Gold prices rose $3.24 an ounce on Monday and hit the highest level since September 8, supported by a weaker U.S. dollar index. World stock markets were mixed yesterday. U.S. markets were closed for a holiday. XAU/USD is currently trading at $1340.81, slightly higher than the opening price of $1340.18.

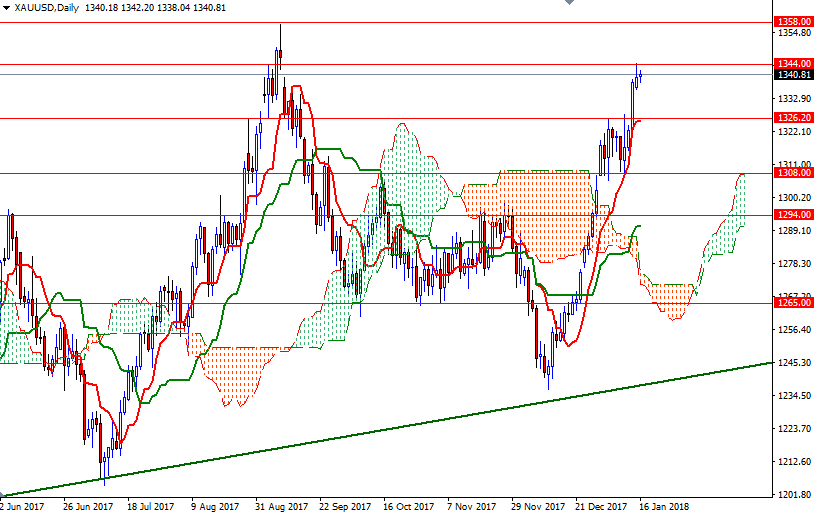

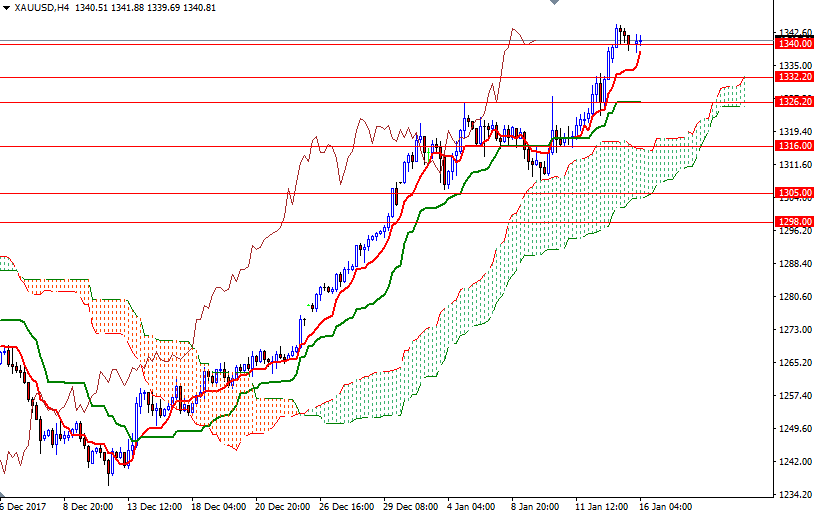

The bulls have the near-term technical advantage, with the market trading above the Ichimoku clouds on the daily and the 4-hourly charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) also resides above the daily cloud. However, as I reiterated in my previous analysis, the bulls have to successfully lift prices above the 1244/0 zone to make a run for 1358/5. On its way up, expect prices to face some resistance in the 1350.80-1350 zone.

To the downside, the initial support sits at 1335.60. If the bears increase downside pressure on the market and pull prices below 1335.60, they may have a chance to test 1332.20-1330.70. Eliminating this support is essential for a continuation towards 1326. A break below 1326 implies that the market will visit 1321.