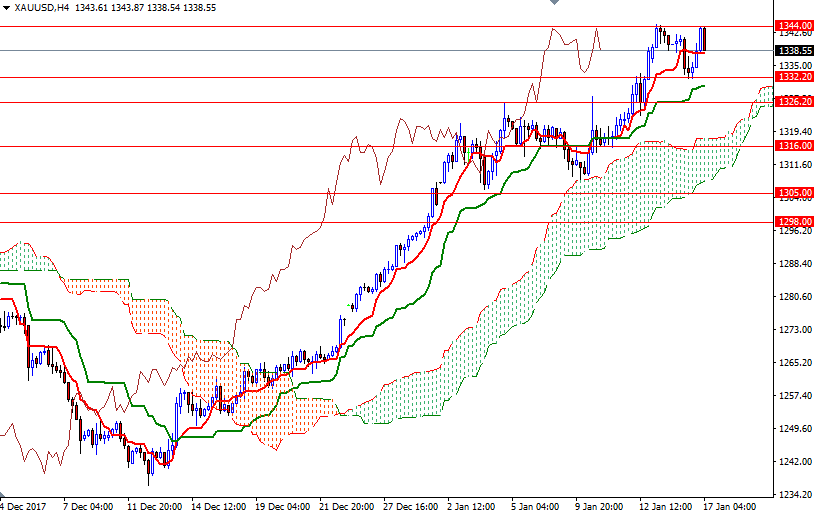

From a chart perspective, trading above the Ichimoku clouds suggests that the bulls have the overall technical advantage. We also have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on the daily and the 4-hourly charts. However, the upside potential will be limited until the resistance at the 1344 level is broken. If the bulls take out Monday’s high of 1344.64, then the market will be targeting 1350.80-1350 next. A break through there could trigger a push up to 1358/5.

On the other hand, if the resistance at 1344 remains intact, XAU/USD will revisit 1335.60. Not too far from there, we have a strategic support in the 1332.20-1330.70 area. The bears will need to pull prices below 1330.70 to make an assault on 1326. If this support is eliminated, 1321 will be the next stop.