Gold prices resumed the move towards resistance at $1321 level an ounce, the highest in 3 months, after the gold’s gains stopped around that level on Wednesday, showing the strength of this level, the breaking of which means more gains. The dollar's weakening contributed strongly to the gold’s chance of resuming the move higher, despite the US stock markets achieving new record highs. The Dow Jones index moved above the record peak at 25.000. Once the Federal Reserve’s minutes were released, the gold dropped towards $1306 an ounce at the start of Thursday’s trading, before resuming the upward move supported by the variance in the US jobs numbers in the ADP data and the unemployment claims. The Federal Reserve maintained the plan of 3 interest rate raise for 2018. The minutes suggested that the low inflation level in the country is transitional and that the job market strength will support facing its implications. The decision makers at the Federal Reserve agreed largely last month that the US tax reform would benefit the economy, however, they split in terms of whether the resulting growth will lead to faster rate raise this year.

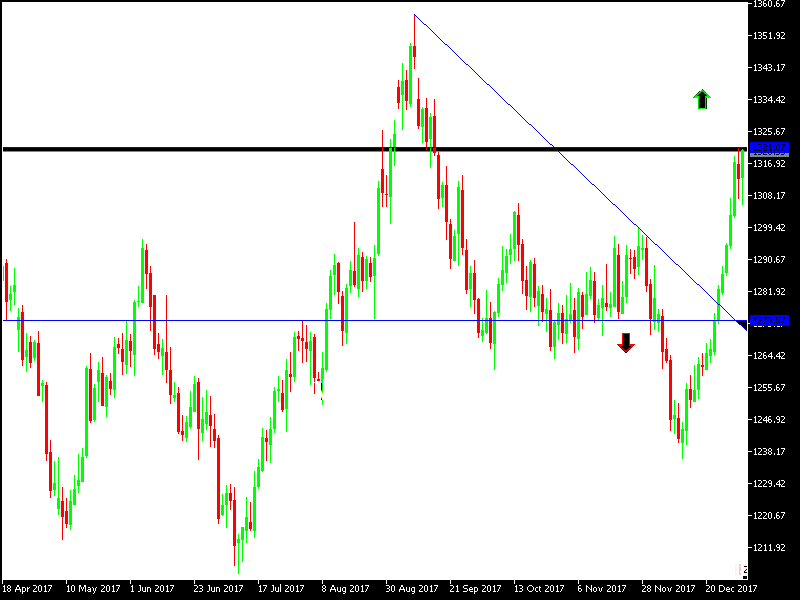

Technically: Gold prices will have a strong bullish move today if the prices moved towards the resistance levels at 1315, 1325 and 1335. Settling on top of the $1300 peak will contribute to a successful move to those levels. The nearest support levels for gold are currently at 1272, 1285 and 1295. We still prefer buying the gold from every bearish level.

On the economic data front today: Gold will have full focus on the dollar’s level while awaiting the release of the US jobs numbers including the unemployment rate, the average hourly wages and the new US jobs. Then there is the services ISM index and factor orders. The gold will also monitor updates regarding renewed geopolitical fears regarding North Korea, BREXIT or Trump’s economic policy.