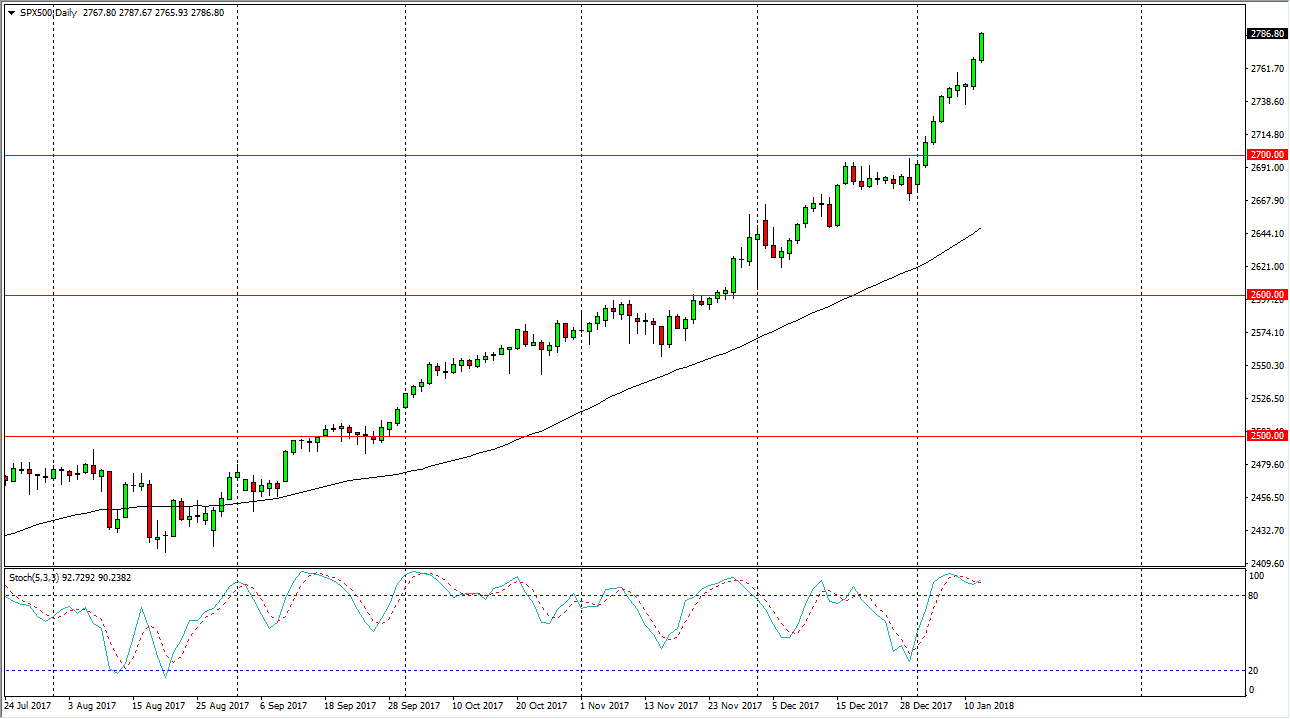

S&P 500

The S&P 500 has showed another strong session on Friday, as the US dollar continues to unwind. That being the case, it’s likely that the market is going to continue to reach towards the 2800 level, although we are bit overextended. We have seen so many green days in a row I would prefer to see some type a pullback to take advantage of what should be perceived value. I think the 2750 level is going to offer plenty of support, and I do recognize that the 2700 level is the “floor”, at least for the time being. 2800 will offer a barrier, but it will be psychological in nature only. I still think that the market goes to the 3000 handle over the next couple of months, but right now it’s probably easier to sell puts in the SPY than anything else, as it leads then you don’t have to target a specific level.

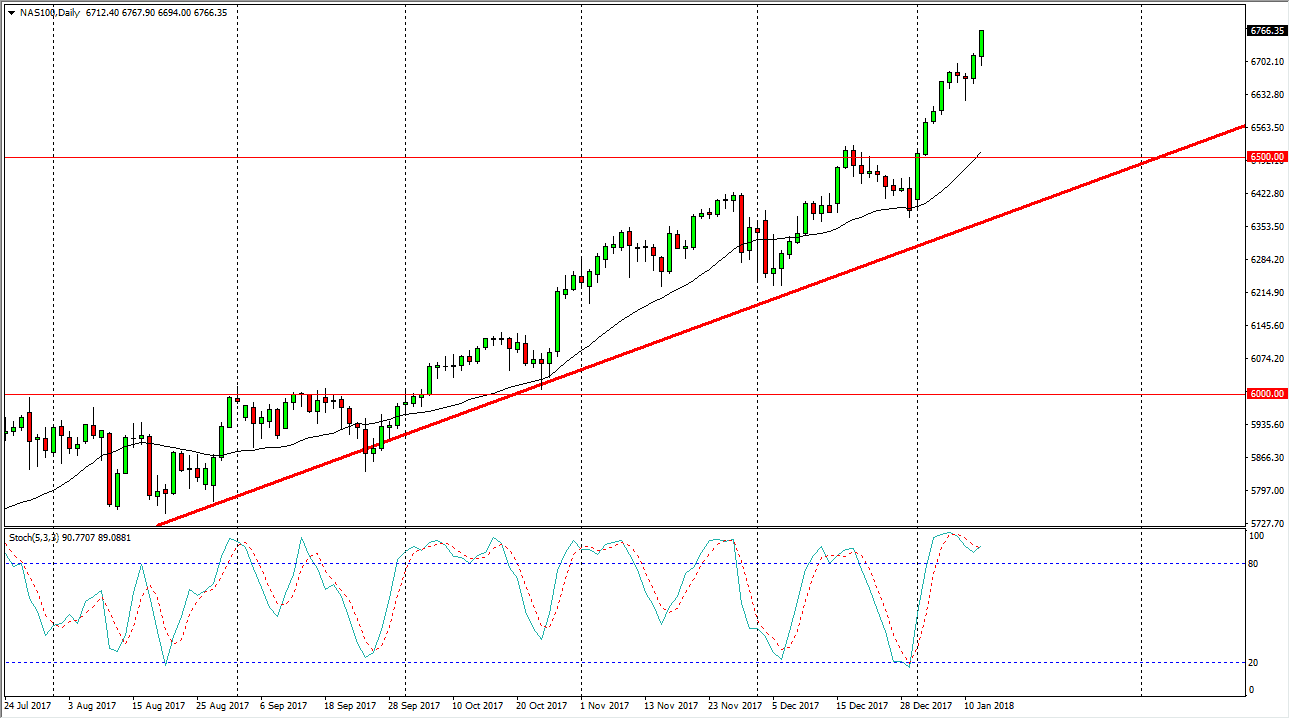

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Friday, but rally just as the S&P 500, the Dow Jones Cappadocia Average, and the Russell 2000 it. I think that it’s only a matter of time before all US indices reach major new milestones, but we are at fresh, new highs, and that in and of itself is reason enough to think that we continue to rally. We are overbought though, so I would like to see some type a pullback and a lot of these indices. The NASDAQ 100 has been a bit of a laggard, so this may be the first place where you start to see cracks in the ceiling. This works in both ways, because if we explode in this market to the upside, that should send the others into the stratosphere.