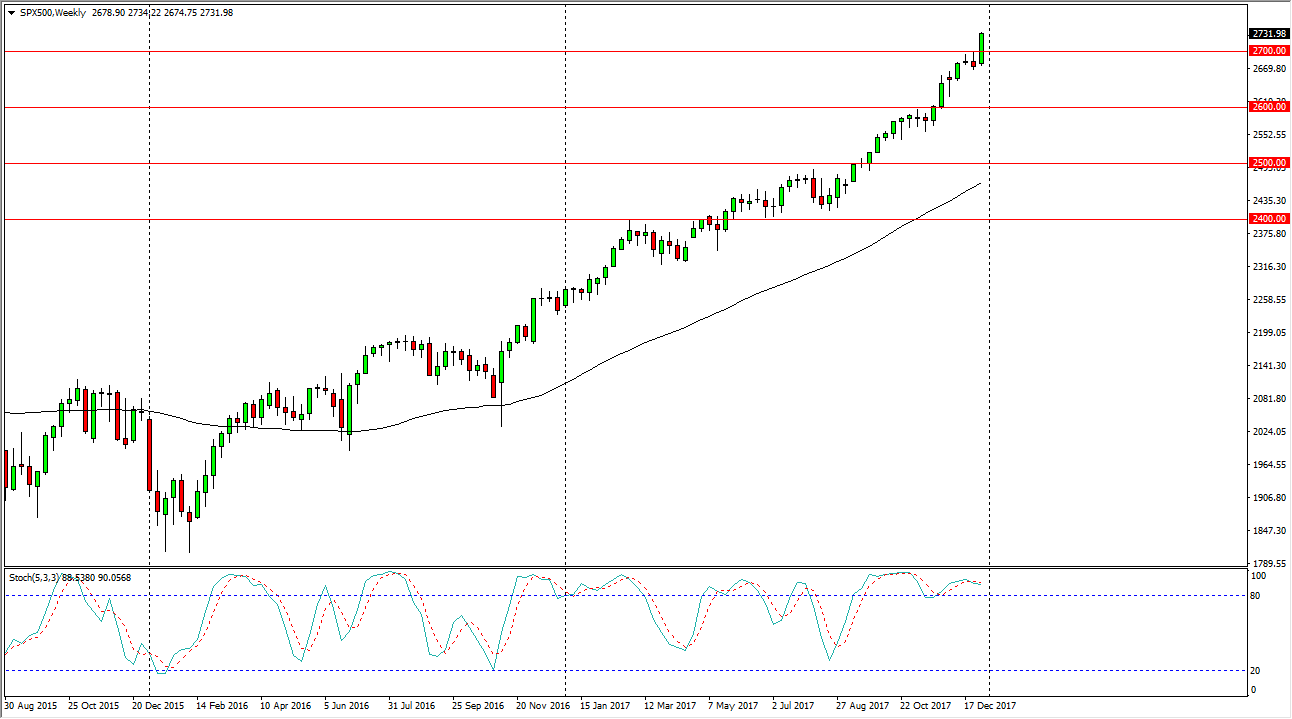

S&P 500

The S&P 500 has rally during the week, as you can see on the weekly chart. We sliced through the 2700 level, breaking a serious amount of resistance, so I think going forward we are going to look at pullbacks as potential buying opportunities, and favor buying on the dips as money managers have come back from the holidays and thrown their trading capital to work.

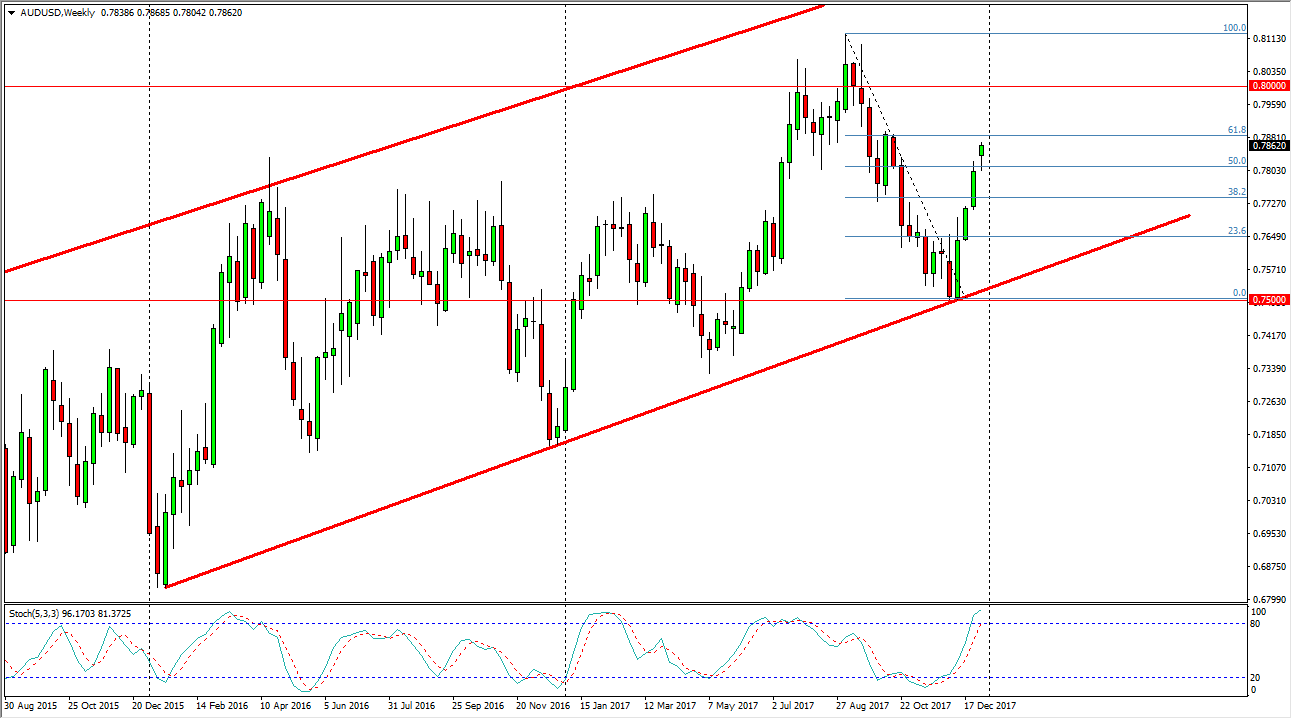

AUD/USD

The Australian dollar initially gapped higher on Tuesday when traders came back to work, roll over to fill that gap, and then bounced again to form a bit of a hammer. I think the market is ready to continue to reach towards the 0.80 level, but it could pull back for short amounts of time. Those pullbacks should offer value the people are willing to take advantage of, so therefore I would treat them as such. The 0.80 level above is a major level on longer-term charts, so of course will attract a lot of attention.

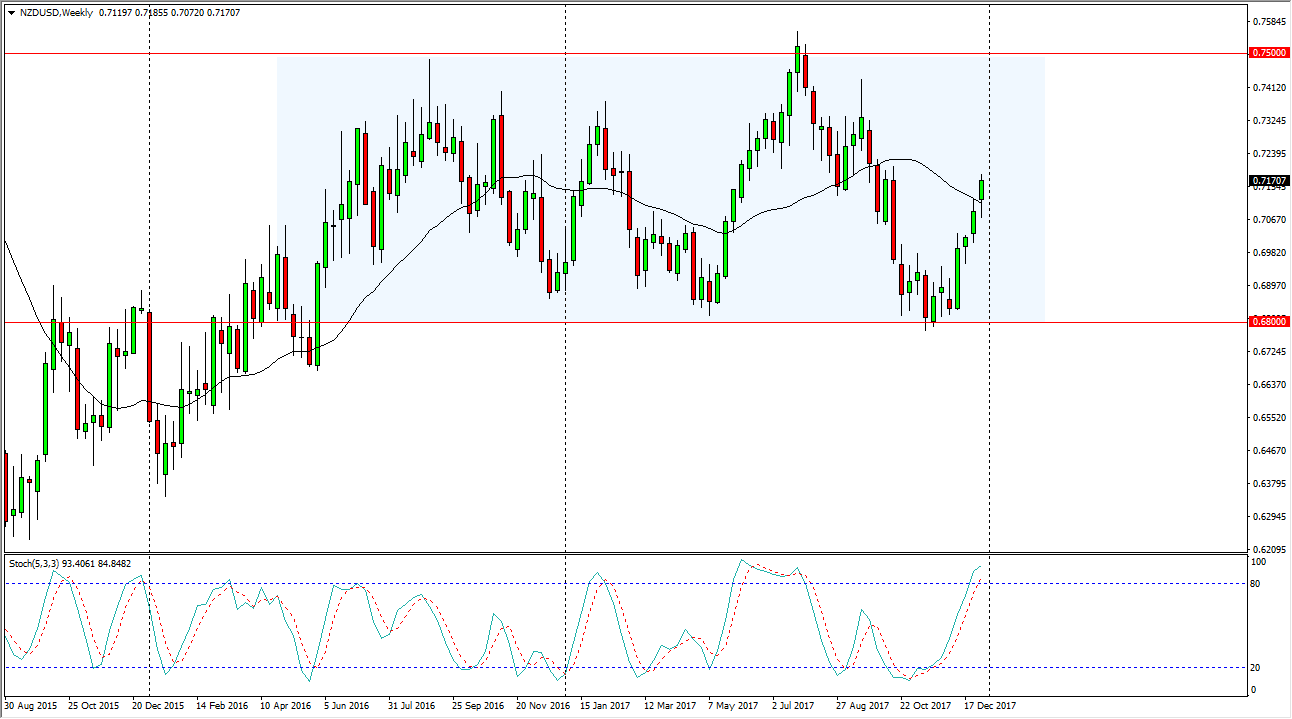

NZD/USD

The New Zealand dollar gapped higher as well, but then pulled back just as the Australian dollar did, filling the gap. By filling the gap, looks as if we are ready to go higher, perhaps reaching towards the top of the overall consolidation that we had seen during the previous year, which is the 0.75 handle. I think that buying on the dips continues to be the mantra for the New Zealand dollar, as it looks like we are ready to continue the overall pressure.

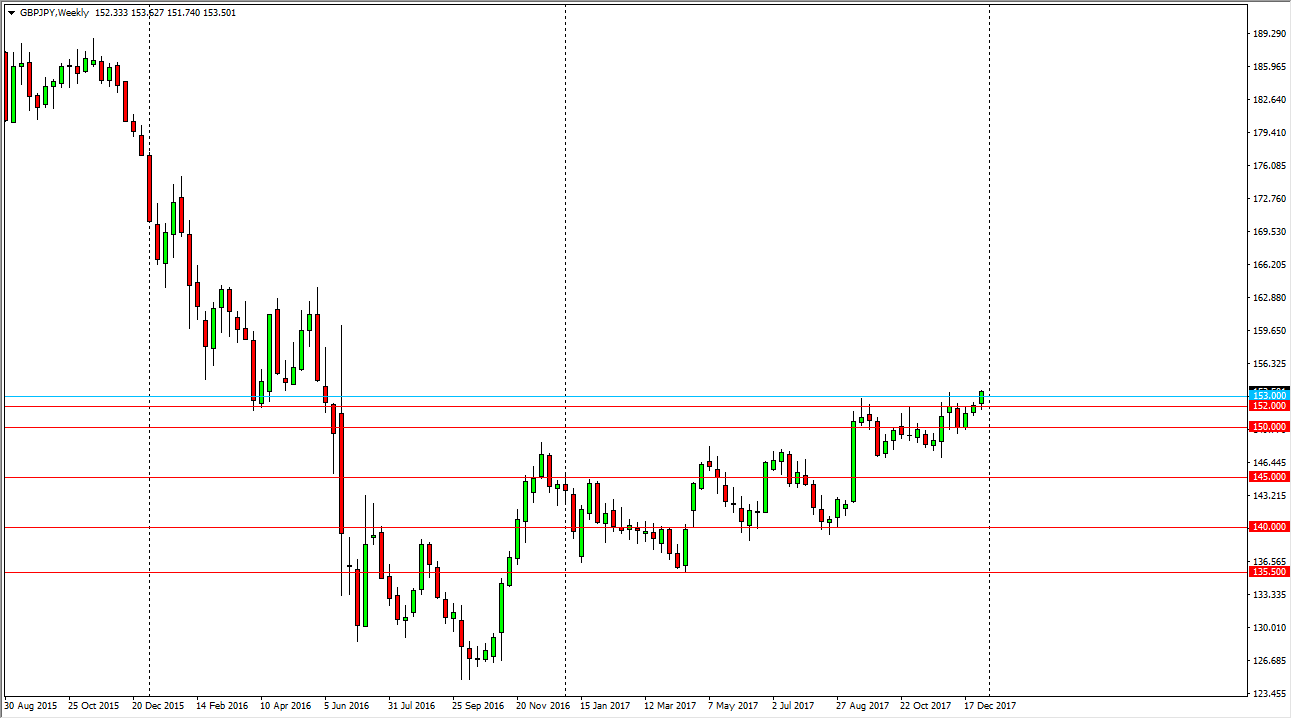

GBP/JPY

The 153 level has been important in this market for some time, as you can see on the weekly chart. The fact that we have pulled back a bit, found support at the 152 handle, and then broke above the 153 handle handily on Friday tells me that the market is ready to continue grinding his way to the upside, and perhaps as high as 163 on the longer-term move. I think buying on the dips in this market also is the best way to play it as the “risk on” attitude of the market continues.