Gold prices ended Tuesday’s session up $7.61 an ounce on rising inflationary expectations and a drop in the dollar. Major world stock markets were mostly up yesterday, bolstered by firm oil prices, and the U.S. dollar index fell to fresh three-year lows. In economic news on Wednesday, Richmond Fed’s manufacturing index came in weaker than expected with a print of 14 in January, down from the previous month’s 20 and below expectations for a reading of 19.

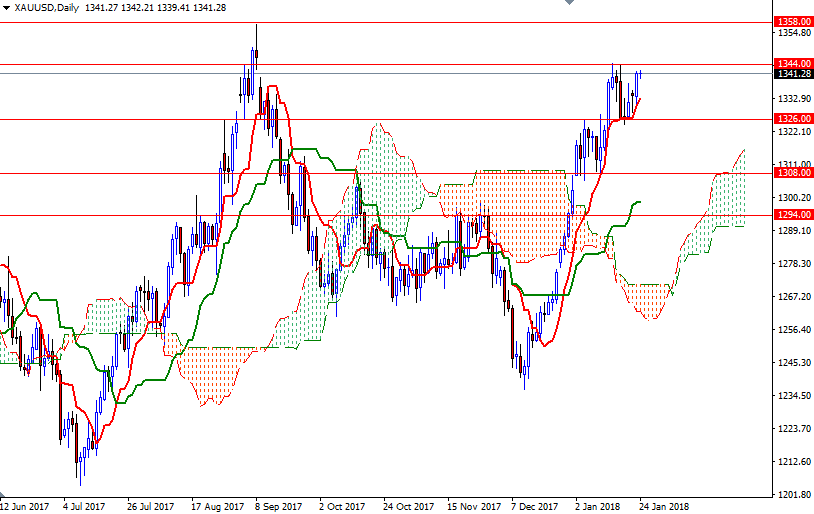

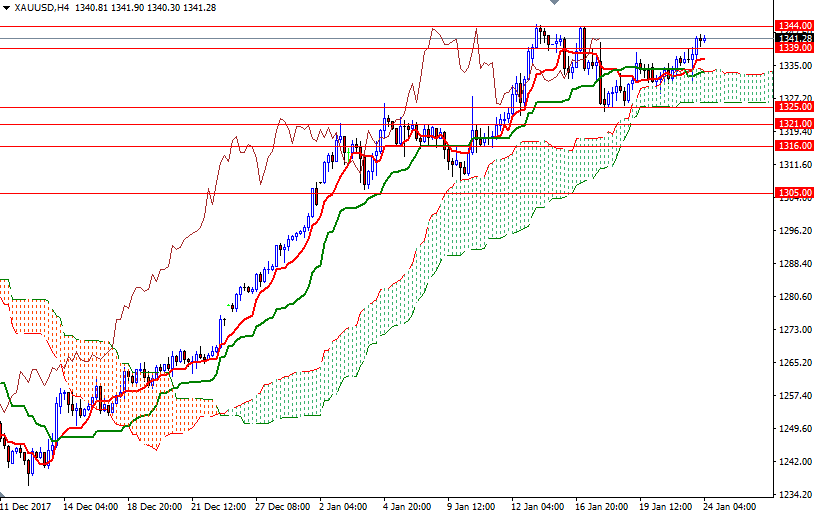

The market is trading above the Ichimoku clouds on the weekly, the daily and the 4-hourly time frames. The short-term charts suggest that prices may continue to rise and test the key resistance level at 1344 if the bulls can hold the market above the hourly cloud. A clean break above 1344 could help gold’s case and trigger a push up to the 1350.80-1350 area. The bulls have to capture this strategic zone to to challenge the bears on the 1358/5 battlefield.

On the other hand, if the bears successfully defend their camp at 1344 and pull prices below 1339, keep an eye on 1336.40. The bears will need to drag prices below 1336.40 to gain momentum for a test of 1333/0, the confluence of the Kijun-sen (twenty six-period moving average, green line) and the top of the cloud on the H4 chart. Closing below 1330 on a daily basis indicates that XAU/USD is on its way back to 1325.