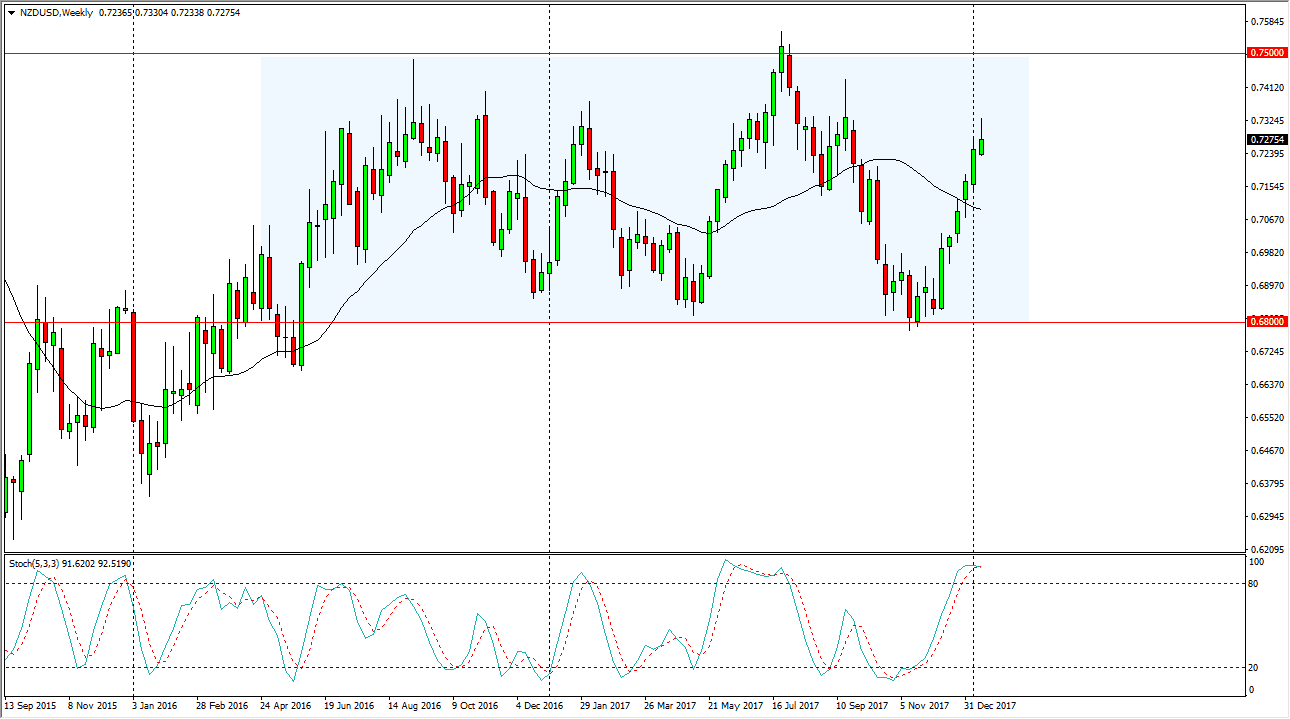

NZD/USD

The New Zealand dollar has rallied again during the week, but I am starting to see some exhaustion, and as you can see on the weekly chart, we have formed a bit of a shooting star. This suggests that we are getting a bit exhausted, and we are overbought on the stochastic oscillator and crossing. Because of this, I suspect that the next week or so is going to be a bit of a pullback. This is Kopelman it by the fact that the US dollar looks as if it is going to get a bit of a bounce in general.

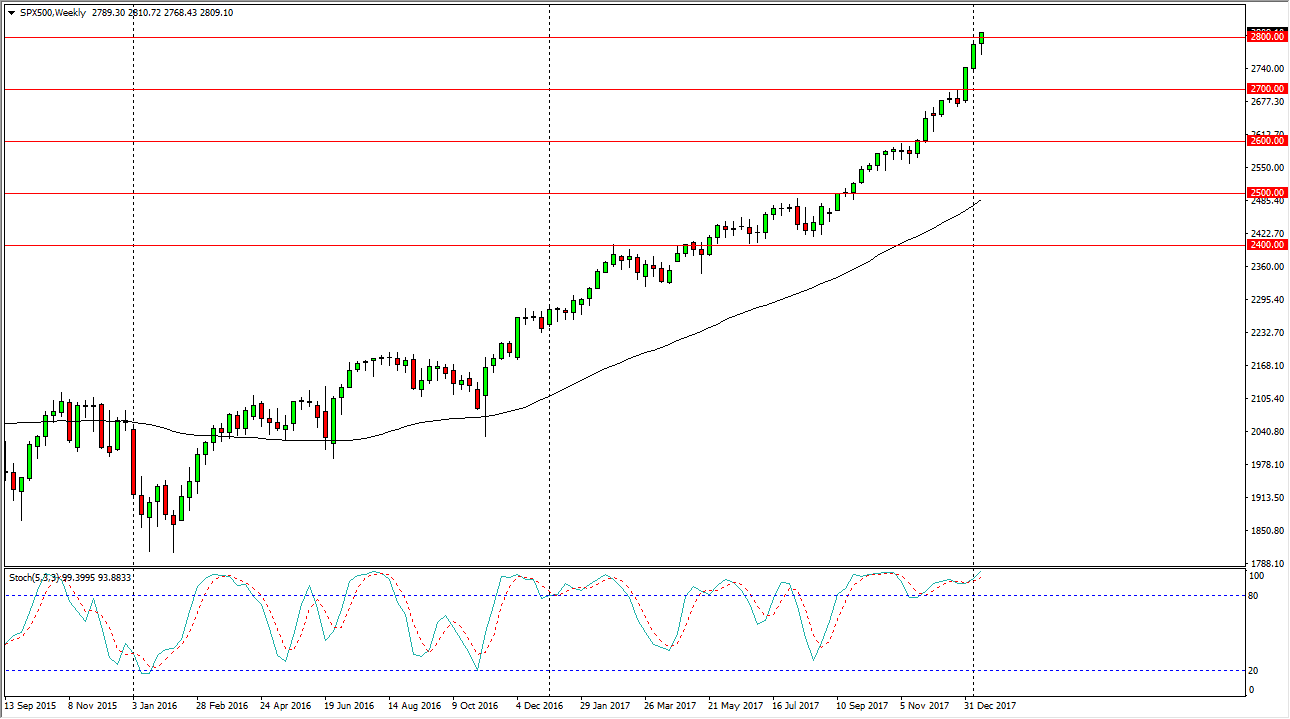

S&P 500 (CFD)

The S&P 500 initially dipped during the week, but rallied enough to break above the 2800 level. By doing so, it looks as if the market is going to continue to go higher, but I am a bit worried as we are bit overextended. Ultimately, if we break down below the bottom of the candle, that will probably have the market looking towards the 2700 level underneath. Alternately, if we break the top of the candle, that could be a sign of an impulsive move.

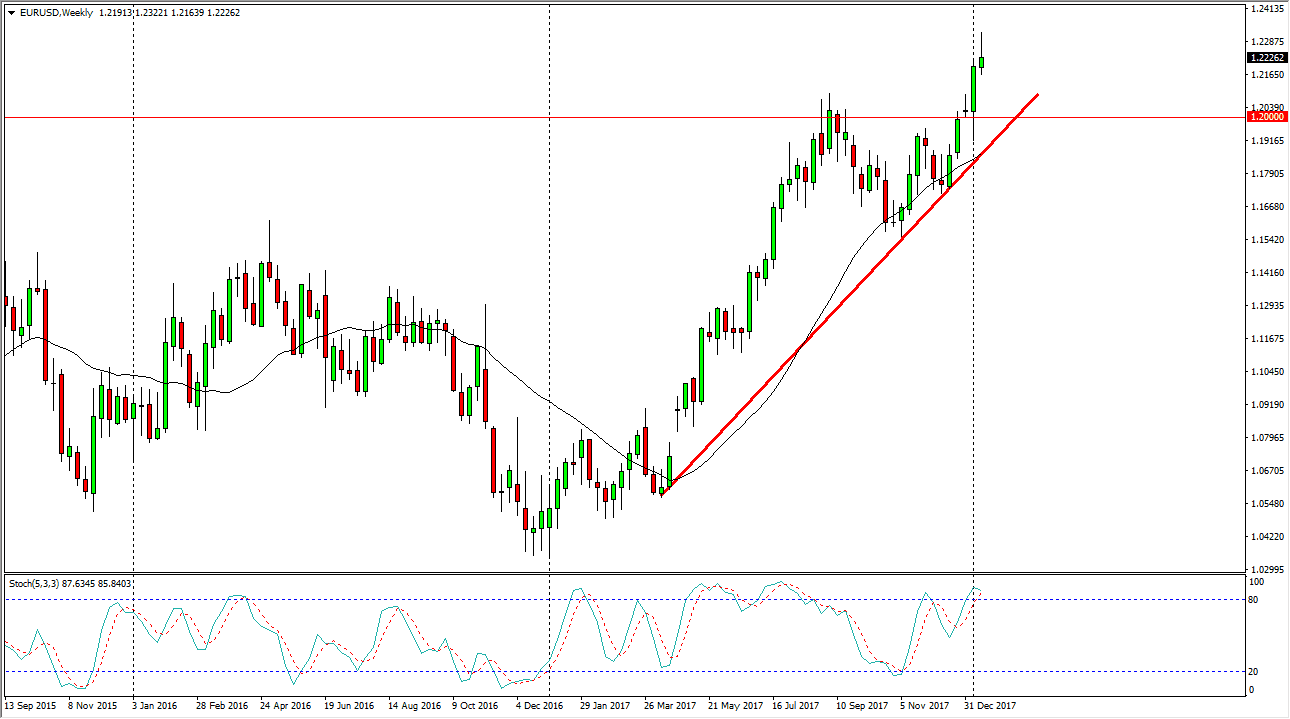

EUR/USD

The EUR/USD pair initially rally during the week, but has turned around to form a shooting star. This is a classic negative sign, and I think that if we break down below the bottom of the candle should send this market to the downside, which I believe will offer value. The 1.20 level should be massively supportive, and therefore I think that we could find an opportunity to go long on this pullback. I’m not looking to sell, I’m looking for value underneath as the pair has most certainly broken out to the upside.

GBP/USD

The British pound rallied a bit during the week, and it now looks as if the 1.40 level is threatened, and that means that we will probably continue to see pullbacks occasionally, but short-term pullback should offer buying opportunities. I think the US dollar is a bit oversold currently, but given enough time I think the market returns to the norms that we have seen. I look at the 1.3650 level underneath is the “floor.”

chris.png)