By: DailyForex

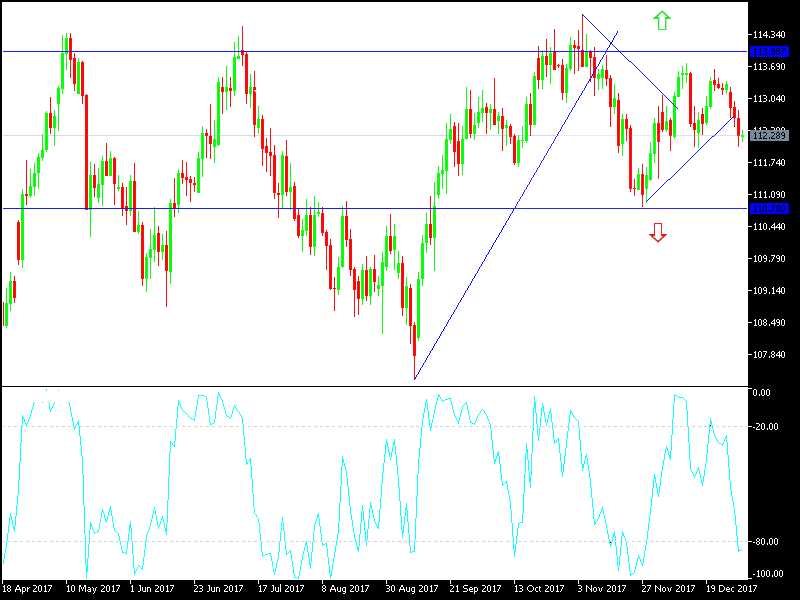

The USD/JPY will depend today on the details of the latest meeting for the Fed Reserve to stop the losses which took the pair to the support level at 112.05. It is clear on the daily chart for the USD/JPY, the start of a new bullish break, which will be stronger as the pair has moved towards the support at 112.00. The drop in the US Treasuries and the retreat in the US index to 91.75 DXY, the lowest since September, strongly supported the drop in the USD/JPY. The investors got rid of the bonds in fear that the passage of the US Tax low will lead to a sudden increase in the inflation and will force the Federal Reserve Board to increase interest rates sharply in 2018. The interest rate raise expectations failed to support the US dollar as it usually does. The passage of the US tax law a direct strong support for the US dollar.

The US data showed the unemployment claims were at 245K last week, which is a historically low level. Separately, the US goods shortage raised by 2.3% in November, and the Chicago PMI reading increased to 67.6 in December, compared to the previous reading of 63.9. The last reading was the highest for the index since April 2011. The US stock markets continues achieving record levels.

Technically:

The USD/JPY will have strong bearish move in case it moved towards support at 112.00 and 111.60, and we still prefer buying at each bearish bounce. On the bullish side, the nearest resistance levels are currently at 113.10, 113.75 and 114.30. The daily chart shows clearly a break of the bullish trend lately. It will watch the US Index and Stock Markets with liquidity back to the markets.

On the economic data today:

The economic agenda does not have any important US or Japanese data. From the US, there will be an announcement for the manufacturing ISM index, the Public Spending Index and the Minutes of the last Federal Reserve meeting. The pair will closely watch for renewed international geopolitical fears, with the reemergence of the North Korean crises, along with anything related to Trump’s internal and external policies.