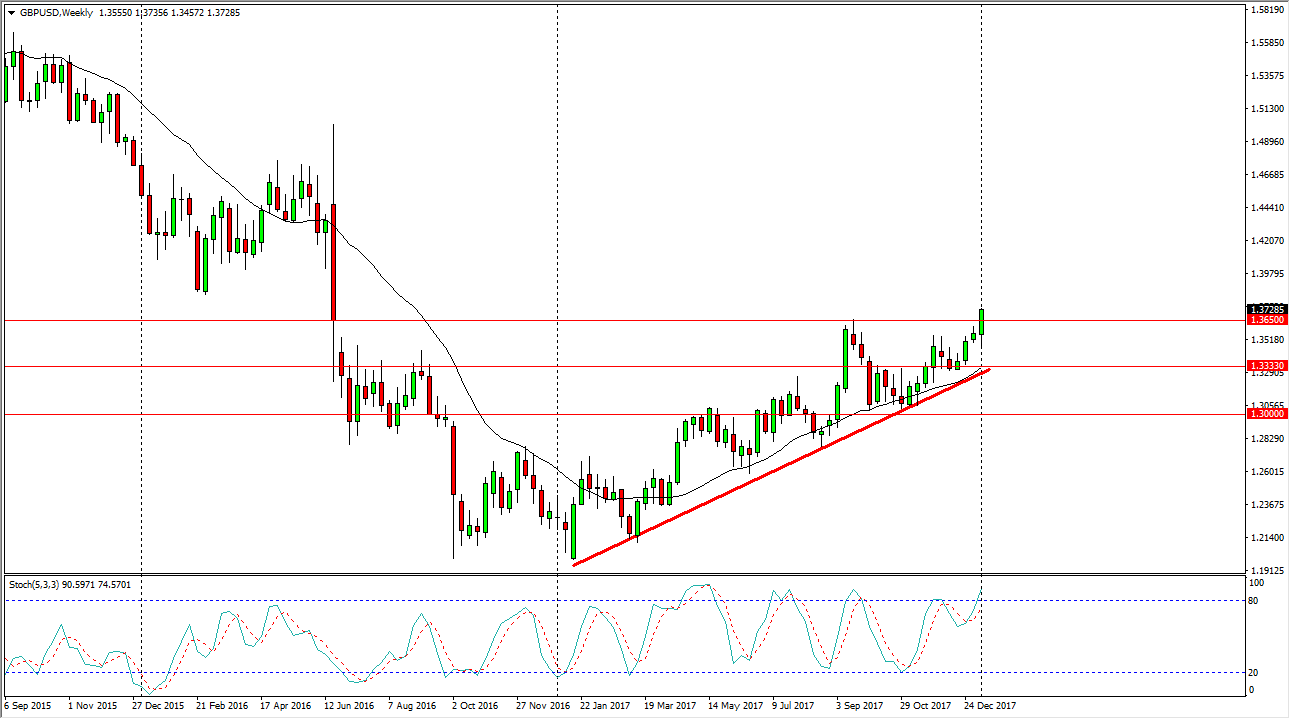

GBP/USD

The British pound fell initially during the week but then rallied rather significantly. More importantly, we broke above the 1.3650 level, which was the scene of a massive gap lower after the vote to move away from the European Union. Because of this, I think that the market will continue to find buyers on dips, and we will finish the week higher. Longer-term, I suspect that this market is going to go looking towards the 1.45 handle above.

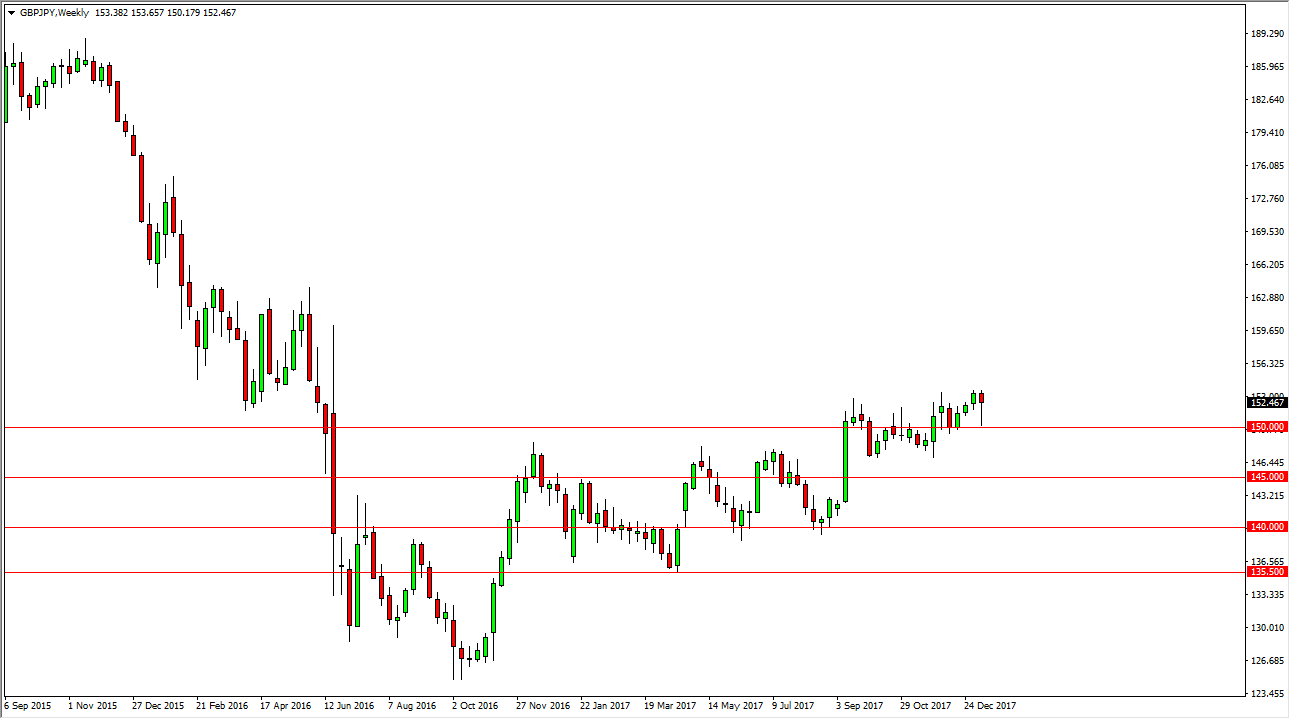

GBP/JPY

The British pound fell a bit during the week, dropping down to the vital 150 handle. However, we exploded to the upside, forming a nice-looking hammer. A break above the top of the weekly candle should send this market much higher, perhaps looking towards 155, followed by 160. I believe in buying dips, and think that the 150 level will now offer a bit of a floor.

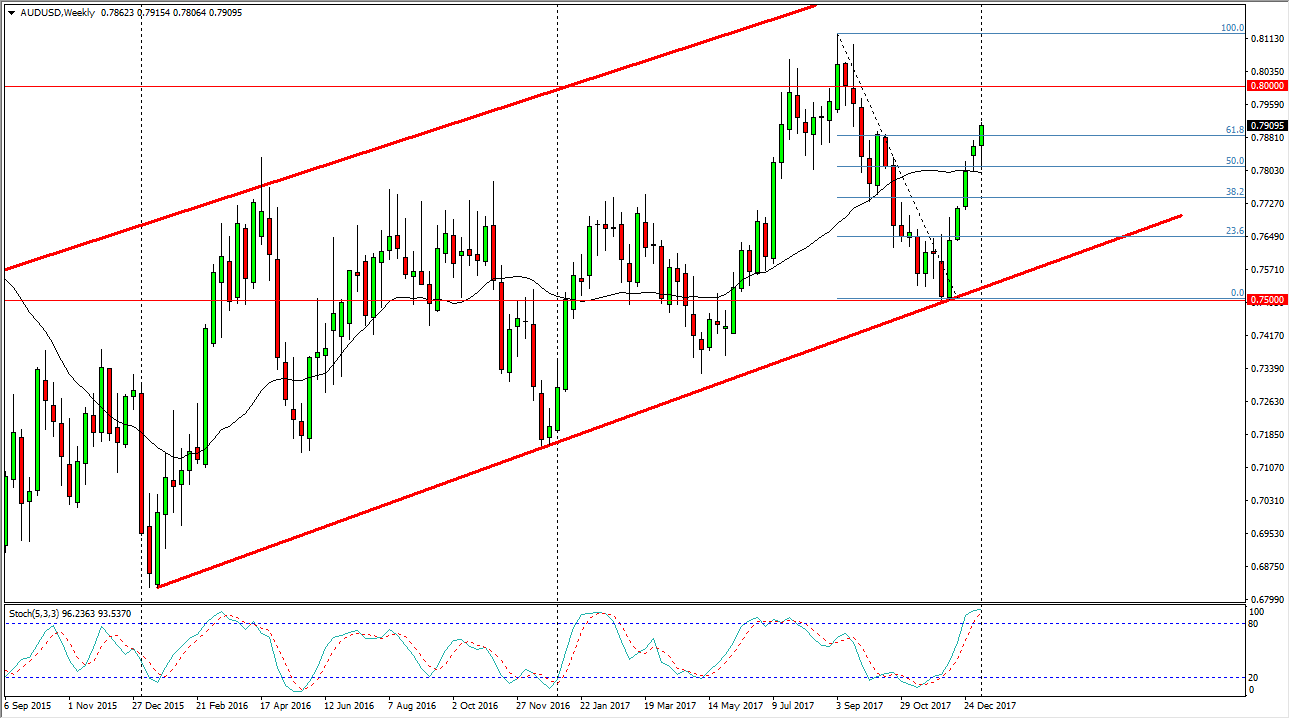

AUD/USD

The Australian dollar initially fell during the week but found enough support near the 0.70 level to turn around and bounce significantly. By doing so, we formed a hammer and closed just above the 0.79 level. It looks likely that we are going to go looking towards the 0.0 level above, which is the fulcrum for price in both directions longer-term, going back decades. I think that we will see a little bit of volatility this week but buying the dips should continue to be the best strategy going forward.

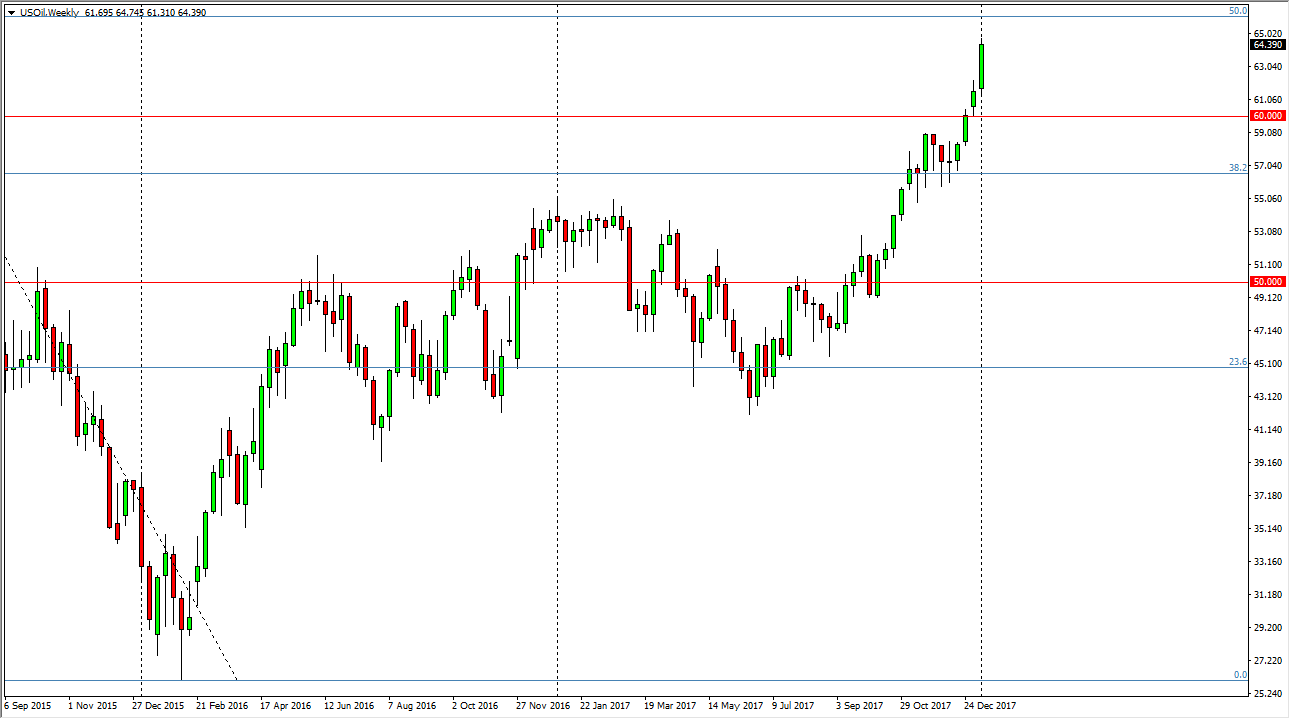

WTI Crude Oil

The WTI Crude Oil market initially fell during the week, but then exploded to the upside, reaching towards the $65 level. I think we are a bit overextended, but that should only offer value on the pullbacks it should occur rather quickly. The $60 level underneath should continue to be the “floor” going forward, and it offers an opportunity to pick up value. I believe that oil markets will continue to rally over the next couple of weeks.