USD/JPY

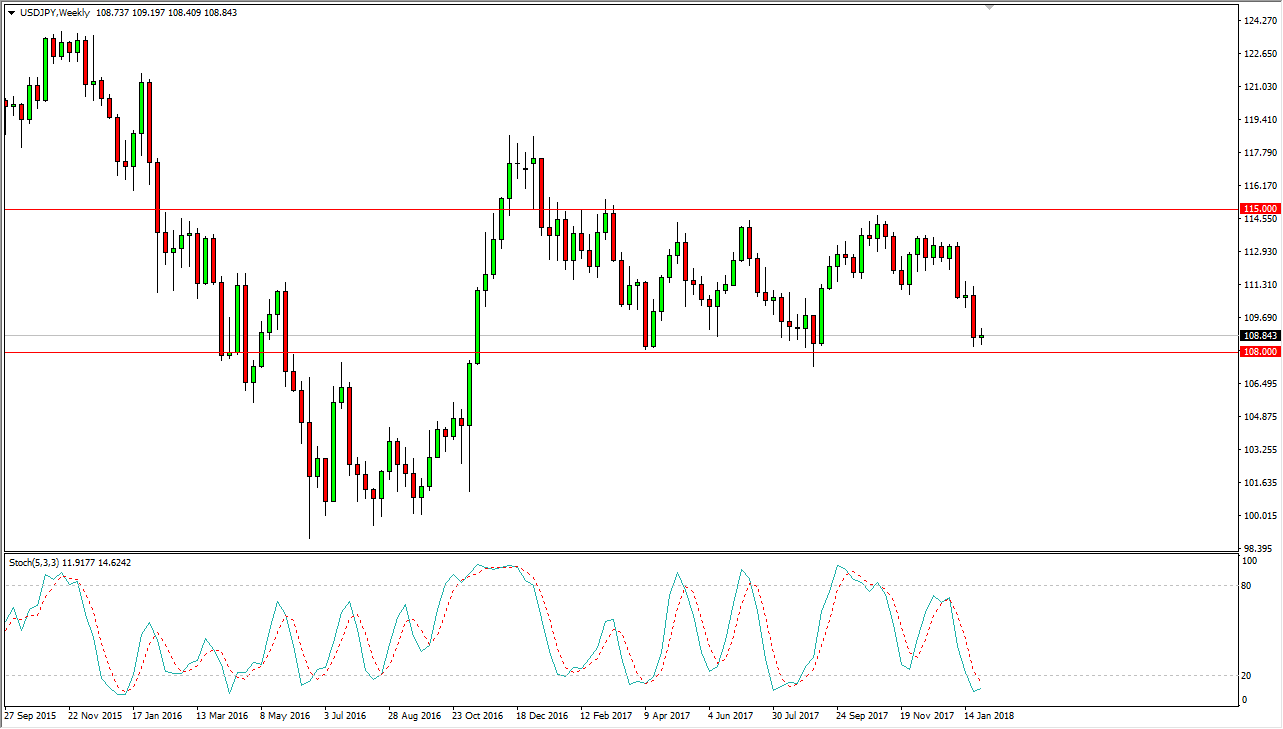

The US dollar has gone back and forth during the week, testing the 108 handle for support, an area that has clearly been an area of interest for the buyers over the last year, and it looks likely that if we break above the top of the weekly candle, I think we will continue to go much higher, perhaps reaching towards the 115 level longer term. I think there are several areas along the way that could be interesting for profit-taking and could cause bits of noise.

The first level where I think we will find some profit-taking will be closer to the 110 handle, followed very closely by the 111 handle. I think it’s likely that the markets will continue to be very noisy, but keep in mind that they are highly correlated to how the stock market does. Typically, if the S&P 500 rallies, so does the USD/JPY pair. I don’t think we break out of this range, least not this month. The market will probably continue to see a lot of back and forth type of trading, but overall, I think that will work out quite well for the short-term inclined. We are most certainly in an oversold position and showing signs of an oversold condition on the stochastic oscillator only adds to that fact.

If we were to break down below the 107.5 level, then I think the market could drop down to the 105 level. That’s an area where I would expect to see massive amounts of support, and therefore we could get even more buying in that area. Right now, though, I look for an opportunity to take advantage of the longer-term consolidation, and I think that should continue to be the overall attitude of the market as we are trying to figure out central bank expectations from both sides of the Pacific Ocean.