Por: DailyForex

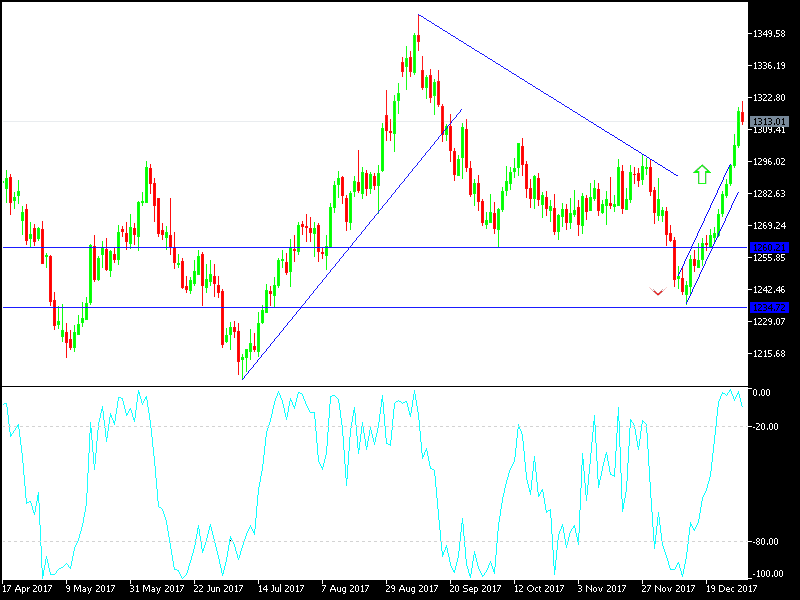

The Gold prices recorded gains reached to $1321 an ounce during the morning trading on Wednesday, before it bounced quickly to $1312 an ounce at the time of writing. The general outlook for the gold will remain bullish as long as it is moving above the psychologically important level at $1300, and with the markets back to work and having more liquidity, the gold moved strongly and took advantage of the US index, which measures the greenback’s strength against a basket of 6 currencies, retreating towards 91.75, the lowest in 3 months, and the drop of the US treasuries, but the US stocks is still making gains. The gold is moving within upward channel as shown on the daily chart, but within tight ranges, even with the strong pressures on the dollar after the passage of the US tax cut bill. It seems that the increased move towards crypto-currencies after the recent record gains, especially the for the Bitcoin, contributed to reduced interest in buying gold, as the recent gains were lower than usual in light of a lower dollar.

The investors got rid of the bonds in fear that the passage of the US Tax low will lead to a sudden increase in the inflation and will force the Federal Reserve Board to increase interest rates sharply in 2018. The interest rate raise expectations failed to support the US dollar as it usually does. The passage of the US tax law a direct strong support for the US dollar.

Technically:

Gold prices will have a strong bullish move today if the prices moved towards the resistance levels at 1315 and 1325. Settling on top of the $1300 peak will contribute to a successful move to those levels. The nearest support levels for gold are currently at 1272, 1285 and 1295. We still prefer buying the gold from every bearish level.

On the economic data front today:

The gold will have full focus on the dollar’s level while awaiting unemployment changes in Spain and Germany, and the Construction PMI from the UK and then the manufacturing ISM and the announcement of the minutes of last Fed Reserve meeting. The gold will also monitor updates regarding renewed geopolitical fears regarding North Korea, BREXIT or Trump’s economic policy.